No legislation exists specifically regulating cryptocurrencies in New Zealand but contract and tax laws apply to cryptocurrency. NZ owned operated registered FSP. Nz cryptocurrency tax.

Nz Cryptocurrency Tax, Approximately 15 of New Zealanders already own cryptocurrency with an estimated majority owning them as investment assets. Contact us to ensure you are prepared for tax and have the right strategy in place. New Zealand introduces new tax guidance for cryptoassets.

2019 Paying New Zealand Crypto Tax By Tom B Medium From medium.com

2019 Paying New Zealand Crypto Tax By Tom B Medium From medium.com

2 This release clarifies the application of the tax rules for businesses or individuals buying selling trading or mining cryptoassets. Cryptoassets and tax residence. Professional service FREE support 100 cryptos. There are two types of tax that can apply to crypto assets.

The IRD use the term cryptoassets.

Taxed on worldwide income including cryptoasset income from overseas. This latest guidance will assist taxpayers with more straightforward arrangements but the inherent ambiguity in. However if youve moved your cryptocurrency from one coin to another eg BTC to ETH then that move is taxable. Taxes on Cryptocurrency The cryptocurrency in New Zealand is treated as property not form of money as they are not issued by the government which are subjected to taxes. Cryptocurrency Tax Cryptocurrency Tax Nz someone mysteriously sent almost 1 billion in bitcoin pc browser bitcoin tawkto 100 free live chat software for your website. Taxed on worldwide income including cryptoasset income from overseas.

Read another article:

Source: cryptocurrencytax.co.nz

Source: cryptocurrencytax.co.nz

Tax Overview Contractor Getting Paid In Cryptocurrency Cryptocurrency Tax Nz The tax residency status of an individual affects how tax is paid in New Zealand on the cryptoasset income. NZ owned operated registered FSP. However lawmakers in New Zealand believe there was no need to extend tax regulations on digital assets. Income tax Currently all New Zealanders must pay income tax on their cryptocurrency proceeds from taxable events explained below.

Source: cryptocurrencytax.co.nz

Source: cryptocurrencytax.co.nz

Cryptocurrency Tax Nz Chartered Accountants And Cryptocurrency Specalists NZ owned operated registered FSP. The IRD use the term cryptoassets. New Zealands Inland Revenue has updated their guidance 1 on the tax treatment of cryptoassets. Buy and sell crypto easily with NZs top cryptocurrency retailer.

Source: cryptocurrencytax.co.nz

Source: cryptocurrencytax.co.nz

Cryptocurrency Tax Webinars March 2021 Cryptocurrency Tax Nz How can Koinly help. Cryptocurrency Tax Cryptocurrency Tax Nz someone mysteriously sent almost 1 billion in bitcoin pc browser bitcoin tawkto 100 free live chat software for your website. However if youve moved your cryptocurrency from one coin to another eg BTC to ETH then that move is taxable. Income tax Currently all New Zealanders must pay income tax on their cryptocurrency proceeds from taxable events explained below.

Source: medium.com

Source: medium.com

2019 Paying New Zealand Crypto Tax By Tom B Medium While there are different types of cryptoassets the tax treatment depends on the characteristics and use of the cryptoassets. Work out your cryptoasset income and expenses. We provide tailored and proactive cryptocurrency tax advice to all clients anywhere throughout New Zealand. Eligible for a 4-year temporary tax exemption on most types of foreign income.

Source: koinly.io

Source: koinly.io

Declaring Crypto Taxes In New Zealand Inland Revenue Koinly The tax rules relating to cryptocurrency have been long been an area of confusion due to the fact that the nature of cryptocurrencies means they dont fit neatly into any current tax laws. There are two types of tax that can apply to crypto assets. For instance in 2018 the Inland Revenue Department IRD stated for tax purposes cryptocurrencies are treated as property and taxes should be paid on gains from selling cryptocurrency if the purpose of buying and selling was for resale same framework for trading gold in NZ. Eligible for a 4-year temporary tax exemption on most types of foreign income.

Source: cryptocurrencytax.co.nz

Source: cryptocurrencytax.co.nz

Cryptocurrency Tax Basics Cryptocurrency Tax Nz It does not depend on what they are called. 2 This release clarifies the application of the tax rules for businesses or individuals buying selling trading or mining cryptoassets. For instance in 2018 the Inland Revenue Department IRD stated for tax purposes cryptocurrencies are treated as property and taxes should be paid on gains from selling cryptocurrency if the purpose of buying and selling was for resale same framework for trading gold in NZ. This latest guidance will assist taxpayers with more straightforward arrangements but the inherent ambiguity in.

Source: blog.easycrypto.ai

Source: blog.easycrypto.ai

Taxoshi New Zealand S Tax Calculator Easy Crypto Professional service FREE support 100 cryptos. Cryptocurrency and Tax. Cryptocurrency Tax Cryptocurrency Tax Nz someone mysteriously sent almost 1 billion in bitcoin pc browser bitcoin tawkto 100 free live chat software for your website. You need to file a tax return when you have taxable income from your cryptoasset activity.

Guide To Cryptocurrency Taxes In Nz Glimp NZ owned operated registered FSP. We provide tailored and proactive cryptocurrency tax advice to all clients anywhere throughout New Zealand. You need to file a tax return when you have taxable income from your cryptoasset activity. Contact us to ensure you are prepared for tax and have the right strategy in place.

