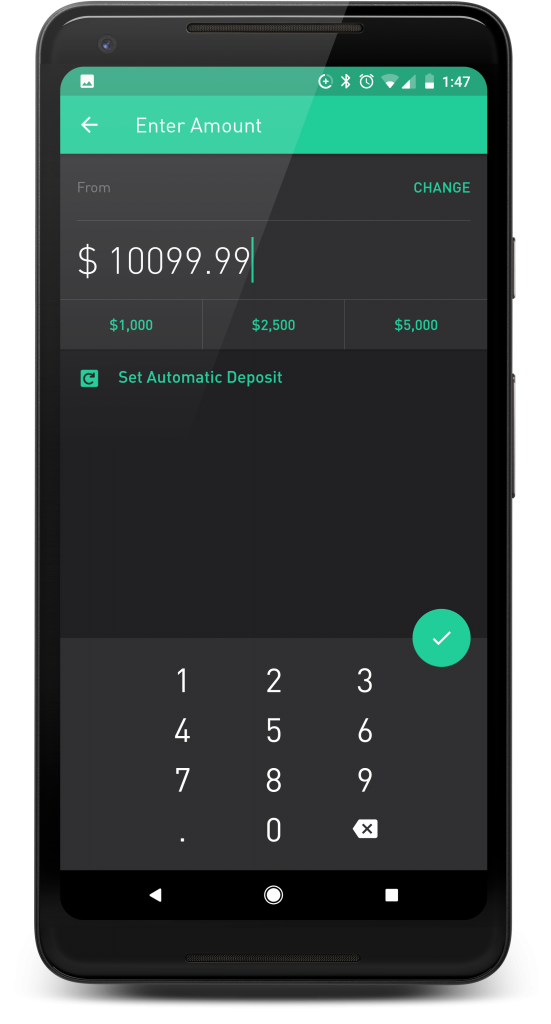

To download your Robinhood transaction history as a CSV. To add your Robinhood transactions download the CSV export of your transactions and import it. Robinhood cryptocurrency taxes.

