The capital tax rate depends which province you live in Canada which varies. Reporting Bitcoin Holdings on Tax Returns. How to report cryptocurrency on taxes canada.

How To Report Cryptocurrency On Taxes Canada, If you spend digital currency on business expenses you should also convert the funds before reporting the business expense on your return. Transaction considering a disposition requires disclosure of your income tax return accordingly as either a gainloss on operating income or a capital gainloss arises depending on the circumstances at play. If it was a disposition then 50 of the capital gain is taxable.

7 Best Crypto Tax Software To Calculate Taxes On Crypto Thinkmaverick My Personal Journey Through Entrepreneurship Best Crypto Tax Software Cryptocurrency From pinterest.com

7 Best Crypto Tax Software To Calculate Taxes On Crypto Thinkmaverick My Personal Journey Through Entrepreneurship Best Crypto Tax Software Cryptocurrency From pinterest.com

Report the resulting gain or loss as either business income or loss or a. Reporting Cryptocurrency On Your Taxes. Coinberry crypto taxes canada learn about the taxpayer responsibilities of. In Canada the Canada Revenue Agency expects all Crypto-Currency transactions to be treated in the same manner as any commodity would which means any increase in the price produces a Capital Gain taxable at 50 and any losses would.

What if I accept cryptocurrency as payment.

The CRA recommends using exchange rates from the Bank of Canada. You have to convert the value of the cryptocurrency you received into Canadian dollars. 20 мая 2021 г. The CRA recommends using exchange rates from the Bank of Canada. As the employer youre still responsible for making sure the right. Otherwise if youre reporting your crypto gains as business income youll report via the T2125 Statement of Business or Professional Activities.

Read another article:

Source: coinpanda.io

Source: coinpanda.io

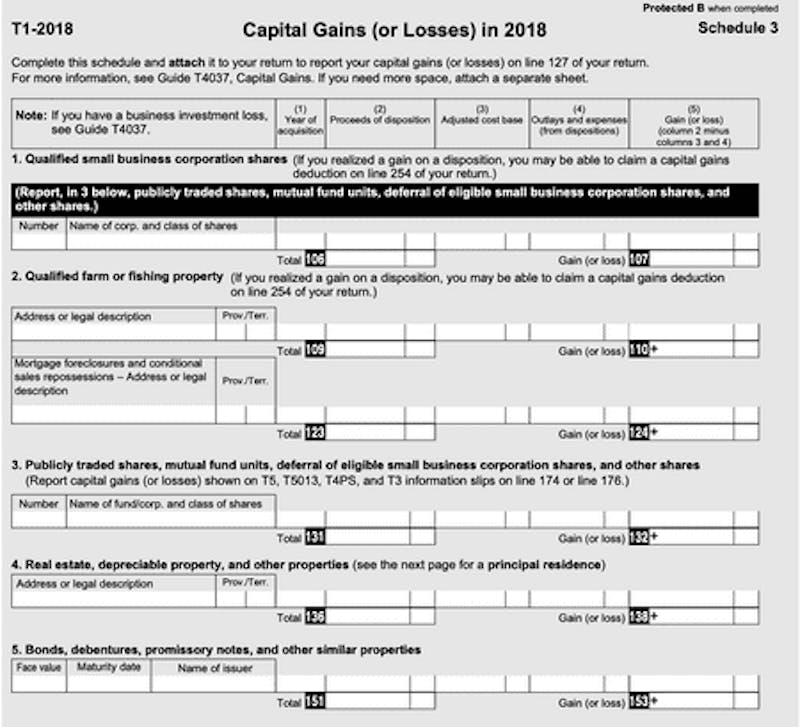

Canada Calculate And File Bitcoin Cryptocurrency Taxes Coinpanda If it was a disposition then 50 of the capital gain is taxable. Coinpanda generates ready-to-file forms based on your trading activity in less than 5 minutes. 100 of business income is taxable whereas only 50 of capital gains are taxable. Not as business income you file capital gains on the Schedule 3.

Bitcoin Taxes Overview Of The Rules And How To Report Taxes 20 мая 2021 г. Canadian citizens have to report their capital gains from cryptocurrencies. The Canadian tax system is a self-assessing system so the onus is on the individual taxpayer to properly report all cryptocurrency sales. Use Form T2125 to report business income for your taxes.

Source: pinterest.com

Source: pinterest.com

Pin On Acn Newswire Your business income on the other hand should be reported on T2125 Statement of Business or Professional Activities. Canadian citizens have to report their capital gains from cryptocurrencies. File your crypto taxes in Canada Learn how to calculate and file your taxes if you live in Canada. Capital gains from your cryptocurrency transactions should be reported on Schedule 3 Form.

