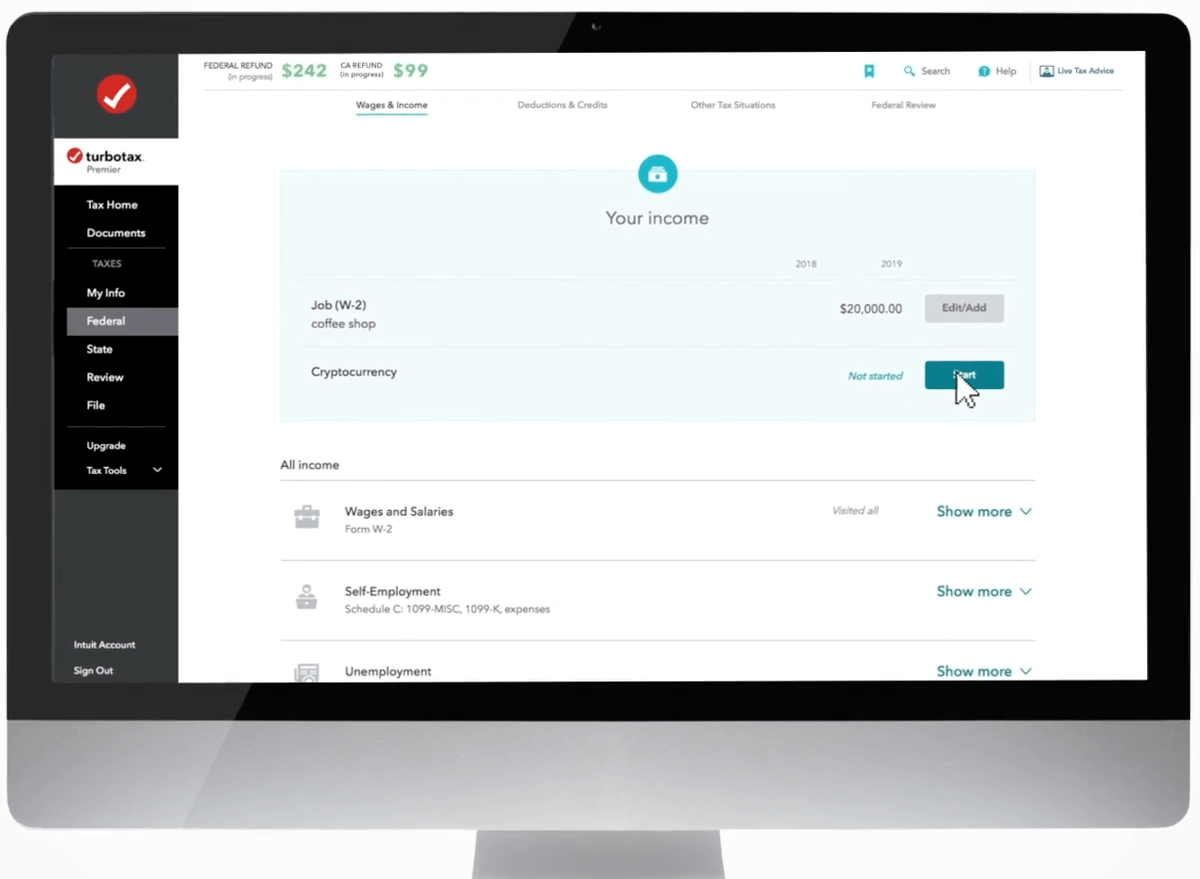

Select Federal from the left menu and Wages Income from the menu near the top. You can e-file your crypto gainloss history with the rest of your taxes. How to enter cryptocurrency on turbotax.

How To Enter Cryptocurrency On Turbotax, Select Start or Revisit next to Cryptocurrency. Type cryptocurrency into the Search bar. Danny Delgado August 13 2021 1102 am.