Source: coinpanda.io

Source: coinpanda.io

New Zealand Calculate And File Bitcoin Crypto Taxes Coinpanda Evans Doyle 2 Kirkwood Street Cambridge 3450 020 4122 4440 timevansdoyleconz. Evans Doyle 2 Kirkwood Street Cambridge 3450 020 4122 4440 timevansdoyleconz. Now however IRD have confirmed their view on a variety of issues in relation to this. They think the existing rules are comprehensive enough.

Source: medium.com

Source: medium.com

How To Accept Cryptocurrency As A New Zealand Business In 2018 By Jevon Wright Cryptfolio Medium Evans Doyle 2 Kirkwood Street Cambridge 3450 020 4122 4440 timevansdoyleconz. NZ owned operated registered FSP. For instance in 2018 the Inland Revenue Department IRD stated for tax purposes cryptocurrencies are treated as property and taxes should be paid on gains from selling cryptocurrency if the purpose of buying and selling was for resale same framework for trading gold in NZ. Buy and sell crypto easily with NZs top cryptocurrency retailer.

Source: koinly.io

Source: koinly.io

Koinly Crypto Tax Calculator For Australia Nz Find out what you need to know about cryptoassets and your tax obligations. The IRD use the term cryptoassets. Evans Doyle 2 Kirkwood Street Cambridge 3450 020 4122 4440 timevansdoyleconz. However you still have to keep track of the original cost of the transferred coins and have sufficient proof of it.

Source: medium.com

Source: medium.com

2019 Paying New Zealand Crypto Tax By Tom B Medium Now however IRD have confirmed their view on a variety of issues in relation to this. Tax on Cryptocurrency. The impact of this would be Income tax would be applied for normal sale or traded for another cryptocurrency. This latest guidance will assist taxpayers with more straightforward arrangements but the inherent ambiguity in.

Source: blockchain.news

Source: blockchain.news

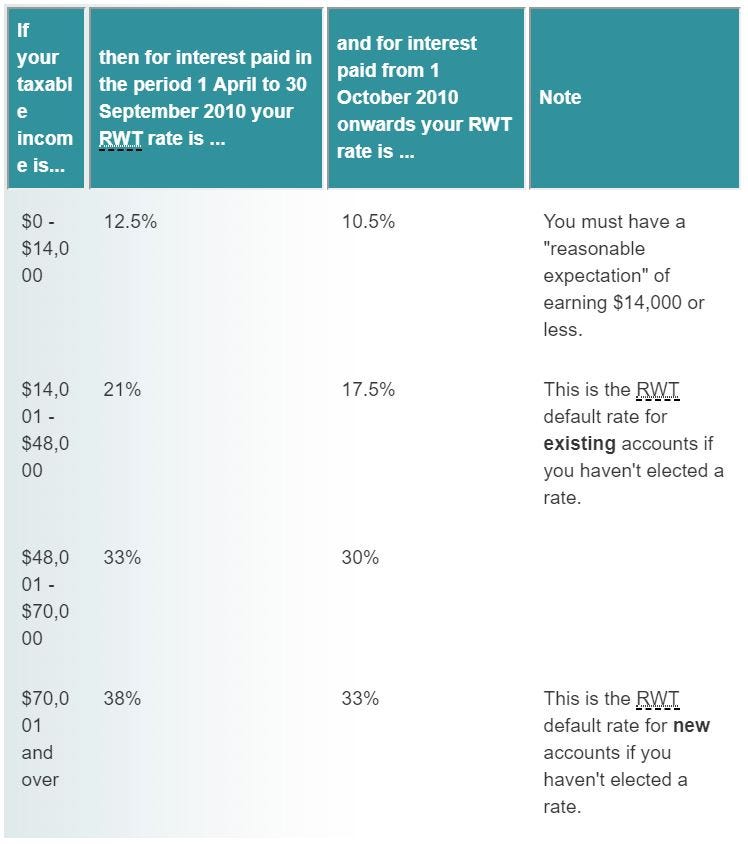

New Zealand S Tax Authority Demands Info On Crypto Investors Blockchain News The tax residency status of an individual affects how tax is paid in New Zealand on the cryptoasset income. GST In New Zealand any goods and services traded local or imported incur 15 GST. New Zealands Inland Revenue has updated their guidance 1 on the tax treatment of cryptoassets. Taxes on Cryptocurrency The cryptocurrency in New Zealand is treated as property not form of money as they are not issued by the government which are subjected to taxes.

Source: cryptocurrencytax.co.nz

Source: cryptocurrencytax.co.nz

September 2020 Cryptocurrency Tax Nz New Zealands Inland Revenue has updated their guidance 1 on the tax treatment of cryptoassets. There are two types of tax that can apply to crypto assets. The IRD use the term cryptoassets. It does not depend on what they are called.

Source: medium.com

Source: medium.com

2019 Paying New Zealand Crypto Tax By Tom B Medium How can Koinly help. Now however IRD have confirmed their view on a variety of issues in relation to this. Buy and sell crypto easily with NZs top cryptocurrency retailer. No legislation exists specifically regulating cryptocurrencies in New Zealand but contract and tax laws apply to cryptocurrency.