Gold and silver trade slightly lower leading into the EU open - Kitco News. PRSI PAYE and USC Will apply at the relevant rates Up to 52 tax. Tax implications of day trading cryptocurrency.

Tax Implications Of Day Trading Cryptocurrency, Whether you are a business with a custom mining rig or you mine on a computer as a personal investment. Cryptocurrency gains from trading coins held as capital assets are treated as investment income by the IRS and the same capital gains rules apply. Capital gains tax CGT - applies to a cryptocurrency at the time it is disposed of.

The profits will be subject to normal income tax rules ie. Tax implications of cryptocurrency mining Mining digital currency creates numerous tax implications that a user must report on multiple forms. In short cryptocurrencies are subject to capital gains tax treatment as well as ordinary income depending on the circumstances of your crypto transactions. But there could be tax consequences when you do any of the following.

For single filers the capital gains tax rate is 0 if you earn up to 40000 per year 15 if you earn up to 441450 and 20 if you make more than that.

A taxpayer who sells a coin position for cash must report a capital gain on Form 8949. You must report the mined cryptocurrency as ordinary income in your tax forms. This manual sets out HMRCs view of the appropriate tax treatment of cryptoassets based on the law as it stands on the date of publication. With day trading taxes we may have to pay taxes quarterly. As such it is subject to the same tax rules as any other capital gain loss. Its important to note that the IRS does not treat cryptocurrency as regular currency.

Read another article:

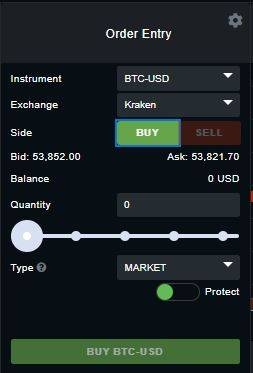

Source: coinpanda.io

Source: coinpanda.io

Guide How To Report Taxes On Cryptocurrency Margin Trading Its always best to check with your accountant on that. Tax implications of cryptocurrency mining Mining digital currency creates numerous tax implications that a user must report on multiple forms. A taxpayer who sells a coin position for cash must report a capital gain on Form 8949. Gold and silver trade slightly lower leading into the EU open - Kitco News.

Source: jeangalea.com

Source: jeangalea.com

Ftx Review 2021 An Exchange For Cryptocurrency Derivatives You may be liable to pay a number of different taxes like CGT Income Tax Corporation Tax Stamp Duties and even VAT depending on the type of transaction. This IRS worksheet can help you do the. The profits will be subject to normal income tax rules ie. We will walk through examples for.

The 4 Hour A Month Crypto Investor How To Make Money When You Re Short On Time By Misha Medium You must report the mined cryptocurrency as ordinary income in your tax forms. Its always best to check with your accountant on that. In short cryptocurrencies are subject to capital gains tax treatment as well as ordinary income depending on the circumstances of your crypto transactions. We will walk through examples for.

Day Trading Cryptocurrency The Best Strategies For Success Tax implications of cryptocurrency transactions By Paul Kruger on 10 August 2021 0 SARS is tightening tax collection on cryptocurrency transactions which makes it important to distinguish between events that will trigger income tax rates or CGT rates. This manual sets out HMRCs view of the appropriate tax treatment of cryptoassets based on the law as it stands on the date of publication. If your profits are larger than your losses and thats the goal you may need to pay quarterly. Gold and silver trade slightly lower leading into the EU open - Kitco News.

