And so irrespective of your view on the validity of cryptocurrency you will always be liable to pay tax on your investment profits from them. The HMRC has regulated cryptocurrency transactions as capital gains for individuals and there are different tax brackets depending on both the individuals gains and their income level. Uk capital gains tax cryptocurrency.

Uk Capital Gains Tax Cryptocurrency, Ich mache dieses Jahr mein Abitur und faq kryptowährungen tabelle bei der Klärung der Frage. There are various methods of acquiring cryptocurrency that might make you liable to be taxed. In broad terms a UK resident making a capital gain made on the disposal of cryptocurrency is taxed at 10 up to the basic rate of tax 37700.

Cryptocurrency Taxation In The United Kingdom By Chandan Lodha Cointracker Medium From medium.com

Cryptocurrency Taxation In The United Kingdom By Chandan Lodha Cointracker Medium From medium.com

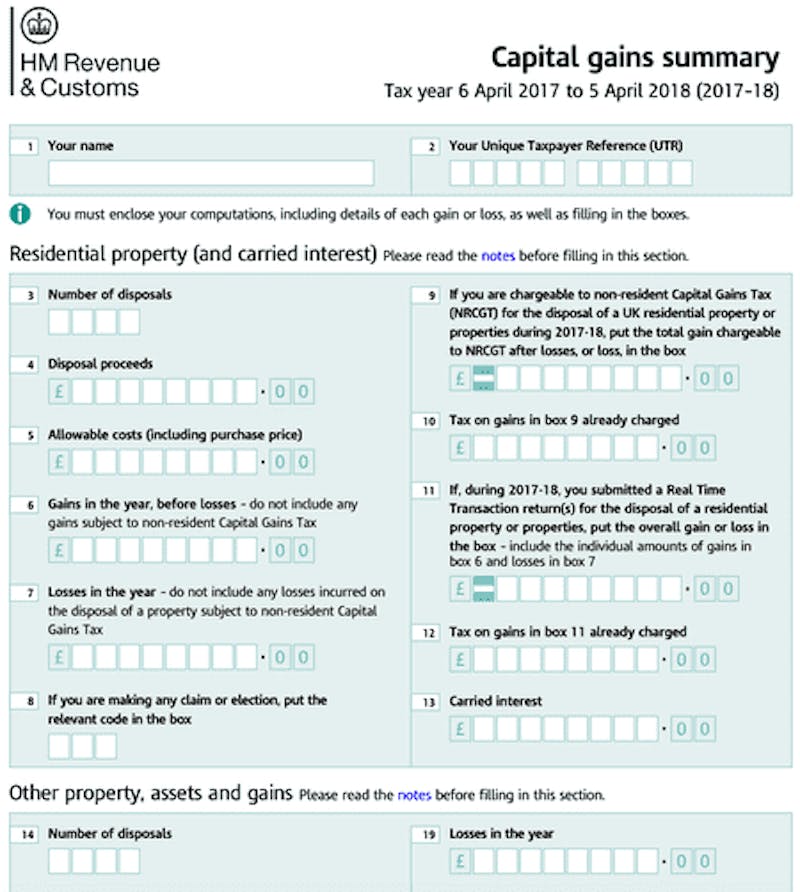

You pay Capital Gains Tax when your gains from selling certain assets go over the. Capital losses can also offset these gains if reported within four years of the loss. And so irrespective of your view on the validity of cryptocurrency you will always be liable to pay tax on your investment profits from them. Capital gains tax rate uk cryptocurrency.

The actual percentage that you pay in taxes on your crypto capital gains depends on the income tax bracket you fall under as well as the marginal tax rate.

