Besides CoinTracker Coinbase and Robinhood. My first question is - will frequent daytrading cryptocurrency make tax reporting next year a management nightmare compared to doing. Turbotax cryptocurrency robinhood.

Turbotax Cryptocurrency Robinhood, How to file crypto taxes Robinhood and all other investments—-FREE CRYPTO FREE STOCKS for signing up—– Easiest ExchangesJoin Robinhood and get a stoc. If you still need to get your crypto tax forms you can use our cryptocurrency tax software to calculate your taxes and create your tax forms. You can then import the CSV directly into TurboTax from the top exchanges including.

How To File Robinhood Investments With Turbo Tax Robinhood From reddit.com

How To File Robinhood Investments With Turbo Tax Robinhood From reddit.com

Usually Ill buy and then sell a cryptocurrency within a few days but very often in the same day. Did this answer your question. The file format for records of my crypto transactions is a PDF. The easiest way is to download your transactions from your exchange as a CSV file.

Virtual currency like Bitcoin has shifted into the public eye in recent years.

Capital gains on crypto are reported on IRS Form 8949. You can now automatically import your crypto taxes into TurboTax. Less than 30 minutes down the road from Napa Sonoma County has an additional 250 wineries specializing in Zinfandel Pinot Noir Chardonnay and Cabernet Sauvignon. Did this answer your question. Youll receive a 1099-K if you made over 200 cryptocurrency transactions or your proceeds exceeded 20000. Dont Overlook the Additional Child.

Read another article:

Source: discoveryoptometry.com

Source: discoveryoptometry.com

Cryptocurrency Robinhood Wash Sale Rule Td Ameritrade Contribute To Previous Year Discovery Optometry Every Cryptocurrency on Robinhood Ranked. How to file crypto taxes Robinhood and all other investments—-FREE CRYPTO FREE STOCKS for signing up—– Easiest ExchangesJoin Robinhood and get a stoc. How to report cryptocurrency on TurboTax. Cryptocurrency you used to pay for products or services or received as payment.

Source: reddit.com

Source: reddit.com

Help On Importing 1099 From Robinhood To Turbotax Tax Usually Ill buy and then sell a cryptocurrency within a few days but very often in the same day. Simply navigate to Robinhood tax document section and download your 1099. TurboTax claims they paired up with Coinbase to allow seamless transfer of cryptocurrency buysell data. Usually Ill buy and then sell a cryptocurrency within a few days but very often in the same day.

Source: youtube.com

Source: youtube.com

Robinhood App How To File Taxes Turbo Tax 2019 Youtube If you still need to get your crypto tax forms you can use our cryptocurrency tax software to calculate your taxes and create your tax forms. Cryptocurrency exchanges are not required to provide a 1099-B or summary tax statement for cryptocurrency transactions. TurboTax is the 1 best-selling tax preparation software to file taxes online. When using TurboTax it will ask you to select which cryptocurrency service you use.

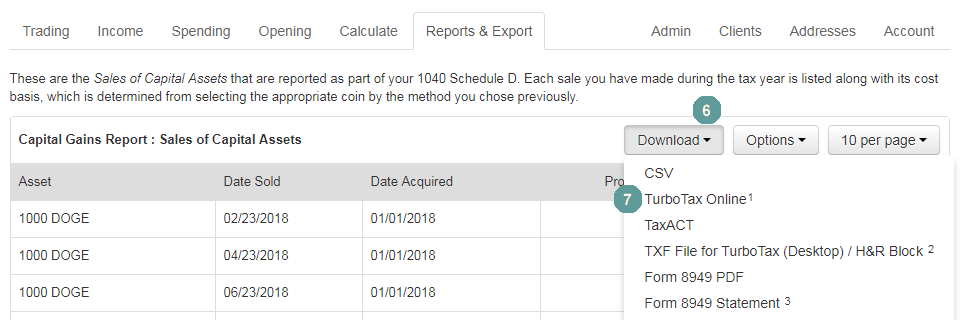

Source: bitcointaxes.zendesk.com

Source: bitcointaxes.zendesk.com

Turbotax Online Only Supports Importing 2251 Transactions What Should I Do Bitcoin Taxes Some employees are paid with Bitcoin more than a few retailers accept Bitcoin as payment and others hold the e-currency as a capital asset. You can now automatically import your crypto taxes into TurboTax. TurboTax has partnered with TokenTax for crypto tax filing. Youll receive a 1099-K if you made over 200 cryptocurrency transactions or your proceeds exceeded 20000.