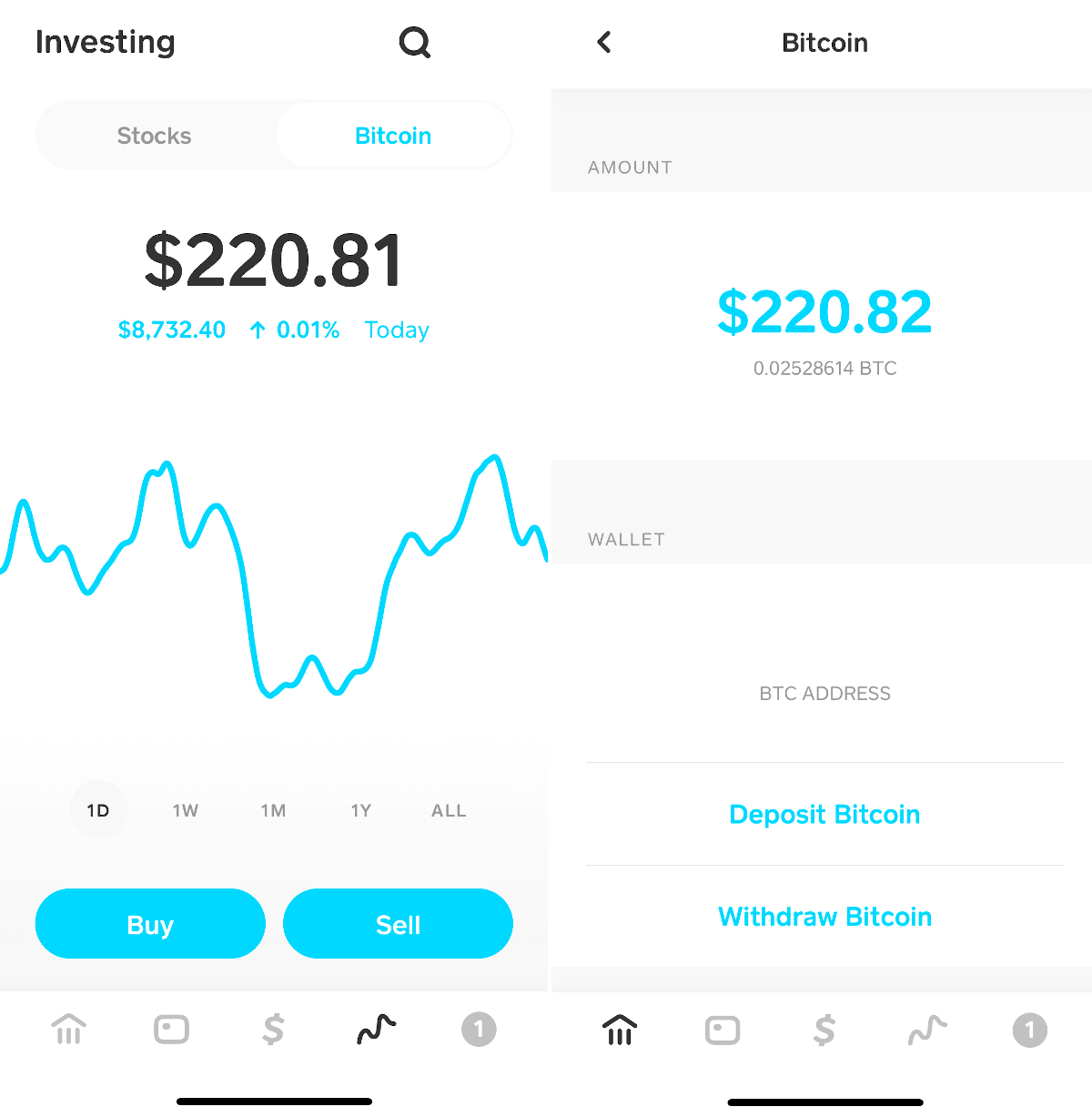

Source: pinterest.com

Source: pinterest.com

Blockchain Applications In Insurance Why Develop A Blockchain Solution Blockchain Solutions Healthcare Solutions Gold and silver trade slightly lower leading into the EU open - Kitco News. Any reference to cryptocurrency in this guidance refers to Bitcoin or other crypto or digital currencies that have similar. In short cryptocurrencies are subject to capital gains tax treatment as well as ordinary income depending on the circumstances of your crypto transactions. The IRS views cryptocurrency as property.

Source: ig.com

Source: ig.com

How To Hedge Bitcoin Risk Cryptocurrency Hedging Explained Ig En Tax implications of cryptocurrency mining Mining digital currency creates numerous tax implications that a user must report on multiple forms. If your profits are larger than your losses and thats the goal you may need to pay quarterly. Cryptocurrency generally operates independently of a central bank central authority or government. Therefore individuals that are trading in cryptocurrency are required to file an income tax return Form 11 or Form 12 each year and declare profits made on trading.

