In recent months the idea that cryptocurrency such as Bitcoin might qualify for 1031 exchange treatment under tax law has been debatable. There was a debate. Like kind exchange cryptocurrency 2017.

Like Kind Exchange Cryptocurrency 2017, You instead owe taxes each time a cryptocurrency is converted into. Section 1031 is an exception to the rule that swaps are fully taxable. Over the prior decade section 1031 was used for more purpose to defer gain.

Crypto Tax Expert Like Kind Exchange Lke Is Highly Effective And Equally Controversial Donnelly Tax Law From donnellytaxlaw.com

Crypto Tax Expert Like Kind Exchange Lke Is Highly Effective And Equally Controversial Donnelly Tax Law From donnellytaxlaw.com

You instead owe taxes each time a cryptocurrency is converted into. There arent direct two-party like-kind exchanges between trader A and B through the exchange. There was a debate. Under this new law trades of digital currencies do not qualify for 1031 like-kind exchanges.

Applying the like-kind exchange treatment is a controversial position in crypto taxation where exchanging one cryptocurrency for another qualifies.

It was time to limit the application of 1031. It was not because of cryptocurrencies alone that it was changed. It was time to limit the application of 1031. Bitcoin and Bitcoin Cash. In recent months the idea that cryptocurrency such as Bitcoin might qualify for 1031 exchange treatment under tax law has been debatable. Similarly Litecoin the fifth-largest cryptocurrency had a hard forkLitecoin Cashin February 2018.

Read another article:

Source: donnellytaxlaw.com

Source: donnellytaxlaw.com

Crypto Tax Expert Like Kind Exchange Lke Is Highly Effective And Equally Controversial Donnelly Tax Law However the new Tax Cuts and Jobs Act of 2017 passed in December ends that discussion. You cant buy a bitcoin in 2017 trade it to litecoin in 2017 sell the litecoin in 2018 and then pay taxes on your total gainslosses then. However the new Tax Cuts and Jobs Act of 2017 passed in December ends that discussion. Each holder of a Bitcoin unit was entitled to one Bitcoin Cash unit.

Source: mdmfinancialservices.com

Source: mdmfinancialservices.com

Cryptocurrency And Like Kind Exchanges Mdm Financial Services In December 2017 Congress passed the TCJA tax law which modified Section 1031 limiting like-kind exchange LKE to only real estate. Similarly Litecoin the fifth-largest cryptocurrency had a hard forkLitecoin Cashin February 2018. In recent months the idea that cryptocurrency such as Bitcoin might qualify for 1031 exchange treatment under tax law has been debatable. Bitcoin and Bitcoin Cash.

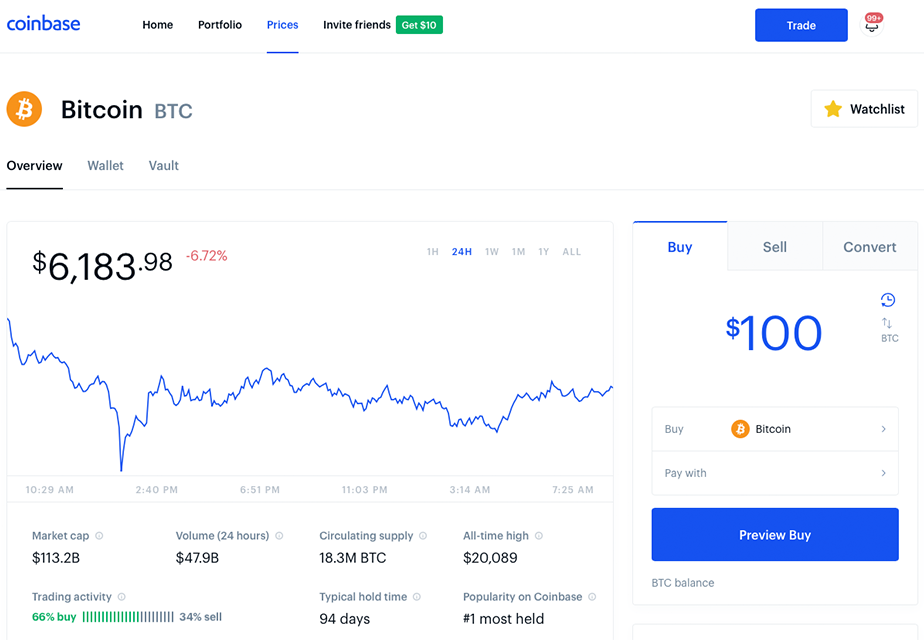

Source: coinsutra.com

Source: coinsutra.com

10 Best Cryptocurrency Exchanges To Buy Sell Any Cryptocurrency 2021 However the new Tax Cuts and Jobs Act of 2017 passed in December ends that discussion. Under this new law trades of digital currencies do not qualify for 1031 like-kind exchanges. Bitcoin and Bitcoin Cash. It was time to limit the application of 1031.

Source: donnellytaxlaw.com

Source: donnellytaxlaw.com

Crypto Tax Expert Like Kind Exchange Lke Is Highly Effective And Equally Controversial Donnelly Tax Law In December 2017 Congress passed the TCJA tax law which modified Section 1031 limiting like-kind exchange LKE to only real estate. It was not because of cryptocurrencies alone that it was changed. Bitcoin and Bitcoin Cash. In December 2017 Congress passed the TCJA tax law which modified Section 1031 limiting like-kind exchange LKE to only real estate.

