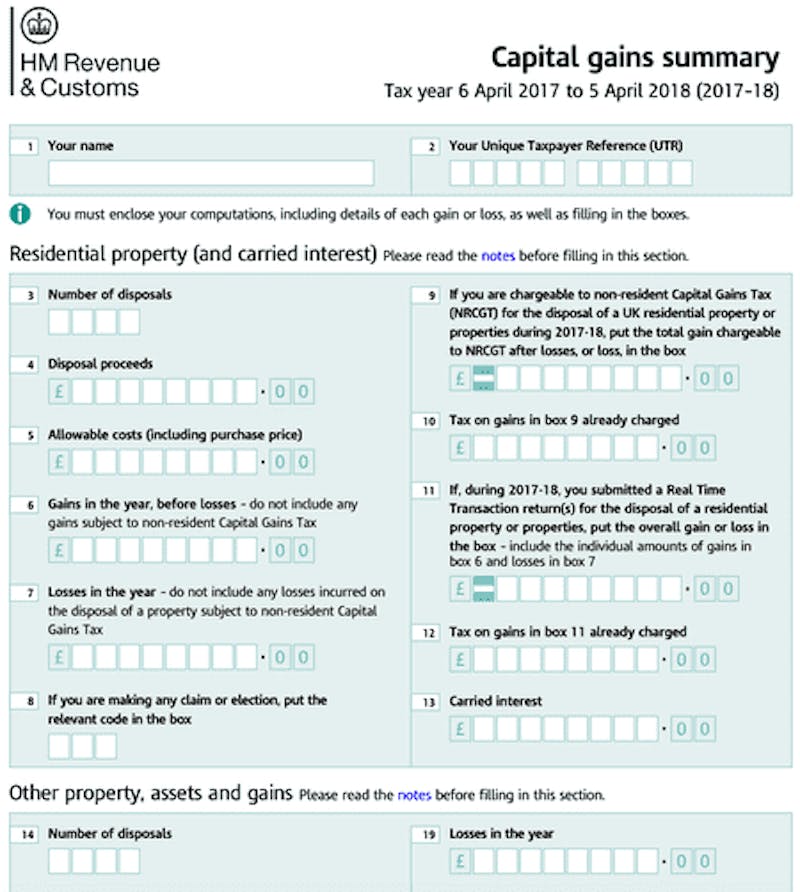

If you hold cryptocurrency as a personal investment you will be subject to Capital Gains Tax rules. If on the other hand youre a basic rate taxpayer your tax rate will depend on your taxable income and the size of the gain after any. How to not pay tax on cryptocurrency uk.

How To Not Pay Tax On Cryptocurrency Uk, Youve only got until January 31 to file your taxes in the UK Image. I only invested about 14k in crypto and currently it rose to 16k. When you dispose of cryptoasset exchange tokens known as cryptocurrency you may need to pay Capital Gains Tax.

How Cryptocurrency Is Taxed In The United Kingdom Tokentax From tokentax.co

How Cryptocurrency Is Taxed In The United Kingdom Tokentax From tokentax.co

HMRC taxes cryptocurrency depending on how you deal with cryptocurrency. If i simply transfer them I do not need to pay taxes right but if I for example say. This can go from 0 to 46 depending on the income level and specific region. The answer to how much tax on cryptocurrency do you have to pay in the UK will depend on your income tax bracket.

Youve only got until January 31 to file your taxes in the UK Image.

The answer to how much tax on cryptocurrency do you have to pay in the UK will depend on your income tax bracket. If you sell the crypto for loss then the loss can be deducted to reduce the overall capital gain. However it is extremely rare for HMRC to assess an individuals cryptoasset activity to apply income tax. If youre a UK crypto holder keep your receiptsevery single one of them whether for a novelty cup of coffee bought with Bitcoin or the tab. If on the other hand youre a basic rate taxpayer your tax rate will depend on your taxable income and the size of the gain after any. Buy Crypto Currency In Your IRA.