Day Trading Cryptocurrency The Best Strategies For Success Yes Day Trading Crypto is Taxable. Because of this difference those who are day trading crypto assets could face a large tax bill on any gains they may have In the meantime. Its important to note that the IRS does not treat cryptocurrency as regular currency. A taxpayer who sells a coin position for cash must report a capital gain on Form 8949.

Source: in.pinterest.com

Source: in.pinterest.com

Cryptocurrency Explained Cryptocurrency Bitcoin Business World News Video Its important to note that the IRS does not treat cryptocurrency as regular currency. HMRC has published guidance for. Gold and silver trade slightly lower leading into the EU open - Kitco News. This manual sets out HMRCs view of the appropriate tax treatment of cryptoassets based on the law as it stands on the date of publication.

Source: cryptocurrencyfacts.com

Source: cryptocurrencyfacts.com

How To Trade Cryptocurrency For Beginners The creation trade and use of cryptocurrency is rapidly evolving. We will walk through examples for. HMRC has published guidance for. In short cryptocurrencies are subject to capital gains tax treatment as well as ordinary income depending on the circumstances of your crypto transactions.

Source: ig.com

Source: ig.com

How To Hedge Bitcoin Risk Cryptocurrency Hedging Explained Ig En This information is our current view of the income tax implications of common transactions involving cryptocurrency. If your profits are larger than your losses and thats the goal you may need to pay quarterly. Therefore individuals that are trading in cryptocurrency are required to file an income tax return Form 11 or Form 12 each year and declare profits made on trading. HMRC has published guidance for.

Source: in.pinterest.com

Source: in.pinterest.com

Flying Bitcoin Rocket Sign Icon For Internet Money Crypto Currency Symbol And Coin Image For Using In Web Projects B Bitcoin Crypto Currencies Internet Money Sell or make a gift of cryptocurrency trade or exchange cryptocurrency including disposing of one cryptocurrency to get another cryptocurrency. Outside of buying selling and trading if you earn cryptocurrencieswhether through a job mining staking airdrop or interest from lending activitiesyou are liable for income taxes on the US Dollar value of your crypto earnings. We will walk through examples for. The creation trade and use of cryptocurrency is rapidly evolving.

Source: ar.pinterest.com

Source: ar.pinterest.com

Bitcoin Magazine Print Subscription Bitcoin Local Bitcoin Ways To Earn Money That is the profits from trading will be taxable under Income Tax rules. In general possessing or holding a cryptocurrency is not taxable. Tax implications of cryptocurrency transactions By Paul Kruger on 10 August 2021 0 SARS is tightening tax collection on cryptocurrency transactions which makes it important to distinguish between events that will trigger income tax rates or CGT rates. HMRC has published guidance for.

Source: forbes.com

Source: forbes.com

How Is Cryptocurrency Taxed Forbes Advisor In general possessing or holding a cryptocurrency is not taxable. Cryptocurrency gains from trading coins held as capital assets are treated as investment income by the IRS and the same capital gains rules apply. Tax implications of cryptocurrency mining Mining digital currency creates numerous tax implications that a user must report on multiple forms. Whether you are a business with a custom mining rig or you mine on a computer as a personal investment.

Source: poole.ncsu.edu

Source: poole.ncsu.edu

Behind Bitcoin A Closer Look At The Tax Implications Of Cryptocurrency Poole Thought Leadership This information is our current view of the income tax implications of common transactions involving cryptocurrency. For accounting purposes as well as a variety of practical reasons traders should maintain separate accounts for day trading. In general possessing or holding a cryptocurrency is not taxable. We will walk through examples for.

How Much Money Can You Make Per Week Simply By Trading Cryptocurrencies If You Start With 1000 Quora This information is our current view of the income tax implications of common transactions involving cryptocurrency. Cryptocurrency trading as a business If you are carrying on a business that involves cryptocurrency transactions then the rules are more complex. Cryptocurrency generally operates independently of a central bank central authority or government. Outside of buying selling and trading if you earn cryptocurrencieswhether through a job mining staking airdrop or interest from lending activitiesyou are liable for income taxes on the US Dollar value of your crypto earnings.