TurboTax makes it easier than ever to file for taxes including many cryptocurrency transactions. Click I sold or traded Cryptocurrency among any other situations that fit your situation. Turbotax cryptocurrency reporting.

Turbotax Cryptocurrency Reporting, Recently the Internal Revenue Service IRS clarified the tax treatment of virtual currency transactions. Even if youre an active trader with complex transactions across exchanges and wallets ZenLedgers integrations can help you ensure that youre properly reporting everything to the IRS. Weve partnered with TurboTax to save you 15 on TurboTax Premier which easily handles cryptocurrency gainslosses.

How To Report Cryptocurrency On Taxes Tokentax From tokentax.co

How To Report Cryptocurrency On Taxes Tokentax From tokentax.co

Before you were required to manually enter each taxable transaction which could take hours. Select this link to have the. You can now automatically import your crypto taxes into TurboTax. Youll have to be report your cryptocurrency on the off.

To report cryptocurrency on TurboTax Ill lay out the steps below.

You can now automatically import your crypto taxes into TurboTax. How to report cryptocurrency on TurboTax TurboTax has partnered with TokenTax for crypto tax filing. This is to be expected and you may disregard the Needs Info. How do I use TurboTax to report on my cryptocurrency. If you still need to get your crypto tax forms you can use our cryptocurrency tax software to. Before you were required to manually enter each taxable transaction which could take hours.

Read another article:

Source: pinterest.com

Source: pinterest.com

A Step By Step Guide Reporting Health Insurance On Your Taxes Turbotax Play To Learn Health Care Reform Weve built a solution that allows you to import transactions from Coinbase to TurboTax with plenty of help and resources along the way. If you still need to get your crypto tax forms you can use our cryptocurrency tax software to. In this article we will explain how to report cryptocurrency on turbotax. Youll have to be report your cryptocurrency on the off.

Source: reddit.com

Source: reddit.com

Turbotax Has An I Sold Or Traded Cryptocurrency Option When Filing Taxes Online Cryptocurrency Before you were required to manually enter each taxable transaction which could take hours. Select this link to have the. Failing to report that income can pose a huge problem now that the digital currency market is bottoming out. TurboTax is a very popular tax reporting tool in the US and Canada.

Source: turbotax.intuit.com

Source: turbotax.intuit.com

Your Cryptocurrency Tax Guide Turbotax Tax Tips Videos If you still need to get your crypto tax forms you can use our cryptocurrency tax software to. TurboTax will ask for a variety of information including what financial transactions youve had throughout the year. Youll have to be report your cryptocurrency on the off. You can usually download a transaction report from your cryptocurrency exchange platform including all of your buys sells and exchanges of cryptocurrency in your account.

Source: cryptotaxaudit.com

Source: cryptotaxaudit.com

Millennials Need A Crypto Tax Amnesty Program Detailing cryptocurrency is comparable to detailing a stock deal. Recently the Internal Revenue Service IRS clarified the tax treatment of virtual currency transactions. When using TurboTax it will ask you to select which cryptocurrency service you use. How to report cryptocurrency on TurboTax TurboTax has partnered with TokenTax for crypto tax filing.

Source: cryptotrader.tax

Source: cryptotrader.tax

The Beginner S Guide To Crypto Mining And Staking Taxes Cryptotrader Tax Before you were required to manually enter each taxable transaction which could take hours. TurboTax makes it easier than ever to file for taxes including many cryptocurrency transactions. This is to be expected and you may disregard the Needs Info. Reporting cryptocurrency is similar to reporting a stock sale.

Source: blog.turbotax.intuit.com

Source: blog.turbotax.intuit.com

Turbotax Makes It Easier For Coinbase Customers To Report Their Cryptocurrency Transactions The Turbotax Blog You can now automatically import your crypto taxes into TurboTax. If you still need to get your crypto tax forms you can use our cryptocurrency tax software to. Youll have to be report your cryptocurrency on the off. To report cryptocurrency on TurboTax Ill lay out the steps below.

Source: support.binance.us

Source: support.binance.us

Cryptocurrency Tax Reporting Binance Us You can usually download a transaction report from your cryptocurrency exchange platform including all of your buys sells and exchanges of cryptocurrency in your account. Capital gains on crypto are reported on IRS Form 8949. When it comes to hard forks and airdrops you only have taxable income if it results new cryptocurrency. Below are the instructions for reporting your cryptocurrency taxes using TurboTax.

Source: taxbit.com

Source: taxbit.com

A Complete 2020 Guide To Cryptocurrency Taxes Taxbit Virtual currency like Bitcoin has shifted into the public eye in recent years. In Canada the Canada Revenue Agency expects all Crypto-Currency transactions to be treated in the same manner as any commodity would which means any increase in the price produces a Capital Gain taxable at 50 and any losses would. Virtual currency like Bitcoin has shifted into the public eye in recent years. TurboTax is taking steps to streamline the crypto communitys experience this tax season.