Source: coinpanda.io

Source: coinpanda.io

How To Report Taxes On Cryptocurrency Mining Coinpanda Cryptocurrency can be taxed as either a business income or capital gain depending on the nature of the gain. 50 of the gains are taxable and added to your income for that year. In Canada the Canada Revenue Agency expects all Crypto-Currency transactions to be treated in the same manner as any commodity would which means any increase in the price produces a Capital Gain taxable at 50 and any losses would. In Canada Crypto is taxed as either capital gains or as income tax depending on whether your activity with cryptocurrency is considered to be as a business or not.

Source: coinpanda.io

Source: coinpanda.io

Canada Calculate And File Bitcoin Cryptocurrency Taxes Coinpanda You would have to report a capital gain of 1000 50 of 2000 which would be added to your income and taxed at your marginal tax rate. If youre running a business 100 of your crypto-related business income is taxable whereas only 50 of. Transaction considering a disposition requires disclosure of your income tax return accordingly as either a gainloss on operating income or a capital gainloss arises depending on the circumstances at play. Lets say you bought a cryptocurrency for 1000 and sold it later for 3000.

Source: cryptotaxcalculator.io

Source: cryptotaxcalculator.io

Crypto Tax Calculator Capital Gains or Losses. 100 of business income is taxable whereas only 50 of capital gains are taxable. You report that amount as income to the CRA. Taxing authorities can use the court system to try and gain access to cryptocurrency transactions completed on third party exchanges.

Cryptocurrency Bitcoin Tax Guide 2021 Edition Cointracker Cryptocurrency can be taxed as either a business income or capital gain depending on the nature of the gain. If it was a disposition then 50 of the capital gain is taxable. Cryptocurrency is taxed like any other commodity in Canada. 20 мая 2021 г.

Source: support.binance.us

Source: support.binance.us

Cryptocurrency Tax Reporting Binance Us 50 of the gains are taxable and added to your income for that year. In Canada Crypto is taxed as either capital gains or as income tax depending on whether your activity with cryptocurrency is considered to be as a business or not. 20 мая 2021 г. Report the resulting gain or loss as either business income or loss or a.

Source: koinly.io

Source: koinly.io

Declare Your Bitcoin Cryptocurrency Taxes In Canada Cra Koinly Capital gains from your cryptocurrency transactions should be reported on Schedule 3 Form. What if I accept cryptocurrency as payment. Otherwise if youre reporting your crypto gains as business income youll report via the T2125 Statement of Business or Professional Activities. Cryptocurrency is taxed in Canada as either capital gains or as income tax depending on whether your activity with cryptocurrency is considered to be as a business or not.

Source: koinly.io

Source: koinly.io

Cryptocurrency Taxes In Canada The 2021 Guide Koinly Taxbit is an irs compliant software provider for reporting on crypto taxes. Cryptocurrency is treated as commodities for Canadian tax purposes. Determine whether you have business income or capital gains. In Canada Crypto is taxed as either capital gains or as income tax depending on whether your activity with cryptocurrency is considered to be as a business or not.

Source: koinly.io

Source: koinly.io

Koinly Bitcoin Tax Calculator For Canada Canadian citizens have to report their capital gains from cryptocurrencies. Reporting Bitcoin Holdings on Tax Returns. Failing to report that income can pose a huge problem now that the digital currency market is bottoming out. The Canadian tax system is a self-assessing system so the onus is on the individual taxpayer to properly report all cryptocurrency sales.

Source: pinterest.com

Source: pinterest.com

7 Best Crypto Tax Software To Calculate Taxes On Crypto Thinkmaverick My Personal Journey Through Entrepreneurship Best Crypto Tax Software Cryptocurrency Use Form T2125 to report business income for your taxes. Cryptocurrency can be taxed as either a business income or capital gain depending on the nature of the gain. The capital tax rate depends which province you live in Canada which varies. Taxbit is an irs compliant software provider for reporting on crypto taxes.

Source: cointracker.io

Source: cointracker.io

Cryptocurrency Taxes In Canada Cointracker Your business income on the other hand should be reported on T2125 Statement of Business or Professional Activities. Cryptocurrency is treated as commodities for Canadian tax purposes. As the employer youre still responsible for making sure the right. The Canadian tax system is a self-assessing system so the onus is on the individual taxpayer to properly report all cryptocurrency sales.

Cryptocurrency Bitcoin Tax Guide 2021 Edition Cointracker You have to convert the value of the cryptocurrency you received into Canadian dollars. Capital Gains or Losses. This transaction is considered a disposition and you have to report it on your income tax return. Canadian tax law wasnt created in a world where.

Cryptocurrency Bitcoin Tax Guide 2021 Edition Cointracker Determine whether you have business income or capital gains. In Canada Crypto is taxed as either capital gains or as income tax depending on whether your activity with cryptocurrency is considered to be as a business or not. If the person does crypto mining then it would be taxed as business income. 50 of the gains are taxable and added to your income for that year.