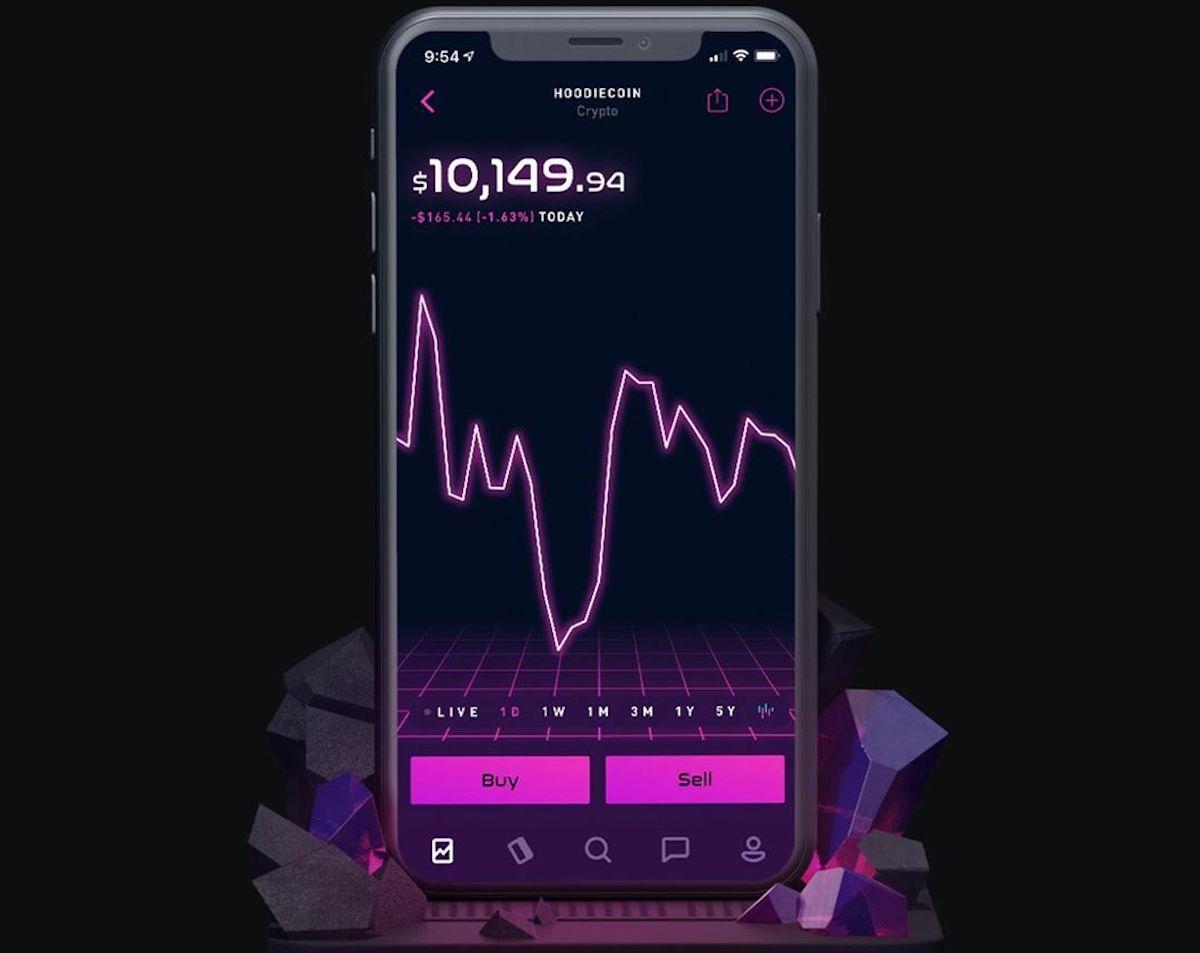

Robinhood Cryptocurrency Taxes, They charge a 49-59 depends on volume fee on credit card purchases. Select Federal from the left menu and Wages Income from the menu near the top. Recently however he has stopped trading in his Robinhood account which has about 238000 in it mostly in Tesla stock.

Robinhood From chelseama.space

Robinhood From chelseama.space

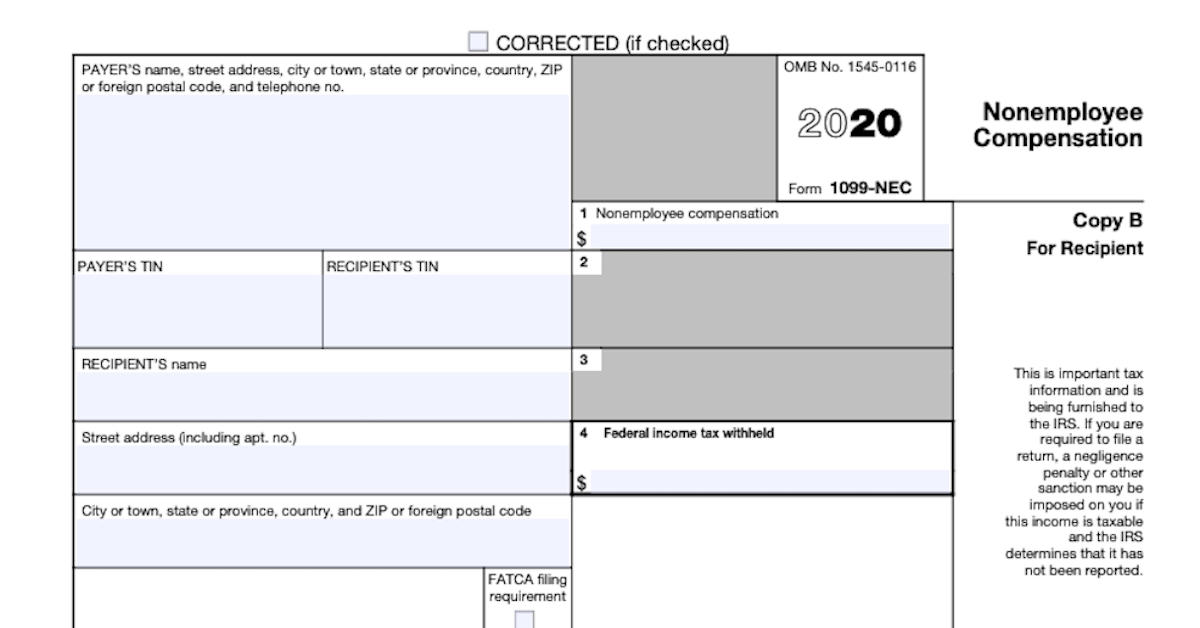

2018 - Robinhood Crypto 1099 CSV Select Download CSV. Upload your CSV file. Earlier this year the company announced that it was branching into cryptocurrency trading with Robinhood CryptoThe Robinhood business model is based on collecting interest on the cash and. Also similar to traditional brokerage firms Robinhood issues a Form 1099-B every year to their customers including both their sales proceeds and cost basis for each crypto.