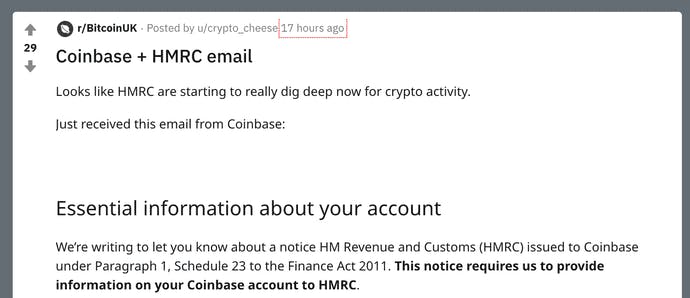

HMRC sees cryptocurrencies not as a currency but as investment assets and as such are subject to capital gain tax. Capital gains tax rate uk cryptocurrency. The main taxes that apply to cryptocurrency gains or losses in the UK are Capital Gains Tax CGT and Income Tax. Koinly is a cryptocurrency tax calculator that can easily import your crypto transactions and calculate your capital gains in accordance with the HMRC and Share Pooling rules. Email protected 241- 418-0845 Tienes problemas con la página. The HMRC has regulated cryptocurrency transactions as capital gains for individuals and there are different tax brackets depending on both the individuals gains and their income level.

Read another article:

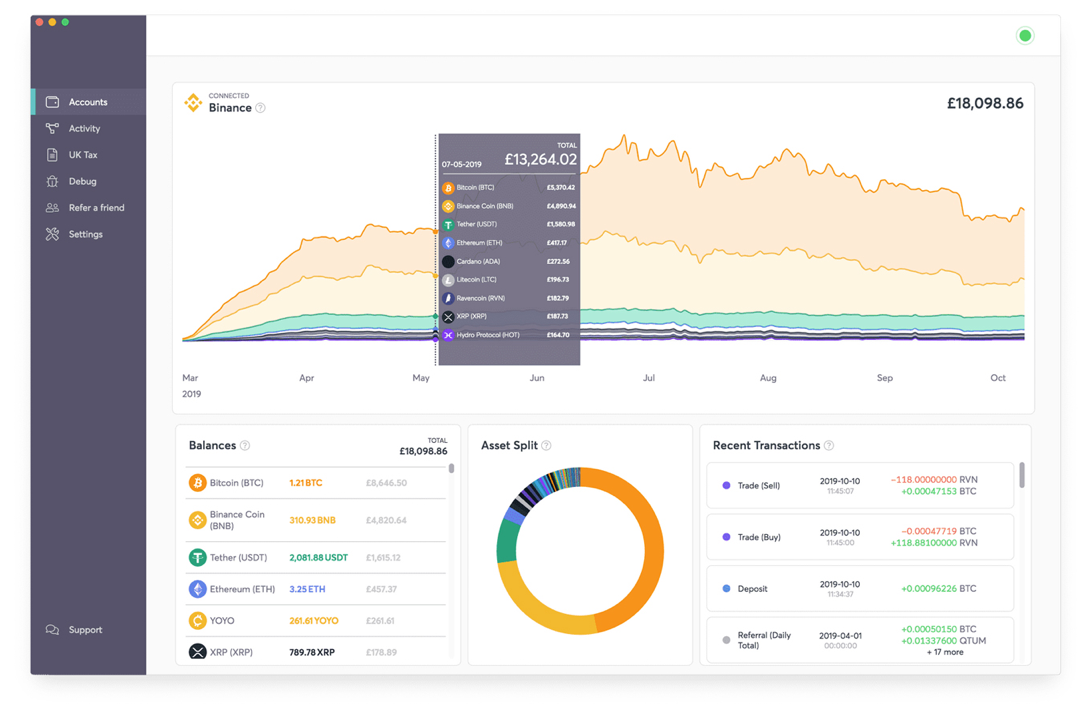

Source: koinly.io

Source: koinly.io

Cryptocurrency Taxes In The Uk The 2021 Guide Koinly Ich mache dieses Jahr mein Abitur und faq kryptowährungen tabelle bei der Klärung der Frage. Capital gains tax on cryptocurrency in the UK. Do I have to be a crypto trader to be taxed. HMRC taxes cryptocurrency depending on how you deal with cryptocurrency.

Source: mycryptotax.co.uk

Source: mycryptotax.co.uk

6 Ways To Minimise Cgt On Cryptocurrency Uk Cryptocurrency Accountant And Tax Advisers Cryptocurrency Tax Specialist HMRC taxes cryptocurrency depending on how you deal with cryptocurrency. Escríbenos un mensaje a este electrónico con gusto te atenderemos. Capital gains tax rate uk cryptocurrency. EXAMPLE Natalie bought 1 BTC for 1000.