Source: donnellytaxlaw.com

Source: donnellytaxlaw.com

Irc Section 1031 Like Kind Exchange Treatment Of Cryptocurrencies Explained Donnelly Tax Law A 1031 or like-kind exchange is a swap of one business or investment asset for another but most swaps are taxable. However the new Tax Cuts and Jobs Act of 2017 passed in December ends that discussion. Like-kind exchanges are not happening on cryptocurrency exchanges. In December 2017 Congress passed the TCJA tax law which modified Section 1031 limiting like-kind exchange LKE to only real estate.

Source: origininvestments.com

Source: origininvestments.com

1031 Exchange Vs Qoz Real Estate Which Tax Break Is Better Origin Investments Under this new law trades of digital currencies do not qualify for 1031 like-kind exchanges. A 1031 or like-kind exchange is a swap of one business or investment asset for another but most swaps are taxable. Over the prior decade section 1031 was used for more purpose to defer gain. Section 1031 is an exception to the rule that swaps are fully taxable.

Source: donnellytaxlaw.com

Source: donnellytaxlaw.com

Crypto Tax Expert Like Kind Exchange Lke Is Highly Effective And Equally Controversial Donnelly Tax Law Applying the like-kind exchange treatment is a controversial position in crypto taxation where exchanging one cryptocurrency for another qualifies. Under this new law trades of digital currencies do not qualify for 1031 like-kind exchanges. A 1031 or like-kind exchange is a swap of one business or investment asset for another but most swaps are taxable. There arent direct two-party like-kind exchanges between trader A and B through the exchange.

Source: donnellytaxlaw.com

Source: donnellytaxlaw.com

Crypto Tax Expert Like Kind Exchange Lke Is Highly Effective And Equally Controversial Donnelly Tax Law Under this new law trades of digital currencies do not qualify for 1031 like-kind exchanges. It was not because of cryptocurrencies alone that it was changed. However the new Tax Cuts and Jobs Act of 2017 passed in December ends that discussion. In December 2017 Congress passed the TCJA tax law which modified Section 1031 limiting like-kind exchange LKE to only real estate.

Source: klasing-associates.com

Source: klasing-associates.com

Do A 1031 Exchange With Bitcoin Or Other Crypto Currancies Under this new law trades of digital currencies do not qualify for 1031 like-kind exchanges. A 1031 or like-kind exchange is a swap of one business or investment asset for another but most swaps are taxable. Each holder of a Bitcoin unit was entitled to one Bitcoin Cash unit. Similarly Litecoin the fifth-largest cryptocurrency had a hard forkLitecoin Cashin February 2018.

Source: greentradertax.com

Source: greentradertax.com

Cryptocurrencies Green Trader Tax Under this new law trades of digital currencies do not qualify for 1031 like-kind exchanges. In December 2017 Congress passed the TCJA tax law which modified Section 1031 limiting like-kind exchange LKE to only real estate. Over the prior decade section 1031 was used for more purpose to defer gain. Each holder of a Bitcoin unit was entitled to one Bitcoin Cash unit.

Source: cryptocurrencyfacts.com

Source: cryptocurrencyfacts.com

How To Trade Cryptocurrency For Beginners It was time to limit the application of 1031. Under this new law trades of digital currencies do not qualify for 1031 like-kind exchanges. A 1031 or like-kind exchange is a swap of one business or investment asset for another but most swaps are taxable. In December 2017 Congress passed the TCJA tax law which modified Section 1031 limiting like-kind exchange LKE to only real estate.

Source: dlapiper.com

Source: dlapiper.com

Irs Concludes Section 1031 Tax Deferred Like Kind Exchange Treatment Is Not Available For Cryptocurrency Trades Insights Dla Piper Global Law Firm Each holder of a Bitcoin unit was entitled to one Bitcoin Cash unit. Like-kind exchanges are not happening on cryptocurrency exchanges. However the new Tax Cuts and Jobs Act of 2017 passed in December ends that discussion. You cant buy a bitcoin in 2017 trade it to litecoin in 2017 sell the litecoin in 2018 and then pay taxes on your total gainslosses then.

Source: forbes.com

Source: forbes.com

Irs Kills Tax Free Crypto Exchanges Not Hardly Bitcoin had a hard fork in its blockchain on August 1 2017 dividing into two separate coins. For an example of the implications of like-kind exchange not applying to cryptocurrency. Like-kind exchanges are not happening on cryptocurrency exchanges. You instead owe taxes each time a cryptocurrency is converted into.

Source: finivi.com

Source: finivi.com

How Are Bitcoin And Crypto Taxed Finivi In December 2017 Congress passed the TCJA tax law which modified Section 1031 limiting like-kind exchange LKE to only real estate. Section 1031 is an exception to the rule that swaps are fully taxable. There was a debate. Applying the like-kind exchange treatment is a controversial position in crypto taxation where exchanging one cryptocurrency for another qualifies.

Source: cryptotax.io

Source: cryptotax.io

Bitcoin And Taxes Blockpit Cryptotax Under this new law trades of digital currencies do not qualify for 1031 like-kind exchanges. You cant buy a bitcoin in 2017 trade it to litecoin in 2017 sell the litecoin in 2018 and then pay taxes on your total gainslosses then. A 1031 or like-kind exchange is a swap of one business or investment asset for another but most swaps are taxable. Like-kind exchanges are not happening on cryptocurrency exchanges.