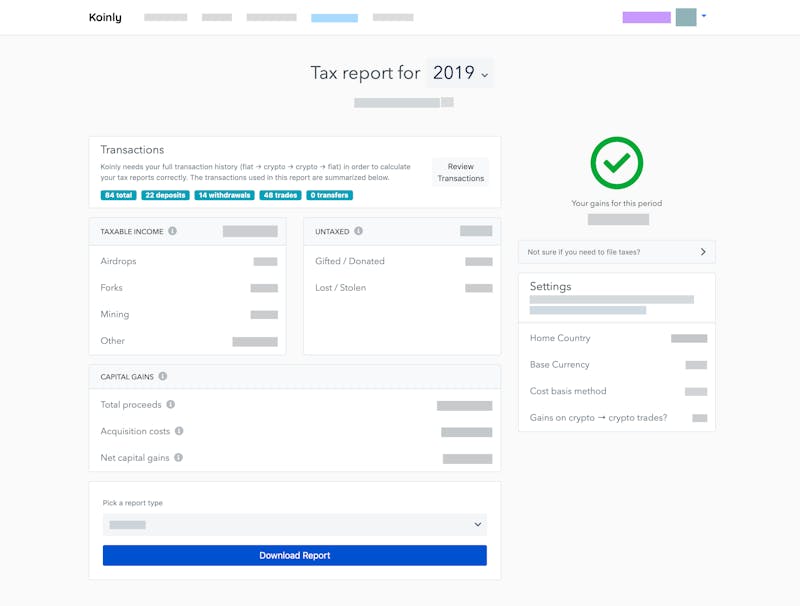

Cryptocurrency Tax Reports In Minutes Koinly From koinly.io

Cryptocurrency Tax Reports In Minutes Koinly From koinly.io

Once you have your figures. In the TurboTax introduction process select I sold or traded Cryptocurrency on the page titled Lets get an idea of your financial picture Once you get to your Wages Income screen click Start next to Cryptocurrency. Report Cryptocurrency On TurboTax Step By Step. Cryptocurrency you sold or converted to US dollars.

How do I use TurboTax to report on my cryptocurrency.

Once you have your figures. I noticed that TurboTax Cryptocurrency section you selected simply asked if you sold or traded Crypto but according to the IRS guidelines Mining Crypto is a taxable event subject to standard Income Tax at your standard tax rate. Select Federal from the left menu and Wages Income from the menu near the top. Select Start or Revisit next to Cryptocurrency. Some employees are paid with Bitcoin more than a few retailers accept Bitcoin as payment and others hold the e-currency as a capital asset. Type cryptocurrency into the Search bar.

Read another article:

Cryptocurrency Bitcoin Tax Guide 2021 Edition Cointracker Download your TurboTax Online Record format of CSV from CoinTrackers Charge page. If you are in TurboTax Desk Top open Forms. Once you have your figures. TurboTax Online has a new Cryptocurrency section.

Source: reddit.com

Source: reddit.com

Turbotax Has An I Sold Or Traded Cryptocurrency Option When Filing Taxes Online Cryptocurrency Scroll down and select Show more next to Investment Income. Sign into your TurboTax account. Select this link to have the 15 discount automatically applied at checkout. How to file crypto taxes Robinhood and all other investments—-FREE CRYPTO FREE STOCKS for signing up—– Easiest ExchangesJoin Robinhood and get a stoc.

Source: pinterest.com

Source: pinterest.com

How To Buy Bitcoin The Best Places To Invest In Cryptocurrency Video In 2021 Buy Bitcoin Investing Investment Quotes Click on Cryptocurrency button to enter information. Type cryptocurrency into the Search bar. Click Federal in the menu on the left choose Income Expenses at the top scroll down into All Income and clicking the Investment Income sectio CoinTracker tutorial on how to file your cryptocurrency and bitcoin taxes with CoinTracker and TurboTaxImport your transactions from top exchanges including. Cryptocurrency you used to pay for products or services or received as payment.

Source: in.pinterest.com

Source: in.pinterest.com

Crypto Focused Software Firm Lukka Releases Tax Preparation Product Tax Software Accounting Firms Turbotax Weve partnered with TurboTax to save you 15 on TurboTax Premier which easily handles cryptocurrency gainslosses. If you are in TurboTax Desk Top open Forms. If you had more than 2251 transactions use a service like CoinTracker Bitcointax Cryptotradertax TokenTax or ZenLedger to calculate your total gains or losses. Cryptocurrency Prices Top Stories each morning.