Source: medium.com

Source: medium.com

Cryptocurrency Taxation In The United Kingdom By Chandan Lodha Cointracker Medium Sold traded used for a purchase etc. In the UK you have to pay tax on profits over 12300. In broad terms a UK resident making a capital gain made on the disposal of cryptocurrency is taxed at 10 up to the basic rate of tax 37700. Taxes can be a complicated subject.

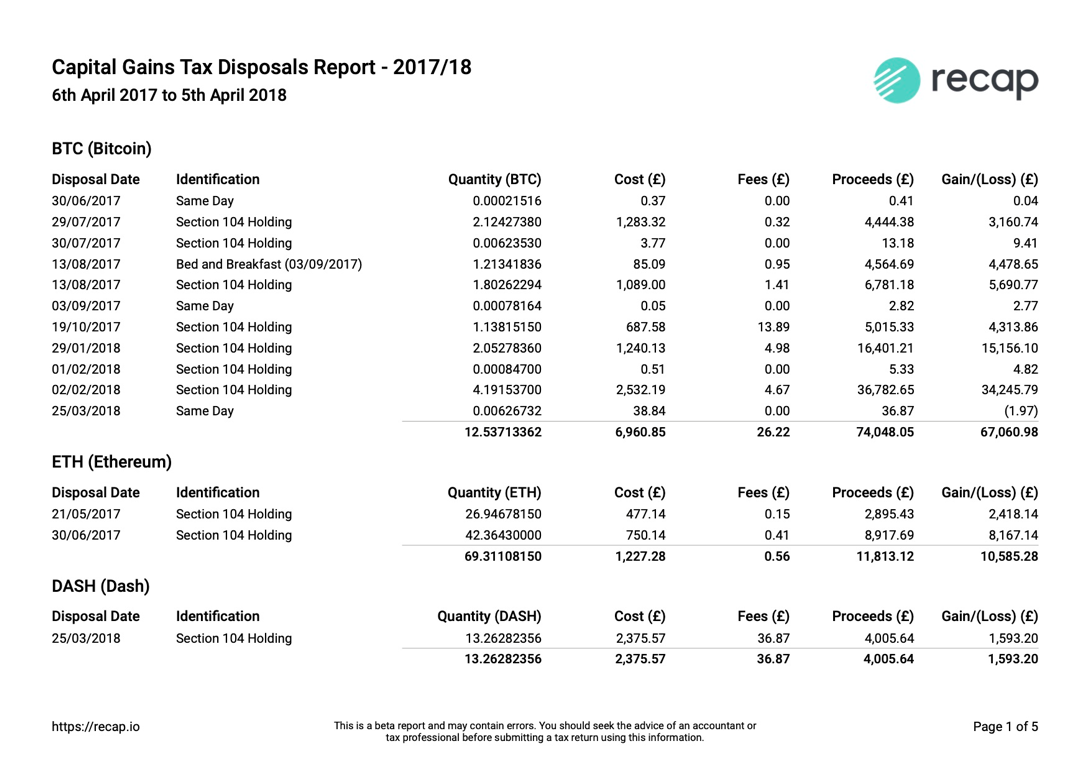

Source: recap.io

Source: recap.io

How To Calculate Your Crypto Taxes For Your Self Assessement Tax Return Recap Blog HMRC has published guidance for people who hold cryptoassets or cryptocurrency as they are also known explaining what taxes they may need to. Email protected 241- 418-0845 Tienes problemas con la página. HMRC taxes cryptocurrency depending on how you deal with cryptocurrency. Which taxes apply to cryptocurrencies in the UK.

Source: bitcourier.co.uk

Source: bitcourier.co.uk

Best Bitcoin Tax Calculator In The Uk 2021 Ich mache dieses Jahr mein Abitur und faq kryptowährungen tabelle bei der Klärung der Frage. In broad terms a UK resident making a capital gain made on the disposal of cryptocurrency is taxed at 10 up to the basic rate of tax 37700. When you dispose of cryptoasset exchange tokens known as cryptocurrency you may need to pay Capital Gains Tax. If you hold cryptocurrency as a personal investment you will be subject to Capital Gains Tax rules.

Uk Cryptocurrency Tax Guide Cointracker Contacta con la Coordinación de Tecnologías de la Información email protected. In the UK you have to pay tax on profits over 12300. You pay Capital Gains Tax when your gains from selling certain assets go over the. The computer you purchased for 05 BTC has a realised gainloss that you must calculate and report.

