Trading cryptocurrency uk tax bitcoin and taxes when do you have to pay taxes on bitcoin. 1 day agoGiven a lot of the US discussion on crypto and tax I had a little search around for UK tax rules. Uk tax rules on cryptocurrency.

Uk Tax Rules On Cryptocurrency, If your taxable income is over 50000 youll pay 20 on your capital gains. You can cash in or give away 12300 worth of gains a year tax-free but then pay 10 tax. HMRC has published guidance for people who hold.

Details This manual sets out HMRCs view of the appropriate tax treatment of cryptoassets based on the law as it stands on the date of publication. The crypto taxation is based on your dealing with cryptocurrency explained as below. HMRC taxes cryptocurrency depending on how you deal with cryptocurrency. So if the profit from selling your cryptocurrency in addition to any other asset gains is.

People holding cryptoassets as a personal investment for capital appreciation or for purchases will be liable to pay Capital Gains Tax when they dispose of their cryptoassets.

Please get in touch to find out more on 0207 043 4000 or infoaccountsandlegalcouk. As a general rule if your taxable income for the financial year is less than 12500 you dont have to pay any CGT. In the UK HMRC treats tax on cryptocurrency like stocks and so any realised gains are subject to Capital Gains Tax. Taxes can be a complicated subject. If your taxable income is between 12500 and 50000 youll pay 10 on your capital gains. People holding cryptoassets as a personal investment for capital appreciation or for purchases will be liable to pay Capital Gains Tax when they dispose of their cryptoassets.

Read another article:

Source: pinterest.com

Source: pinterest.com

Coin4coinkorean Lawmakers Planning To Delay Crypto Income Tax Rule Tax Rules Income Tax How To Plan How Bitcoins and other Cryptocurrencies are Taxed in UK Tax treatment of any transaction involving the use of cryptocurrencies needs to be looked at on a case-by-case basis considering the specific facts each case being considered based on its own individual facts and circumstances. HMRC taxes cryptocurrency depending on how you deal with cryptocurrency. Details This manual sets out HMRCs view of the appropriate tax treatment of cryptoassets based on the law as it stands on the date of publication. HMRC requires share pool accounting when calculating the cost basis of a coin disposition CoinTracker offers this option in the settings for United Kingdom based users.

Source: coinpanda.io

Source: coinpanda.io

How To Report Taxes On Cryptocurrency Staking Rewards Selling crypto assets for money. People holding cryptoassets as a personal investment for capital appreciation or for purchases will be liable to pay Capital Gains Tax when they dispose of their cryptoassets. Although all information provided has been verified in communication with HM Revenue. Lets look at the crypto tax rules in more detail.

Source: pinterest.com

Source: pinterest.com

Tax Professional Explains The Most Important Thing For Us Crypto Holders Capital Gains Tax Capital Gain Cryptocurrency Although all information provided has been verified in communication with HM Revenue. The tax regulations cover crypto trading payments income mining gifts and business activity. If your taxable income is over 50000 youll pay 20 on your capital gains. People holding cryptoassets as a personal investment for capital appreciation or for purchases will be liable to pay Capital Gains Tax when they dispose of their cryptoassets.

Source: pinterest.com

Source: pinterest.com

Cryptocurrency Taxation In Romania Cryptocurrency Romania Transaction Cost Details This manual sets out HMRCs view of the appropriate tax treatment of cryptoassets based on the law as it stands on the date of publication. People holding cryptoassets as a personal investment for capital appreciation or for purchases will be liable to pay Capital Gains Tax when they dispose of their cryptoassets. HMRC taxes cryptocurrency depending on how you deal with cryptocurrency. HMRC has published guidance for people who hold.

Source: cryptotrader.tax

Source: cryptotrader.tax

Uk Crypto Tax Guide 2021 Cryptotrader Tax What is a tax on cryptocurrency. If you are cryptocurrency trading as a business or as an individual our experienced accountants and online accountants can ensure you get it right when it comes to tax. The tax regulations cover crypto trading payments income mining gifts and business activity. HMRC requires share pool accounting when calculating the cost basis of a coin disposition CoinTracker offers this option in the settings for United Kingdom based users.

Uk Cryptocurrency Tax Guide Cointracker This site aims to provide a simple overview of UK tax rules for newcomers to bitcoin and cryptocurrency. Complete a Self Assessment tax return at the end of the tax year. If your taxable income is between 12500 and 50000 youll pay 10 on your capital gains. HMRC has published guidance for people who hold.

Bitcoin Taxes Overview Of The Rules And How To Report Taxes For the 201819 tax years the thresholds are 46800 4x 11700 and for 20172018. If you hold crypto assets for personal investment you. Following days of negotiations the Senate on Monday struck down a bipartisan amendment to overhaul and clarify newly proposed cryptocurrency tax-reporting requirements included in the Senates 1. According to cryptocurrency tax software TaxBit which recently contracted with the IRS to aid the agency in digital currency-related audits tax rates vary between 10-37 on mining proceeds.

Source: balcellsgroup.com

Source: balcellsgroup.com

Taxes On Cryptocurrency In Spain How Much When How To Pay We are proud to be hosting an online seminar Crypto Tax with Adrian. Following days of negotiations the Senate on Monday struck down a bipartisan amendment to overhaul and clarify newly proposed cryptocurrency tax-reporting requirements included in the Senates 1. As a general rule if your taxable income for the financial year is less than 12500 you dont have to pay any CGT. HMRC has published guidance for people who hold.

