Unfortunately IFRIC said nothing about miners so you need to apply currently existing IFRS to this situation. Intuitively it might appear that cryptocurrency should be accounted for as a financial asset at fair value through profit or loss FVTPL in accordance with IFRS 9. Ifrs accounting for cryptocurrency.

Ifrs Accounting For Cryptocurrency, In this Viewpoint we explore the acceptable methods of accounting for holdings in cryptocurrencies. There are still no cryptocurrency specific GAAP rules. Other crypto assets should be.

Cryptocurrency Accounting For Investment Funds U S Gaap Vs Ifrs Gaap Dynamics From gaapdynamics.com

Cryptocurrency Accounting For Investment Funds U S Gaap Vs Ifrs Gaap Dynamics From gaapdynamics.com

The classification considerations of any cryptocurrency issued are analysed below. If the cryptocurrency is treated as income then it might be re venue as opposed to other income only if there is an enforceable contract with a customer as required under IFRS 15. In that circumstance a holding of cryptocurrency is inventory for the entity and accordingly IAS 2 applies to that holding. Accounting Policies Changes in Accounting Estimates and Errors.

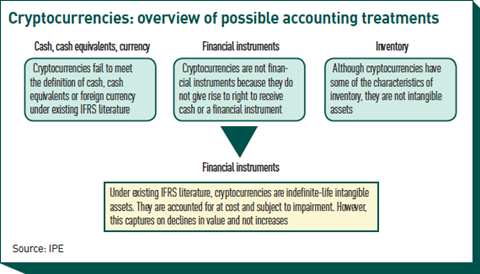

For example an approach of accounting for holdings of cryptocurrencies at fair value through profit or loss may seem intuitive but is incompatible with the requirements of IFRS in most circumstances.

In that circumstance a holding of cryptocurrency is inventory for the entity and accordingly IAS 2 applies to that holding. If the cryptocurrency is treated as income then it might be re venue as opposed to other income only if there is an enforceable contract with a customer as required under IFRS 15. An introduction to accounting for cryptocurrencies 20 Jun 2018 Chartered Professional Accountants of Canada CPA Canada has published an introduction to. Intuitively it might appear that cryptocurrency should be accounted for as a financial asset at fair value through profit or loss FVTPL in accordance with IFRS 9. Unfortunately IFRIC said nothing about miners so you need to apply currently existing IFRS to this situation. Under current US GAAP and usually under IFRS intangible asset accounting is applied.

Read another article:

Source: gaapdynamics.com

Source: gaapdynamics.com

Cryptocurrency Is It A Financial Asset Under Ifrs Gaap Dynamics For example an approach of accounting for holdings of cryptocurrencies at fair value through profit or loss may seem intuitive but is incompatible with the requirements of IFRS in most circumstances. Introduction to accounting for cryptocurrencies under IFRS Learn about cryptocurrencies and the primary issues involved in accounting for them under International Financial Reporting Standards. Cryptocurrency accounting for miners The miners or entities involved in creating and forming cryptocurrency would account for it differently. The Committee also observed that an entity may act as a broker-trader of cryptocurrencies.

Source: semanticscholar.org

Source: semanticscholar.org

Pdf Accounting For Bitcoin And Other Cryptocurrencies Under Ifrs A Comparison And Assessment Of Competing Models Semantic Scholar For example an approach of accounting for holdings of cryptocurrencies at fair value through profit or loss may seem intuitive but is incompatible with the requirements of IFRS in most circumstances. 2 Technical Line A holders accounting for cryptocurrencies 18 October 2018 We believe that cryptocurrencies meet the definition of indefinite-lived intangible assets and holders should account for them at historical cost less impairment applying the guidance in Accounting Standards Codification ASC 350 Intangibles Goodwill and Other. An entity applies the disclosure requirements in the IFRS Standard applicable to its holdings of cryptocurrencies. Introduction to accounting for cryptocurrencies under IFRS Learn about cryptocurrencies and the primary issues involved in accounting for them under International Financial Reporting Standards.

Https Www Pwc Com Au Assurance Ifrs Assets Cryptographic Assets And Related Transactions Accounting Considerations Under Ifrs Pdf In that circumstance a holding of cryptocurrency is inventory for the entity and accordingly IAS 2 applies to that holding. The Committee also observed that an entity may act as a broker-trader of cryptocurrencies. The classification considerations of any cryptocurrency issued are analysed below. Intuitively it might appear that cryptocurrency should be accounted for as a financial asset at fair value through profit or loss FVTPL in accordance with IFRS 9.

Source: youtube.com

Source: youtube.com

Accounting For Cryptocurrencies Under Ifrs Youtube Cryptocurrency accounting for miners The miners or entities involved in creating and forming cryptocurrency would account for it differently. In that circumstance a holding of cryptocurrency is inventory for the entity and accordingly IAS 2 applies to that holding. An introduction to accounting for cryptocurrencies 20 Jun 2018 Chartered Professional Accountants of Canada CPA Canada has published an introduction to. For example an approach of accounting for holdings of cryptocurrencies at fair value through profit or loss may seem intuitive but is incompatible with the requirements of IFRS in most circumstances.

Source: gaapdynamics.com

Source: gaapdynamics.com

Cryptocurrency Accounting For Investment Funds U S Gaap Vs Ifrs Gaap Dynamics Requires the use of a specifc IFRS Standard if it is applicable. IFRS Accounting for crypto-assets 5 22. Intuitively it might appear that cryptocurrency should be accounted for as a financial asset at fair value through profit or loss FVTPL in accordance with IFRS 9. In this Viewpoint we explore the acceptable methods of accounting for holdings in cryptocurrencies.