Read another article:

Source: forbes.com

Source: forbes.com

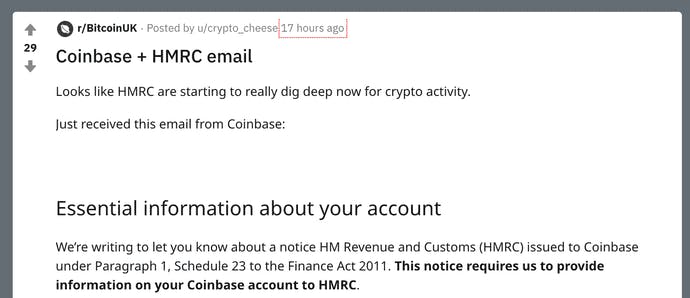

What Are 2020 2021 Cryptocurrency Taxes Forbes Advisor If youre a higher or additional rate taxpayer your capital gains tax rate will be 20. The answer to how much tax on cryptocurrency do you have to pay in the UK will depend on your income tax bracket. This means that you are taxed on the capital gain at the time the cryptocurrency is disposed of eg. So since Binance is banned in the UK currently i wanted to move my coins over to coinbase.

Source: medium.com

Source: medium.com

Complete Guide On Crypto Taxes In Uk By Neeta Gupta Akeo Medium This can go from 0 to 46 depending on the income level and specific region. Unsplash The deadline to file your tax return in the UK is January 31and holding cryptocurrency introduces an additional layer of complexity to the process. Income tax instead of CGT would only apply to businesses that generate trading profits in cryptoassets. If you simply buy bitcoin or another cryptocurrency and hold it in a wallet you do not have any sort of tax reporting requirement as you havent realized a gain or loss on your investment yet.

Uk Cryptocurrency Tax Guide Cointracker The answer to how much tax on cryptocurrency do you have to pay in the UK will depend on your income tax bracket. This means that you are. The deductible costs related to the original crypto assets will be split between the two different pools one for the original asset and one for the newly forked crypto. So if the profit from selling your cryptocurrency in addition to any other asset gains is less than this you wont have to report or pay tax on it.

Source: youtube.com

Source: youtube.com

How To Avoid Tax On Cryptocurrency Uk Youtube If on the other hand youre a basic rate taxpayer your tax rate will depend on your taxable income and the size of the gain after any. I only invested about 14k in crypto and currently it rose to 16k. Youve only got until January 31 to file your taxes in the UK Image. So if the profit from selling your cryptocurrency in addition to any other asset gains is less than this you wont have to report or pay tax on it.

Uk Cryptocurrency Tax Guide Cointracker However exchange of one cryptocurrency for another will also be considered disposal. I have that in a variety of coins like bitcoin litecoin matic XLM XRP and ethereum. However if you sell up to four times the annual allowance 45200 for 201718 of crypto-assets even if you make a profit of. If you sell the crypto for loss then the loss can be deducted to reduce the overall capital gain.

Source: cryptotrader.tax

Source: cryptotrader.tax

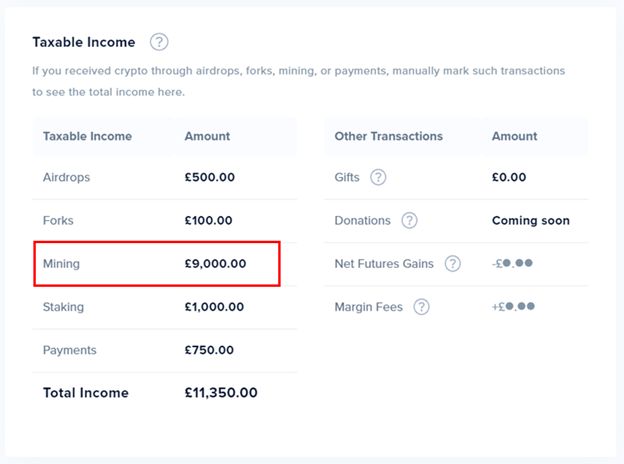

Uk Crypto Tax Guide 2021 Cryptotrader Tax For individuals income tax supersedes capital gains tax and applies to profits. Appropriate expenses can be deducted from this income before adding it to the taxable income. The crypto assets donated to charity do not apply to capital gains tax unless the donation is more than the acquisition cost. HMRC taxes cryptocurrency depending on how you deal with cryptocurrency.

