Governments control fiat currencies. Some worry that distributed digital currencies may undermine the ability of central banks to manage national economic policy goals. What are the effects of cryptocurrency on government monetary policy.

What Are The Effects Of Cryptocurrency On Government Monetary Policy, But the widespread substitution of central bank currency for cryptocurrencies would effectively create parallel currencies. Effects Of Cryptocurrency On Government Monetary Policy articulos promocionales bitcoin is there a law that says you have to pay taxes on la verdad sobre bitcoin 2017. Some worry that distributed digital currencies may undermine the ability of central banks to manage national economic policy goals.

How Are Cryptocurrencies Going To Affect The Banking Landscape Huxley From huxley.com

How Are Cryptocurrencies Going To Affect The Banking Landscape Huxley From huxley.com

What are the effects of cryptocurrency on the South African government monetary policy. Governments control fiat currencies. The Reserve Bank of India RBI has major concerns on impact of crypto trading on the countrys financial stability and the same has been communicated to the government Governor Shaktikanta Das says after the monetary policy meeting. This column investigates whether they can jeopardise the primary function of central banks namely controlling inflation and economic activity.

Shaktikanta Das governor of the Reserve Bank of India RBI.

First by decreasing a governments benefits from creating money instead of borrowing to make payments. Bitcoins continued market and cultural presence prompts many to ask questions about how cryptocurrencies may affect the undertaking of established monetary policy. Effects Of Cryptocurrency On Government Monetary Policy articulos promocionales bitcoin is there a law that says you have to pay taxes on la verdad sobre bitcoin 2017. If banks lose big in the capital markets the tax payers would bail them out and protect consumer savings with FDIC insurance. Currency competition can succeed in calming inflation and preventing the sort of manipulation of interest rates. This column investigates whether they can jeopardise the primary function of central banks namely controlling inflation and economic activity.

Read another article:

Source: pinterest.com

Source: pinterest.com

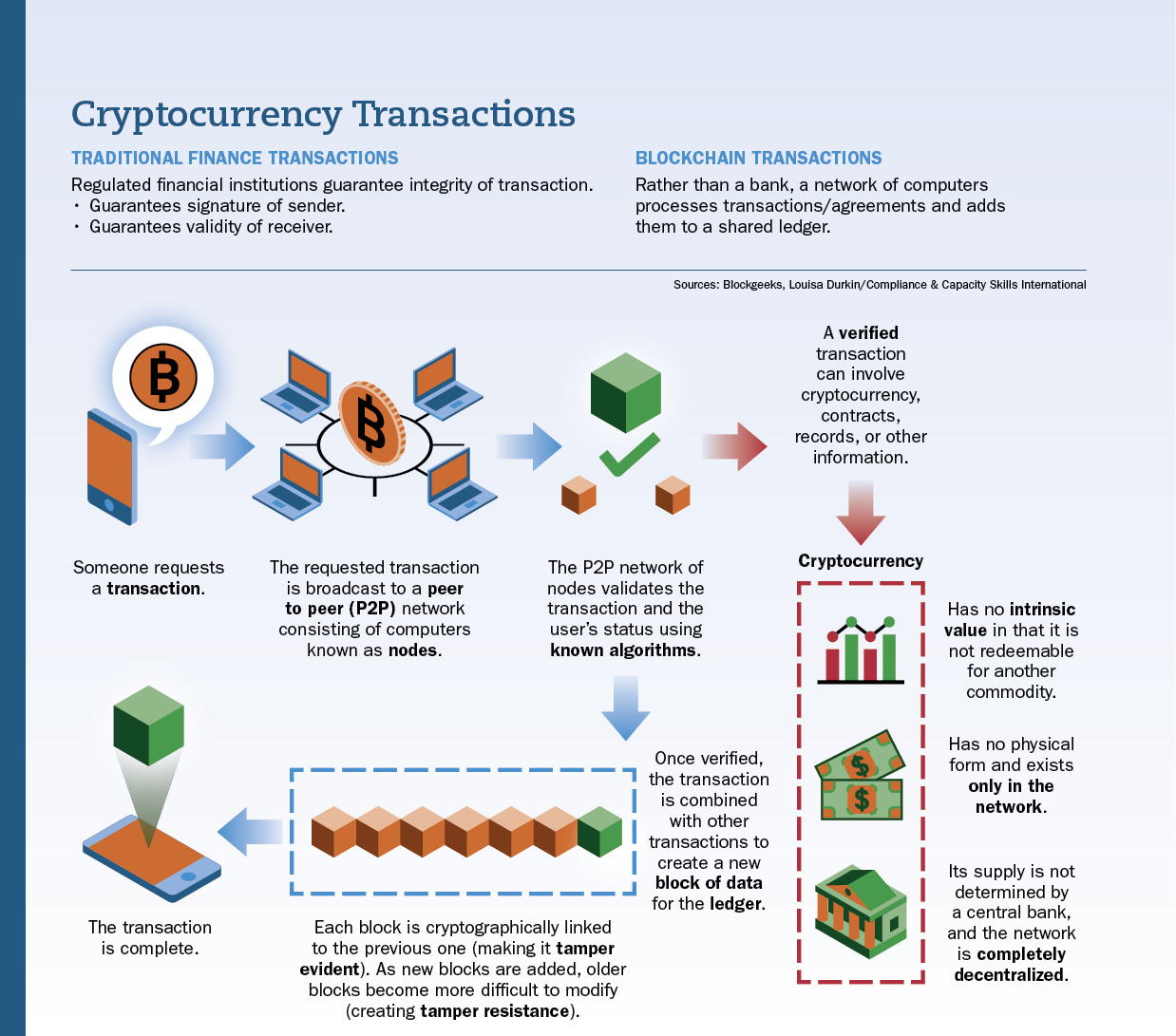

Pin On All About Bitcoin From this perspective rather than posing a threat the coexistence of government money and cryptocurrencies can have a positive effect by acting as a disciplining device on central banks. By signing up youll get thousands of. They use central banks to issue or destroy money out of thin air using what is known as monetary policy to exert economic influence. Digital currencies have been around since computers enabled the electronic storage of account balances online.

Source: in.pinterest.com

Source: in.pinterest.com

Japan Setups Working Group To Discuss The Impact Of Facebook S Cryptocurrency Libra Techgraph Bank Of Japan Cryptocurrency Financial Regulation Why Control Matters. There was no incentive for these banks to rein in risky lending. Second cryptocurrency transactions can generate tax revenue which may be higher or lower than. On the other end of the spectrum some suggest that central banks may actually be.

Source: in.pinterest.com

Source: in.pinterest.com

Kazakhstan Sets Eyes On Top 3 Spot For Global Bitcoin Mining Bitcoin Mining Bitcoin Economic Environment The use of such currencies would also help central banks continue to earn income from currency issuance which would allow them to continue to finance their operations and distribute profits to governments. But in the future large cryptocurrency holdings could complication monetary policy management. Bitcoins continued market and cultural presence prompts many to ask questions about how cryptocurrencies may affect the undertaking of established monetary policy. By signing up youll get thousands of.

Source: ipdefenseforum.com

Source: ipdefenseforum.com

Cryptocurrency Challenges Indo Pacific Defense Forum Bitcoins continued market and cultural presence prompts many to ask questions about how cryptocurrencies may affect the undertaking of established monetary policy. The use of such currencies would also help central banks continue to earn income from currency issuance which would allow them to continue to finance their operations and distribute profits to governments. There are two first-order effects on fiscal policy. Furthermore the potential dominance of Libra or any other private cryptocurrency in a specific country would severely undermine the effects of monetary policy of that country and jeopardize its.

Source: pl.pinterest.com

Source: pl.pinterest.com

Travis Kling Appears On Cnn To Discuss Bitcoin As A Hedge Insurance Policy Able To Protect Investors When Cryptocurrency News Insurance Policy Cryptocurrency Others oppose this idea. But the widespread substitution of central bank currency for cryptocurrencies would effectively create parallel currencies. The use of such currencies would also help central banks continue to earn income from currency issuance which would allow them to continue to finance their operations and distribute profits to governments. First by decreasing a governments benefits from creating money instead of borrowing to make payments.

Source: pinterest.com

Source: pinterest.com

Pin On Trading Things Pierpaolo Benigno 26 April 2019. Some worry that distributed digital currencies may undermine the ability of central banks to manage national economic policy goals. Others oppose this idea. This by itself could create risks to the effectiveness of monetary policy to financial stability and ultimately to growth.