Source: gaapdynamics.com

Source: gaapdynamics.com

Cryptocurrency Is It A Financial Asset Under Ifrs Gaap Dynamics The Committee also observed that an entity may act as a broker-trader of cryptocurrencies. Introduction to accounting for cryptocurrencies under IFRS Learn about cryptocurrencies and the primary issues involved in accounting for them under International Financial Reporting Standards. Although IFRS Standards do not explicitly refer to cryptocurrencies the scope of an IFRS Standard may include items with the characteristics of cryptocu. An introduction to accounting for cryptocurrencies 20 Jun 2018 Chartered Professional Accountants of Canada CPA Canada has published an introduction to.

Source: gaapdynamics.com

Source: gaapdynamics.com

Cryptocurrency Accounting For Investment Funds U S Gaap Vs Ifrs Gaap Dynamics Cryptocurrency accounting for miners The miners or entities involved in creating and forming cryptocurrency would account for it differently. Requires the use of a specifc IFRS Standard if it is applicable. Accordingly an entity applies the disclosure requirements in a paragraphs 3639 of IAS 2 to cryptocurrencies held for sale in the ordinary course of business and b paragraphs 118128 of IAS 38 to holdings of cryptocurrencies to which it applies IAS 38. An entity applies the disclosure requirements in the IFRS Standard applicable to its holdings of cryptocurrencies.

Source: gaapdynamics.com

Source: gaapdynamics.com

Cryptocurrency Is It A Financial Asset Under Ifrs Gaap Dynamics Requires the use of a specifc IFRS Standard if it is applicable. An entity applies the disclosure requirements in the IFRS Standard applicable to its holdings of cryptocurrencies. Consideration should also be given to the entitys purpose for holding the cryptographic assets to determine the accounting model. Accounting for cryptocurrencies by the holders Until recently there was literally nothing official related to accounting for holding of cryptocurrency.

Source: crowdfundinsider.com

Source: crowdfundinsider.com

How Do You Account For That The Ifrs To Address Accounting For Cryptocurrency In Meeting Next Week IFRS Accounting for crypto-assets 5 22. Introduction to accounting for cryptocurrencies under IFRS Learn about cryptocurrencies and the primary issues involved in accounting for them under International Financial Reporting Standards. IFRS does not include specific guidance on the accounting for cryptographic assets and there is no clear industry practice so the accounting for cryptographic assets could fall into a variety of different standards. We use the reporting by MicroStrategy to illustrate why this does not provide the right information for investors and explain how you should include cryptocurrency assets in your analysis.

Source: annualreporting.info

Source: annualreporting.info

Best Intro To Accounting For Cryptocurrencies In 1 View Annual Reporting We use the reporting by MicroStrategy to illustrate why this does not provide the right information for investors and explain how you should include cryptocurrency assets in your analysis. In contrast to cryptocurrency which is designed as a general-purpose medium of exchange across applications tokens tend to be designed to support a more narrowly-defined. Tokens crypto-assets other than cryptocurrencies We use tokens as an umbrella term for a wide variety of crypto-assets. In that circumstance a holding of cryptocurrency is inventory for the entity and accordingly IAS 2 applies to that holding.

Source: in.pinterest.com

Source: in.pinterest.com

Overcoming Ifrs Adoption Challenges With Smart Contract Development Development Overcoming Financial Information However IFRS Interpretations Committee IFRIC met in June 2019 and discussed that and issued their decision so at. The IFRS Interpretations Committee observed that an entity may hold cryptocurrencies for sale in the ordinary course of business. IFRS Accounting for crypto-assets 5 22. If a sole miner concludes that it has income then it will measure.

Source: zampadebattista.com

Source: zampadebattista.com

Ifrs Update Holding Of Cryptocurrencies Zampa Debattista For example an approach of accounting for holdings of cryptocurrencies at fair value through profit or loss may seem intuitive but is incompatible with the requirements of IFRS in most circumstances. Other crypto assets should be. There are still no cryptocurrency specific GAAP rules. However its not always clear who the customer is.

Source: ipe.com

Source: ipe.com

Accounting Matters To Virtually Toss A Coin Or Not Features Ipe Requires the use of a specifc IFRS Standard if it is applicable. 2 Technical Line A holders accounting for cryptocurrencies 18 October 2018 We believe that cryptocurrencies meet the definition of indefinite-lived intangible assets and holders should account for them at historical cost less impairment applying the guidance in Accounting Standards Codification ASC 350 Intangibles Goodwill and Other. Under current US GAAP and usually under IFRS intangible asset accounting is applied. Accounting Policies Changes in Accounting Estimates and Errors.

Source: bookstime.com

Source: bookstime.com

Cryptocurrency Accounting A Bookkeeper S Cheat Sheet On Accounting For Crypto Bookstime Under current US GAAP and usually under IFRS intangible asset accounting is applied. The accounting of cryptocurrency issued is derived by the rights and obligations attached to the cryptocurrency and the guidance of the relevant accounting standards. However its not always clear who the customer is. Tokens crypto-assets other than cryptocurrencies We use tokens as an umbrella term for a wide variety of crypto-assets.

Source: bookstime.com

Source: bookstime.com

Cryptocurrency Accounting A Bookkeeper S Cheat Sheet On Accounting For Crypto Bookstime IFRS Accounting for crypto-assets 5 22. Accordingly an entity applies the disclosure requirements in a paragraphs 3639 of IAS 2 to cryptocurrencies held for sale in the ordinary course of business and b paragraphs 118128 of IAS 38 to holdings of cryptocurrencies to which it applies IAS 38. Under current US GAAP and usually under IFRS intangible asset accounting is applied. We use the reporting by MicroStrategy to illustrate why this does not provide the right information for investors and explain how you should include cryptocurrency assets in your analysis.