Source: picnictax.com

Source: picnictax.com

Bitcoin Taxes How Is Cryptocurrency Taxed In 2021 Picnic S Blog Start your TurboTax tax return like you usually would. Cryptocurrency sold exchanged spent or converted is treated as sale of property. Detailing cryptocurrency is comparable to detailing a stock deal. TurboTax makes it easier than ever to file for taxes including many cryptocurrency transactions.

Source: cryptotaxcalculator.io

Source: cryptotaxcalculator.io

How To Submit Your Cryptocurrency Report Using Turbotax If all of your cryptocurrency transactions occur on one exchange gathering the information you need to report transactions on your tax return should be relatively easy. By Lucas WylandJan 20 20193 mins to read. Weve partnered with TurboTax to save you 15 on TurboTax Premier which easily handles cryptocurrency gainslosses. Weve built a solution that allows you to import transactions from Coinbase to TurboTax with plenty of help and resources along the way.

Cryptocurrency Bitcoin Tax Guide 2021 Edition Cointracker Youll have to be report your cryptocurrency on the off. Cryptocurrency received as payment for goods and services is taxed as earned income If you earned money by providing a service or selling something youd have to report it as earned income either wages or self-employment income as if youd been paid in cash. Cryptocurrency sold exchanged spent or converted is treated as sale of property. Youll have to be report your cryptocurrency on the off.

Source: twitter.com

Source: twitter.com

Beartax Cryptocurrency Tax Software Bear Tax Twitter In this guide we walk through the step-by-step process for crypto and bitcoin tax reporting within TurboTaxboth online and desktop versions. Youll need to report your cryptocurrency if you sold exchanged spent or converted it. The report generated by CryptoTraderTax is aggregated across multiple cryptocurrency exchanges so the Financial Institution name is not set. Reporting cryptocurrency is similar to reporting a stock sale.

Source: tokentax.co

Source: tokentax.co

How To Report Cryptocurrency On Taxes Tokentax Reporting cryptocurrency is similar to reporting a stock sale. Capital gains on crypto are reported on IRS Form 8949. To report cryptocurrency on TurboTax Ill lay out the steps below. Reporting cryptocurrency is similar to reporting a stock sale.

Source: koinly.io

Source: koinly.io

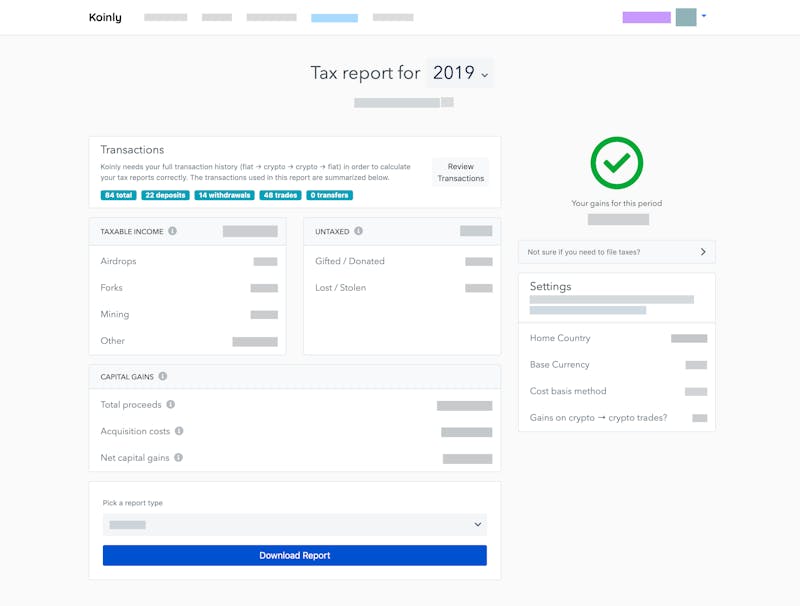

Cryptocurrency Tax Reports In Minutes Koinly In this article we will explain how to report cryptocurrency on turbotax. When it comes to hard forks and airdrops you only have taxable income if it results new cryptocurrency. Start your TurboTax tax return like you usually would. The report generated by CryptoTraderTax is aggregated across multiple cryptocurrency exchanges so the Financial Institution name is not set.

Source: youtube.com

Source: youtube.com

How To File Your Cryptocurrency Taxes With Turbotax Cryptotrader Tax Youtube Some employees are paid with Bitcoin more than a few retailers accept Bitcoin as payment and others hold the e-currency as a capital asset. Failing to report that income can pose a huge problem now that the digital currency market is bottoming out. Start your TurboTax tax return like you usually would. Capital gains on crypto are reported on IRS Form 8949.