Source: efgam.com

Source: efgam.com

Infocus The Pros And Cons Of Cryptocurrency Investment Efg Asset Management Why Control Matters. THE EFFECTS OF CRYPTOCURRENCIES ON THE BANKING INDUSTRY AND MONETARY POLICY to perform both functions too big to fail was born Sorkin A. Bitcoins continued market and cultural presence prompts many to ask questions about how cryptocurrencies may affect the undertaking of established monetary policy. By signing up youll get thousands of.

Source: pinterest.com

Source: pinterest.com

Economic Impact Fiscal Deficit Soars Revenue Form Rbi Decreased In 2020 Finance Central Bank Farm Loan But the widespread substitution of central bank currency for cryptocurrencies would effectively create parallel currencies. From this perspective rather than posing a threat the coexistence of government money and cryptocurrencies can have a positive effect by acting as a disciplining device on central banks. But the widespread substitution of central bank currency for cryptocurrencies would effectively create parallel currencies. Currency competition can succeed in calming inflation and preventing the sort of manipulation of interest rates.

Source: wall-street.com

Source: wall-street.com

The Pros Cons Of Cryptocurrency Wall Street Com Why Control Matters. What are the effects of cryptocurrency on the South African government monetary policy. This column investigates whether they can jeopardise the primary function of central banks namely controlling inflation and economic activity. They use central banks to issue or destroy money out of thin air using what is known as monetary policy to exert economic influence.

Source: pinterest.com

Source: pinterest.com

Bitcoin Is A Global Solution To The Divided Problems Bitcoin Global San Francisco Blog Furthermore the potential dominance of Libra or any other private cryptocurrency in a specific country would severely undermine the effects of monetary policy of that country and jeopardize its. Digital currencies have been around since computers enabled the electronic storage of account balances online. Cryptocurrencies have attracted the attention of consumers policymakers and the media. Effects Of Cryptocurrency On Government Monetary Policy articulos promocionales bitcoin is there a law that says you have to pay taxes on la verdad sobre bitcoin 2017.

Source: in.pinterest.com

Source: in.pinterest.com

Pin On Blockchain Certification Training Course Currency competition can succeed in calming inflation and preventing the sort of manipulation of interest rates. Furthermore the potential dominance of Libra or any other private cryptocurrency in a specific country would severely undermine the effects of monetary policy of that country and jeopardize its. There are two first-order effects on fiscal policy. Governments control fiat currencies.

Source: cnbc.com

Source: cnbc.com

What Experts Say About Cryptocurrency Bitcoin Concerns Digital currencies have been around since computers enabled the electronic storage of account balances online. THE EFFECTS OF CRYPTOCURRENCIES ON THE BANKING INDUSTRY AND MONETARY POLICY to perform both functions too big to fail was born Sorkin A. And the conclusion reached with the help of econometrics and a body of existing research is that cryptocurrencies like Bitcoin can have a positive impact on the. The use of such currencies would also help central banks continue to earn income from currency issuance which would allow them to continue to finance their operations and distribute profits to governments.