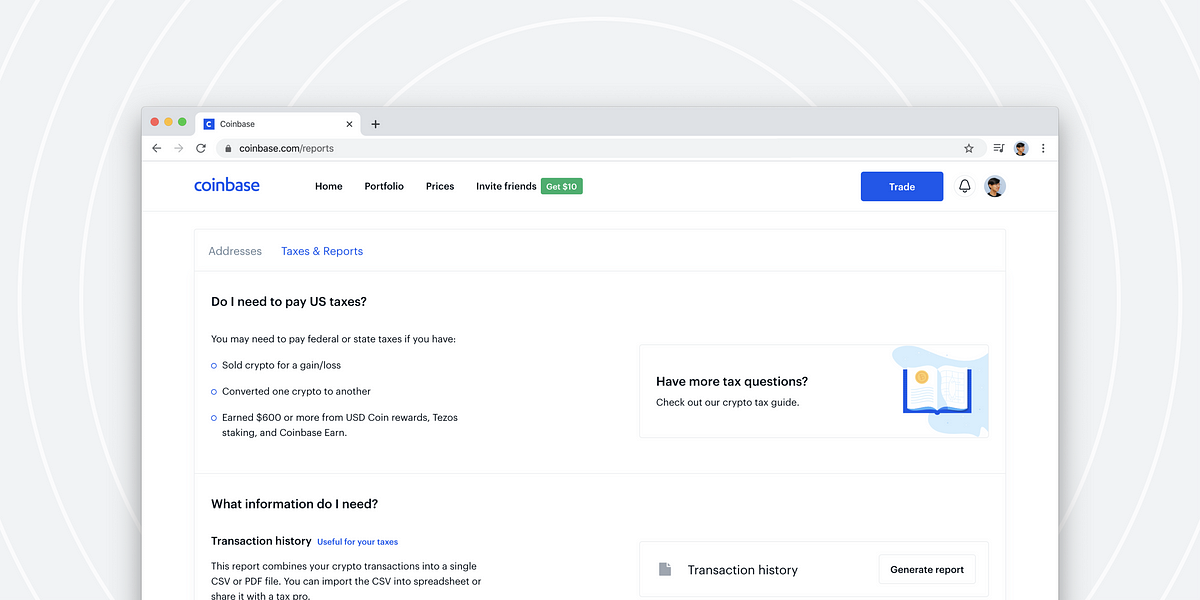

Source: blog.coinbase.com

Source: blog.coinbase.com

Coinbase Resources For 2019 Tax Returns By Coinbase The Coinbase Blog Cryptocurrency you sold or converted to US dollars. Select this link to have the 15 discount automatically applied at checkout. Follow the instructions and well. You can e-file your crypto gainloss history with the rest of your taxes.

Source: pinterest.com

Source: pinterest.com

3d Model Of Mining Farm Crypto Mining Farm Mining Scroll down and select Show more next to Investment Income. Check out our latest bitcoin newsletter. If you are in TurboTax Desk Top open Forms. Sign into TurboTax 4 and go through the setup steps.

Source: pinterest.com

Source: pinterest.com

Cryptomite Cryptocurrencycommunity Cryptocurrency Cryptosupplychain Btconeshot Bchcommunity Neotraditional Ethe Tron Legacy Cryptocurrency Supply Chain Select Federal from the left menu and Wages Income from the menu near the top. Danny Delgado August 13 2021 1102 am. Report Cryptocurrency On TurboTax Step By Step. Select this link to have the 15 discount automatically applied at checkout.

Cryptocurrency Taxes In Australia 2020 2021 Guide Cointracker Follow the instructions and well. Right now TurboTax is probably the easiest online tax-filing software to use. Select this link to have the 15 discount automatically applied at checkout. The company has made it relatively simple for you to file your taxes on.

Source: taxbit.com

Source: taxbit.com

How To Report Taxes On Cryptocurrency Taxbit Blog Cryptocurrency Prices Top Stories each morning. Cryptocurrency Prices Top Stories each morning. If you had more than 2251 transactions use a service like CoinTracker Bitcointax Cryptotradertax TokenTax or ZenLedger to calculate your total gains or losses. TurboTax Online has a new Cryptocurrency section.

Source: turbotax.intuit.com

Source: turbotax.intuit.com

Your Cryptocurrency Tax Guide Turbotax Tax Tips Videos If you are in TurboTax Desk Top open Forms. Sign into TurboTax 4 and go through the setup steps. Click Federal in the menu on the left choose Income Expenses at the top scroll down into All Income and clicking the Investment Income sectio CoinTracker tutorial on how to file your cryptocurrency and bitcoin taxes with CoinTracker and TurboTaxImport your transactions from top exchanges including. Select this link to have the 15 discount automatically applied at checkout.