You cannot import them from a PDF unfortunately.

In the last decade cryptocurrency has gone from a little-known or understood commodity to a common investment and a source of payment used by some of the worlds biggest corporations. Select Federal from the left menu and Wages Income from the menu near the top. Thats up from its latest 56 billion valuation in 2018. Scroll down and select Show more next to Investment Income. To download your Robinhood transaction history as a CSV. You can deduct your losses if you sold or spent cryptocurrency that lost value.

Read another article:

Source: chelseama.space

Source: chelseama.space

Robinhood How do I enter my crypto tax documents into TurboTax. They charge a 49-59 depends on volume fee on credit card purchases. Earlier this year the company announced that it was branching into cryptocurrency trading with Robinhood CryptoThe Robinhood business model is based on collecting interest on the cash and. Similar to other types of tax documents received at year end W2 etc you can import this 1099-B that you receive from Robinhood into tax filing software such as TurboTax or give it directly to your tax professional to file on your behalf.

Cryptocurrency Bitcoin Tax Guide 2021 Edition Cointracker Select Start or Revisit next to Cryptocurrency. The same laws that govern. To add your Robinhood transactions download the CSV export of your transactions and import it. Robinhood provides you with a 1099-B tax form just like every other broker.

Source: coincentral.com

Source: coincentral.com

Robinhood Crypto Review What You Need To Know Robinhood stocks and cryptocurrency trades might be subject to capital gain tax. Robinhood stocks and cryptocurrency trades might be subject to capital gain tax. You can deduct your losses if you sold or spent cryptocurrency that lost value. Similar to other types of tax documents received at year end W2 etc you can import this 1099-B that you receive from Robinhood into tax filing software such as TurboTax or give it directly to your tax professional to file on your behalf.

Source: youtube.com

Source: youtube.com

Robinhood Taxes Explained How To File Robinhood Taxes On Turbotax Youtube For taxable accounts the value of all Robinhood Crypto and affiliate offers received may be reported as Other Income on a Form 1099-MISC where required by applicable rules and regulations. Robinhood stocks and cryptocurrency trades might be subject to capital gain tax. How do I enter my crypto tax documents into TurboTax. On the screen where you enter income find the Cryptocurrency Start button in TurboTax.

Source: investorjunkie.com

Source: investorjunkie.com

Cryptocurrency Taxes Guide 2021 How Why To Report Your Profits Select Start or Revisit next to Cryptocurrency. Also similar to traditional brokerage firms Robinhood issues a Form 1099-B every year to their customers including both their sales proceeds and cost basis for each crypto. Cryptocurrency may be under the Investment Income subsection. Bloomberg – Robinhood Markets Inc.

Source: youtube.com

Source: youtube.com

How To File Crypto Taxes Robinhood And All Other Brokerage Acct Turbotax 1099b Youtube Also similar to traditional brokerage firms Robinhood issues a Form 1099-B every year to their customers including both their sales proceeds and cost basis for each crypto. So if you see gains on your cryptocurrency holdings you will owe taxes but it may be taxed differently than your other investments. The company raised 323. Bloomberg – Robinhood Markets Inc.

Source: crypto-taxadvisors.com

Source: crypto-taxadvisors.com

How To Report Robinhood Crypto Transactions Crypto Tax Advisors Also similar to traditional brokerage firms Robinhood issues a Form 1099-B every year to their customers including both their sales proceeds and cost basis for each crypto. The company raised 323. You may need to report your gains if you sold a cryptocurrency exchanged cryptocurrencies or used cryptocurrency to purchase goods or services. The Internal Revenue Service IRS considers cryptocurrency property for tax purposes.

Source: founderscpa.com

Source: founderscpa.com

Bought And Sold Crypto On Robinhood Here S How To File Your Taxes Founder S Cpa Earlier this year the company announced that it was branching into cryptocurrency trading with Robinhood CryptoThe Robinhood business model is based on collecting interest on the cash and. Robinhood Crypto does not take responsibility for any tax related to this reward. However you can link Robinhood and import them. In 2021 Robinhood started making the forms available in mid-February so you can have enough time to calculate your crypto gains or losses into your 2020 tax return.