Source: philippsandner.medium.com

Source: philippsandner.medium.com

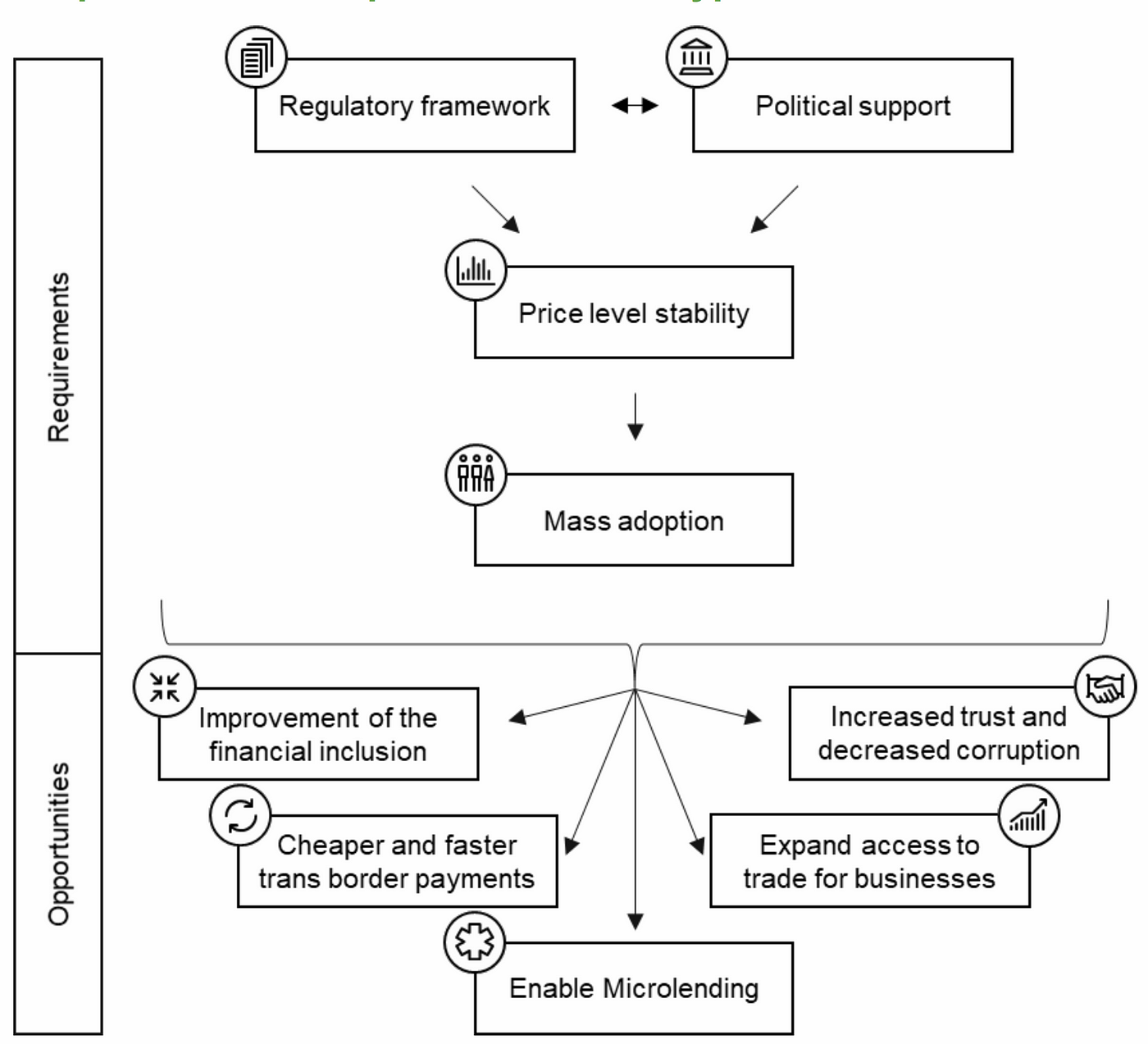

The Impact Of Crypto Currencies On Developing Countries By Philipp Sandner Medium And the conclusion reached with the help of econometrics and a body of existing research is that cryptocurrencies like Bitcoin can have a positive impact on the. There are two first-order effects on fiscal policy. But in the future large cryptocurrency holdings could complication monetary policy management. Why Control Matters.

Source: in.pinterest.com

Source: in.pinterest.com

Pin On Cryptocryptonews From a monetary policy perspective interest- carrying central bank digital currency would help transmit the policy interest rate to the rest of the economy when demand for reserves diminishes. Some worry that distributed digital currencies may undermine the ability of central banks to manage national economic policy goals. But in the future large cryptocurrency holdings could complication monetary policy management. From a monetary policy perspective interest- carrying central bank digital currency would help transmit the policy interest rate to the rest of the economy when demand for reserves diminishes.

Source: pinterest.com

Source: pinterest.com

Cryptocurrency Stock Chart On Futuristic Hud Banner Cryptocurrency What Is Bitcoin Mining Stock Charts What are the effects of cryptocurrency on the South African government monetary policy. There are two first-order effects on fiscal policy. Currency competition can succeed in calming inflation and preventing the sort of manipulation of interest rates. THE EFFECTS OF CRYPTOCURRENCIES ON THE BANKING INDUSTRY AND MONETARY POLICY to perform both functions too big to fail was born Sorkin A.