Source: blog.turbotax.intuit.com

Source: blog.turbotax.intuit.com

Turbotax Makes It Easier For Coinbase Customers To Report Their Cryptocurrency Transactions The Turbotax Blog Click Federal in the menu on the left choose Income Expenses at the top scroll down into All Income and clicking the Investment Income sectio CoinTracker tutorial on how to file your cryptocurrency and bitcoin taxes with CoinTracker and TurboTaxImport your transactions from top exchanges including. Right now TurboTax is probably the easiest online tax-filing software to use. Lets see how to report cryptocurrency on turbotax. I noticed that TurboTax Cryptocurrency section you selected simply asked if you sold or traded Crypto but according to the IRS guidelines Mining Crypto is a taxable event subject to standard Income Tax at your standard tax rate.

Source: youtube.com

Source: youtube.com

How To File Your Cryptocurrency Taxes With Turbotax Cryptotrader Tax Youtube Sign into your TurboTax account. Sign into TurboTax 4 and go through the setup steps. If you had more than 2251 transactions use a service like CoinTracker Bitcointax Cryptotradertax TokenTax or ZenLedger to calculate your total gains or losses. Once you have your figures.

Source: buybitcoinworldwide.com

Source: buybitcoinworldwide.com

5 Best Crypto Tax Software Accounting Calculators 2021 Bitcoin Daily is delivered to your inbox each morning we find the top 3 stories and offer our expert analysis highlight current cryptocurrency How To Enter Cryptocurrency On Turbotax Desktop prices. Click on Cryptocurrency button to enter information. If you had more than 2251 transactions use a service like CoinTracker Bitcointax Cryptotradertax TokenTax or ZenLedger to calculate your total gains or losses. Click Federal in the menu on the left choose Income Expenses at the top scroll down into All Income and clicking the Investment Income section.

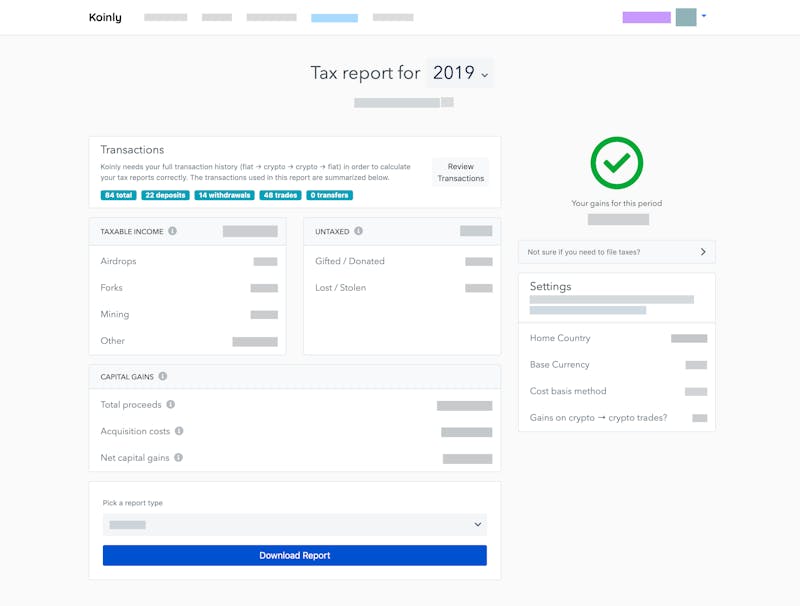

Source: koinly.io

Source: koinly.io

Cryptocurrency Tax Reports In Minutes Koinly For more information about cryptocurrency taxes checkout our Complete 2019 Guide to Cryptocurrency Taxes. Download your TurboTax Online Record format of CSV from CoinTrackers Charge page. I noticed that TurboTax Cryptocurrency section you selected simply asked if you sold or traded Crypto but according to the IRS guidelines Mining Crypto is a taxable event subject to standard Income Tax at your standard tax rate. Select Jump to cryptocurrency.

Source: taxbit.com

Source: taxbit.com

A Complete 2020 Guide To Cryptocurrency Taxes Taxbit Once you have your figures. Select Start or Revisit next to Cryptocurrency. Select this link to have the 15 discount automatically applied at checkout. The company has made it relatively simple for you to file your taxes on.