Source: tokentax.co

Source: tokentax.co

How Cryptocurrency Is Taxed In The United Kingdom Tokentax For that please consult a financial adviser or tax consultant. So if the profit from selling your cryptocurrency in addition to any other asset gains is. If you are cryptocurrency trading as a business or as an individual our experienced accountants and online accountants can ensure you get it right when it comes to tax. HMRC taxes cryptocurrency depending on how you deal with cryptocurrency.

Source: in.pinterest.com

Source: in.pinterest.com

South Korean Government To Delay Crypto Tax Rules By Three Months In 2020 Tax Rules Months Tax Taxes can be a complicated subject. HMRC does not treat crypto assets as currency or money. The instrument is just one factor in your tax status. The tax regulations cover crypto trading payments income mining gifts and business activity.

Uk Cryptocurrency Tax Guide Cointracker HMRC requires share pool accounting when calculating the cost basis of a coin disposition CoinTracker offers this option in the settings for United Kingdom based users. Individuals that hold crypto as a personal investment will be liable to pay capital gains tax when they dispose of their cryptocurrency. Please get in touch to find out more on 0207 043 4000 or infoaccountsandlegalcouk. As a general rule if your taxable income for the financial year is less than 12500 you dont have to pay any CGT.

Source: pinterest.com

Source: pinterest.com

Calculate Bitcoin Taxes For Capital Gains And Income Capital Gain Bitcoin Ways To Earn Money How to report and pay. How to report and pay. You can cash in or give away 12300 worth of gains a year tax-free but then pay 10 tax. How Bitcoins and other Cryptocurrencies are Taxed in UK Tax treatment of any transaction involving the use of cryptocurrencies needs to be looked at on a case-by-case basis considering the specific facts each case being considered based on its own individual facts and circumstances.

Source: pinterest.com

Source: pinterest.com

British Tax Authority Seeks Data From Crypto Exchanges In Search Of Tax Evaders Tax Services British Taxes Internal Revenue Service For the 201819 tax years the thresholds are 46800 4x 11700 and for 20172018. What is a tax on cryptocurrency. Following days of negotiations the Senate on Monday struck down a bipartisan amendment to overhaul and clarify newly proposed cryptocurrency tax-reporting requirements included in the Senates 1. Individuals that hold crypto as a personal investment will be liable to pay capital gains tax when they dispose of their cryptocurrency.

Source: wandererswealth.com

Source: wandererswealth.com

The Most Crypto Friendly Tax Countries Wanderers Wealth I lost money trading cryptocurrency. Individuals that hold crypto as a personal investment will be liable to pay capital gains tax when they dispose of their cryptocurrency. How to report and pay. Lets look at the crypto tax rules in more detail.

Source: cryptoresearch.report

Source: cryptoresearch.report

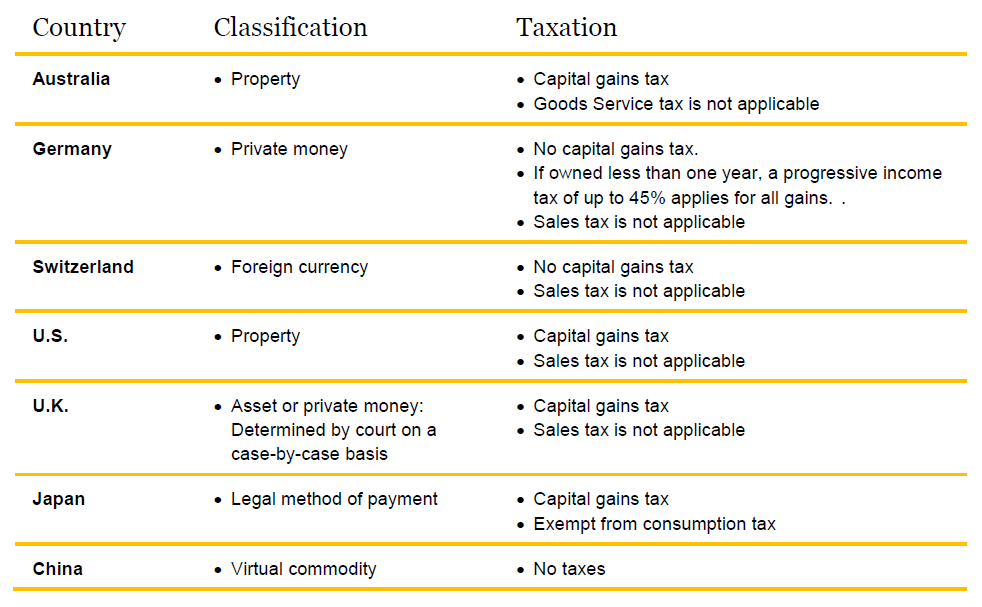

Taxation Of Cryptocurrencies In Europe Crypto Research Report So if the profit from selling your cryptocurrency in addition to any other asset gains is. We are proud to be hosting an online seminar Crypto Tax with Adrian. How Bitcoins and other Cryptocurrencies are Taxed in UK Tax treatment of any transaction involving the use of cryptocurrencies needs to be looked at on a case-by-case basis considering the specific facts each case being considered based on its own individual facts and circumstances. Exchanging crypto assets for a different type of crypto asset.