Source: koinly.io

Source: koinly.io

Cryptocurrency Taxes In The Uk The 2021 Guide Koinly Crypto received from a hard fork is therefore not subject to income tax. However exchange of one cryptocurrency for another will also be considered disposal. If you hold cryptocurrency as a personal investment you will be subject to Capital Gains Tax rules. So since Binance is banned in the UK currently i wanted to move my coins over to coinbase.

Source: koinly.io

Source: koinly.io

Declare Your Bitcoin Cryptocurrency Taxes In Uk Hmrs Koinly So if the profit from selling your cryptocurrency in addition to any other asset gains is less than this you wont have to report or pay tax on it. This means that you are. Tax on this cryptocurrency exchange in the UK will include capital gains tax. However it is extremely rare for HMRC to assess an individuals cryptoasset activity to apply income tax.

Source: koinly.io

Source: koinly.io

Cryptocurrency Taxes In The Uk The 2021 Guide Koinly I have that in a variety of coins like bitcoin litecoin matic XLM XRP and ethereum. If you hold cryptocurrency as a personal investment you will be subject to Capital Gains Tax rules. However after the fork the crypto assets have to go into their own pool. HMRC taxes cryptocurrency depending on how you deal with cryptocurrency.

Source: mycryptotax.co.uk

Source: mycryptotax.co.uk

6 Ways To Minimise Cgt On Cryptocurrency Uk Cryptocurrency Accountant And Tax Advisers Cryptocurrency Tax Specialist For individuals income tax supersedes capital gains tax and applies to profits. The easiest way to defer or eliminate tax on your cryptocurrency investments is to buy inside of an IRA 401-k defined benefit or other retirement plans. Ii You still have your CG allowance 11700 upon which you wont pay tax and. I only invested about 14k in crypto and currently it rose to 16k.

Uk Cryptocurrency Tax Guide Cointracker The answer to how much tax on cryptocurrency do you have to pay in the UK will depend on your income tax bracket. This means that you are taxed on the capital gain at the time the cryptocurrency is disposed of eg. I have that in a variety of coins like bitcoin litecoin matic XLM XRP and ethereum. Buy Crypto Currency In Your IRA.

Source: buybitcoinworldwide.com

Source: buybitcoinworldwide.com

5 Best Crypto Tax Software Accounting Calculators 2021 For individuals income tax supersedes capital gains tax and applies to profits. If on the other hand youre a basic rate taxpayer your tax rate will depend on your taxable income and the size of the gain after any. Crypto received from a hard fork is therefore not subject to income tax. Income tax instead of CGT would only apply to businesses that generate trading profits in cryptoassets.

Source: cryptotrader.tax

Source: cryptotrader.tax

Uk Crypto Tax Guide 2021 Cryptotrader Tax I have that in a variety of coins like bitcoin litecoin matic XLM XRP and ethereum. If activities are considered trading they will face different cryptocurrency tax in the UK. If you simply buy bitcoin or another cryptocurrency and hold it in a wallet you do not have any sort of tax reporting requirement as you havent realized a gain or loss on your investment yet. However if you sell up to four times the annual allowance 45200 for 201718 of crypto-assets even if you make a profit of.

Uk Cryptocurrency Tax Guide Cointracker This is reserved for professional traders and businesses. The deductible costs related to the original crypto assets will be split between the two different pools one for the original asset and one for the newly forked crypto. If youre a higher or additional rate taxpayer your capital gains tax rate will be 20. Income tax instead of CGT would only apply to businesses that generate trading profits in cryptoassets.

Source: medium.com

Source: medium.com

Complete Guide On Crypto Taxes In Uk By Neeta Gupta Akeo Medium HMRC taxes cryptocurrency depending on how you deal with cryptocurrency. HMRC has published guidance for people who hold cryptoassets or cryptocurrency as they are also known explaining what taxes they may need to pay. When you dispose of cryptoasset exchange tokens known as cryptocurrency you may need to pay Capital Gains Tax. Appropriate expenses can be deducted from this income before adding it to the taxable income.