Source: marketrealist.com

Source: marketrealist.com

How Do You Pay Taxes On Robinhood Stocks Again this is because all of your gains losses cost basis and proceeds are already completely listed out on the 1099-B that you receive from Robinhood. On the screen where you enter income find the Cryptocurrency Start button in TurboTax. Thats up from its latest 56 billion valuation in 2018. You may need to report your gains if you sold a cryptocurrency exchanged cryptocurrencies or used cryptocurrency to purchase goods or services.

Source: thecryptobase.io

Source: thecryptobase.io

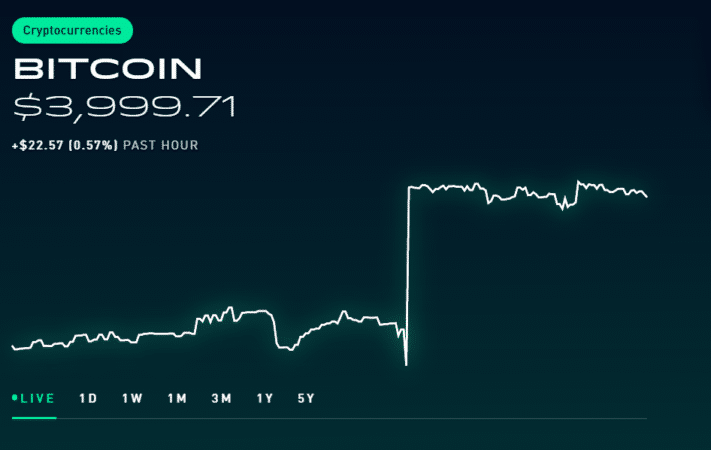

How To Buy Cryptocurrency On Robinhood App The Cryptobase One big difference though is that Robinhood does not allow its users to transfer crypto in or out of its platform. So if you see gains on your cryptocurrency holdings you will owe taxes but it may be taxed differently than your other investments. Robinhood provides a crypto trading platform similar to crypto exchanges such as Coinbase Gemini Bittrex etc. You may need to report your gains if you sold a cryptocurrency exchanged cryptocurrencies or used cryptocurrency to purchase goods or services.

Source: marketrealist.com

Source: marketrealist.com

How Do You Pay Taxes On Robinhood Stocks However you can link Robinhood and import them. To download your Robinhood transaction history as a CSV. One big difference though is that Robinhood does not allow its users to transfer crypto in or out of its platform. Crypto Taxes on Robinhood The IRS considers cryptocurrency property for the purpose of federal income taxes.

Source: techcrunch.com

Source: techcrunch.com

Robinhood Adds Zero Fee Cryptocurrency Trading And Tracking Techcrunch Form 8949 is the tax form that is used to report the sales and disposals of capital assets including cryptocurrency. 2018 - Robinhood Crypto 1099 CSV Select Download CSV. I got the instructions off the Robinhood website. He says a major reason is taxes.

Cryptocurrency Bitcoin Tax Guide 2021 Edition Cointracker Robinhood Crypto does not take responsibility for any tax related to this reward. Earlier this year the company announced that it was branching into cryptocurrency trading with Robinhood CryptoThe Robinhood business model is based on collecting interest on the cash and. On the screen where you enter income find the Cryptocurrency Start button in TurboTax. Bloomberg – Robinhood Markets Inc.

Source: youtube.com

Source: youtube.com

How To Read Your Brokerage 1099 Tax Form Youtube Cryptocurrency may be under the Investment Income subsection. Robinhood Crypto does not take responsibility for any tax related to this reward. In 2021 Robinhood started making the forms available in mid-February so you can have enough time to calculate your crypto gains or losses into your 2020 tax return. Similar to other types of tax documents received at year end W2 etc you can import this 1099-B that you receive from Robinhood into tax filing software such as TurboTax or give it directly to your tax professional to file on your behalf.

Source: investingsimple.com

Source: investingsimple.com

Robinhood Taxes Explained How Do Taxes Work Robinhood Crypto does not take responsibility for any tax related to this reward. To add your Robinhood transactions download the CSV export of your transactions and import it. Coinmama allows customers in California to buy Bitcoins Litecoins Ethereum and many other coins with a credit or debit card or bank transfer. However you can link Robinhood and import them.