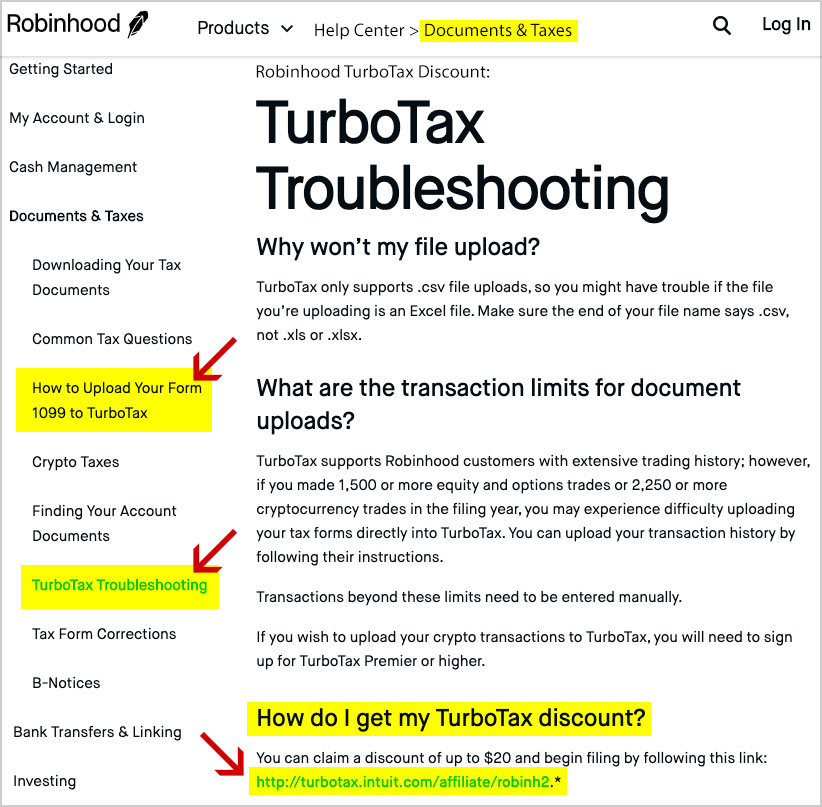

Source: mightytaxes.com

Source: mightytaxes.com

Turbotax Robinhood Discount Save Up To 20 2021 Usually Ill buy and then sell a cryptocurrency within a few days but very often in the same day. Dont Overlook the Additional Child. Cryptocurrency you used to pay for products or services or received as payment. The file format for records of my crypto transactions is a PDF.

Source: youtube.com

Source: youtube.com

Robinhood Taxes Explained How To File Robinhood Taxes On Turbotax Youtube Cramers Mad Money Recap. My first question is - will frequent daytrading cryptocurrency make tax reporting next year a management nightmare compared to doing. The file format for records of my crypto transactions is a PDF. Some employees are paid with Bitcoin more than a few retailers accept Bitcoin as payment and others hold the e-currency as a capital asset.

Source: reddit.com

Source: reddit.com

How To File Robinhood Investments With Turbo Tax Robinhood Simply navigate to Robinhood tax document section and download your 1099. BITCOIN CANNABIS CRYPTOCURRENCY ETFS EARNINGS FIXED INCOME. Did this answer your question. TurboTax Onlin Robinhood caused quite a kerfuffle last week after it temporarily suspended trading of several popular stocks including GameStop and AMC and then limited cryptocurrency purchases as well.

Source: au.pcmag.com

Source: au.pcmag.com

Turbotax Vs H R Block Which Tax Software Is Best For Filing Your Taxes Online TurboTax has partnered with TokenTax for crypto tax filing. Easily file federal and state income tax returns with 100 accuracy to get your maximum tax refund guaranteed. If you still need to get your crypto tax forms you can use our cryptocurrency tax software to calculate your taxes and create your tax forms. The DesktopCD version of TurboTax will not accept an upload of CSV files from the cryptocurrency traders like the Online version does.

Source: reddit.com

Source: reddit.com

The 2021 Tax Season Is Upon Us Robinhood For more information discussing this in detail checkout the blog article we wrote about this here. Did this answer your question. For more information about cryptocurrency taxes checkout our Complete 2019 Guide to Cryptocurrency Taxes. Usually Ill buy and then sell a cryptocurrency within a few days but very often in the same day.

Source: cryptotrader.tax

Source: cryptotrader.tax

Robinhood Crypto Taxes Explained Cryptotrader Tax If you still need to get your crypto tax forms you can use our cryptocurrency tax software to calculate your taxes and create your tax forms. The formats are completely incompatible. No data will be double counted. When using TurboTax it will ask you to select which cryptocurrency service you use.