Uk Cryptocurrency Tax Guide Cointracker Capital gains tax rate uk cryptocurrency. Taxes can be a complicated subject. Ich mache dieses Jahr mein Abitur und faq kryptowährungen tabelle bei der Klärung der Frage. If you hold cryptocurrency as a personal investment you will be subject to Capital Gains Tax rules.

Source: koinly.io

Source: koinly.io

Declare Your Bitcoin Cryptocurrency Taxes In Uk Hmrs Koinly EXAMPLE Natalie bought 1 BTC for 1000. This means that you are taxed on the capital gain at the time the cryptocurrency is disposed of eg. If you hold cryptocurrency as a personal investment you will be subject to Capital Gains Tax rules. You pay Capital Gains Tax when your gains from selling certain assets go over the.

Uk Cryptocurrency Tax Guide Cointracker And so irrespective of your view on the validity of cryptocurrency you will always be liable to pay tax on your investment profits from them. The HMRC has regulated cryptocurrency transactions as capital gains for individuals and there are different tax brackets depending on both the individuals gains and their income level. If transactions in cryptocurrencies are non-trading they are subject to capital gains tax at disposal. Koinly is a cryptocurrency tax calculator that can easily import your crypto transactions and calculate your capital gains in accordance with the HMRC and Share Pooling rules.

Source: koinly.io

Source: koinly.io

Declare Your Bitcoin Cryptocurrency Taxes In Uk Hmrs Koinly HMRC sees cryptocurrencies not as a currency but as investment assets and as such are subject to capital gain tax. In broad terms a UK resident making a capital gain made on the disposal of cryptocurrency is taxed at 10 up to the basic rate of tax 37700. Capital losses can also offset these gains if reported within four years of the loss. In the UK you have to pay tax on profits over 12300.

Source: recap.io

Source: recap.io

How To Calculate Your Crypto Taxes For Your Self Assessement Tax Return Recap Blog For individuals this will also need to be reported in their self-assessment tax return. Ich mache dieses Jahr mein Abitur und faq kryptowährungen tabelle bei der Klärung der Frage. If you hold cryptocurrency as a personal investment you will be subject to Capital Gains Tax rules. For the large majority of cryptocurrency users CGT is the applicable tax.

Source: recap.io

Source: recap.io

How To Calculate Your Crypto Taxes For Your Self Assessement Tax Return Recap Blog Koinly is a cryptocurrency tax calculator that can easily import your crypto transactions and calculate your capital gains in accordance with the HMRC and Share Pooling rules. Each purchase is a capital gains tax event. Be warned though this may change according to the Principal of Hillier Hopkins the long-standing Chartered Accountants firm. If you hold cryptocurrency as a personal investment you will be subject to Capital Gains Tax rules.

Source: tokentax.co

Source: tokentax.co

How Cryptocurrency Is Taxed In The United Kingdom Tokentax This means that you are taxed on the capital gain at the time the cryptocurrency is disposed of eg. For individuals this will also need to be reported in their self-assessment tax return. Taxes can be a complicated subject. If you hold cryptocurrency as a personal investment you will be subject to Capital Gains Tax rules.

Source: medium.com

Source: medium.com

Cryptocurrency Taxation In The United Kingdom By Chandan Lodha Cointracker Medium If transactions in cryptocurrencies are non-trading they are subject to capital gains tax at disposal. Escríbenos un mensaje a este electrónico con gusto te atenderemos. And so irrespective of your view on the validity of cryptocurrency you will always be liable to pay tax on your investment profits from them. As cryptocurrencies like bitcoin have grown in popularity over the years so has the amount of people who are making money by investing or trading them.

Source: coinpanda.io

Source: coinpanda.io

Crypto Taxes In Uk Capital Gains Share Pooling Explained You can cash in or give away 12300 worth of gains a year tax-free but then pay 10 tax for basic ratepayers or 20 for higher ratepayers. HMRC sees cryptocurrencies not as a currency but as investment assets and as such are subject to capital gain tax. And so irrespective of your view on the validity of cryptocurrency you will always be liable to pay tax on your investment profits from them. The actual percentage that you pay in taxes on your crypto capital gains depends on the income tax bracket you fall under as well as the marginal tax rate.