Solved What Do I Do If I Have Way Too Many Stock Transactions With Robinhood To Manually Record In My Taxes Youll receive a 1099-K if you made over 200 cryptocurrency transactions or your proceeds exceeded 20000. Easily file federal and state income tax returns with 100 accuracy to get your maximum tax refund guaranteed. One bullish option trade is the following butterfly. Every Cryptocurrency on Robinhood Ranked.

Source: youtube.com

Source: youtube.com

How To File Crypto Taxes Robinhood And All Other Brokerage Acct Turbotax 1099b Youtube The easiest way is to download your transactions from your exchange as a CSV file. BITCOIN CANNABIS CRYPTOCURRENCY ETFS EARNINGS FIXED INCOME. TurboTax has partnered with TokenTax for crypto tax filing. TurboTax Onlin Robinhood caused quite a kerfuffle last week after it temporarily suspended trading of several popular stocks including GameStop and AMC and then limited cryptocurrency purchases as well.

Source: money.stackexchange.com

Source: money.stackexchange.com

What Are The Requirements To Not Report All Stock Transactions On The Tax Return 1099 B Personal Finance Money Stack Exchange Buy to open 1 INTU October 425 call for 195 sell to open 2 INTU October 45 calls at. Recently the Internal Revenue Service IRS clarified the tax treatment of virtual currency transactions. For more information discussing this in detail checkout the blog article we wrote about this here. You can now automatically import your crypto taxes into TurboTax.

Source: uk.pcmag.com

Source: uk.pcmag.com

Turbotax Vs H R Block Which Tax Software Is Best For Filing Your Taxes Online No data will be double counted. Did this answer your question. How to report cryptocurrency on TurboTax. One bullish option trade is the following butterfly.

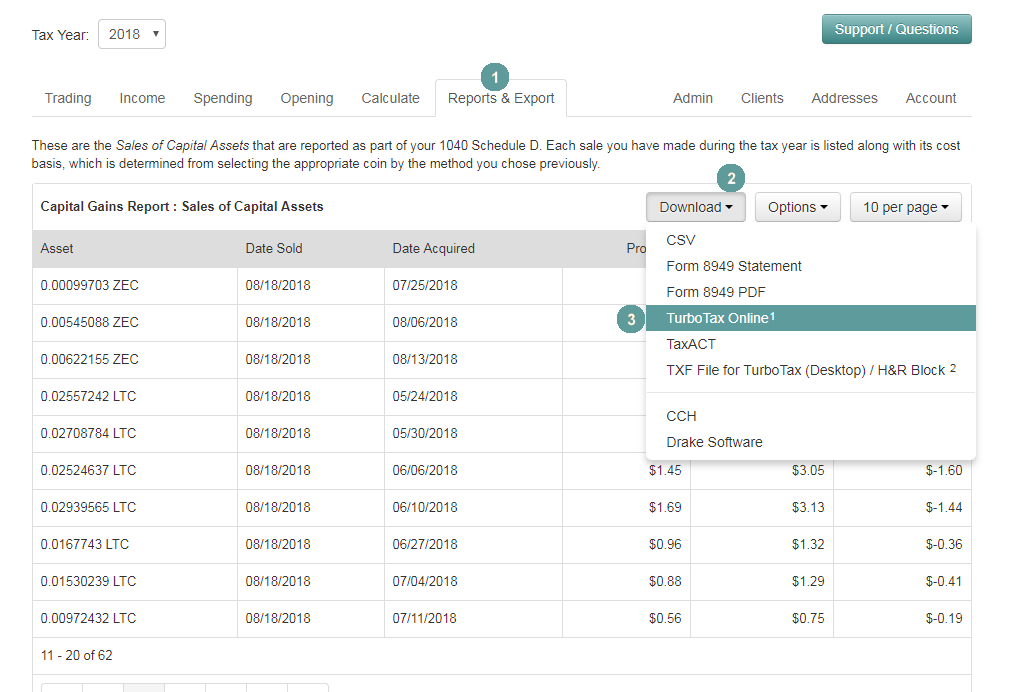

Source: bitcointaxes.zendesk.com

Source: bitcointaxes.zendesk.com

How To Import Capital Gains In To Turbotax Online Bitcoin Taxes You can now automatically import your crypto taxes into TurboTax. If you are using TurboTax or any other tax filing software you should import your TurboTax CSV that CryptoTraderTax exports as well as your 1099-B that Robinhood exports into your TurboTax account. Taxes on daytrading cryptocurrencies on Robinhood. Virtual currency like Bitcoin has shifted into the public eye in recent years.