How To Import Cryptocurrency Trades Turbotax Premier intro to cryptocurrency trading ethereum wallet track address bitcoin mccafee. Next go to your TokenTax Documents page and create a TurboTax CSV. How to add cryptocurrency to turbotax.

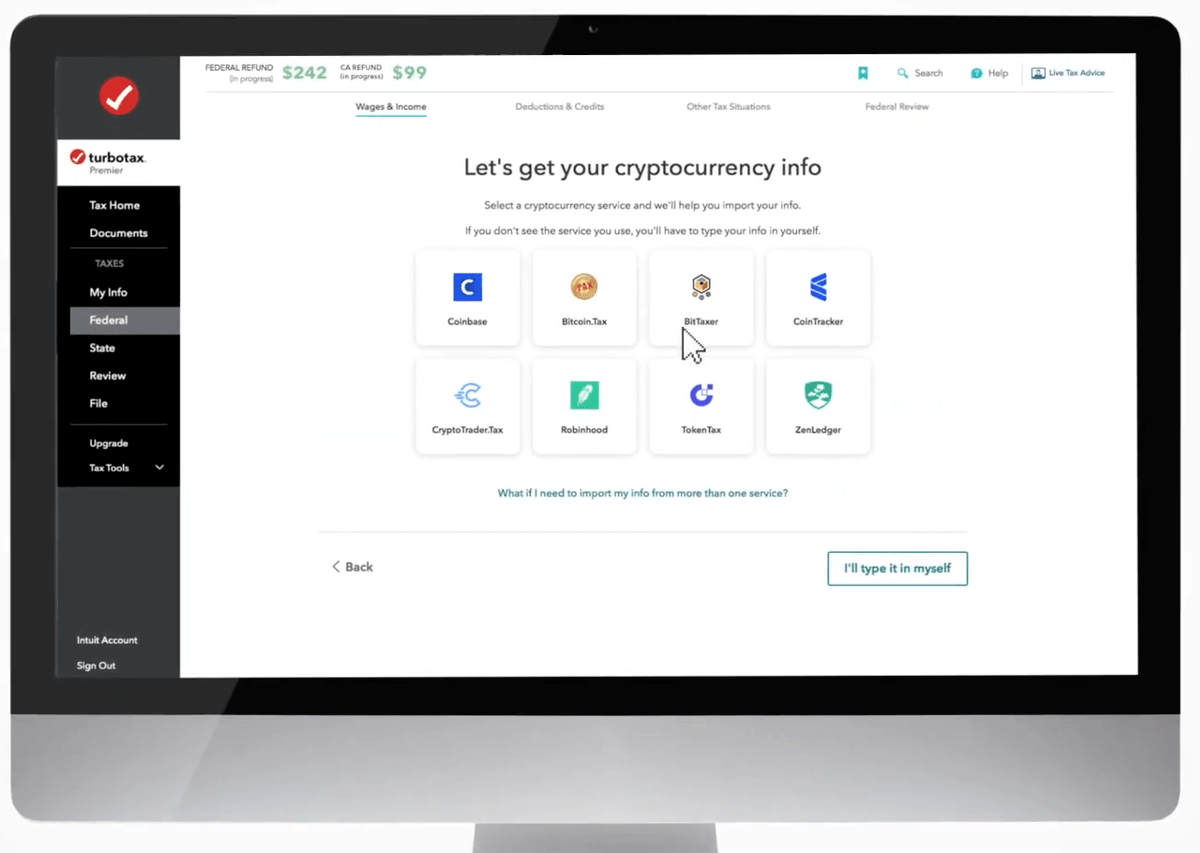

How To Add Cryptocurrency To Turbotax, CoinTracker is free for up to 25 transactions per customer. Once you get to your Wages Income screen click Start next to Cryptocurrency. I noticed that TurboTax Cryptocurrency section you selected simply asked if you sold or traded Crypto but according to the IRS guidelines Mining Crypto is a taxable event subject to standard Income Tax at your standard tax rate.

5 Best Crypto Tax Software Accounting Calculators 2021 From buybitcoinworldwide.com

5 Best Crypto Tax Software Accounting Calculators 2021 From buybitcoinworldwide.com

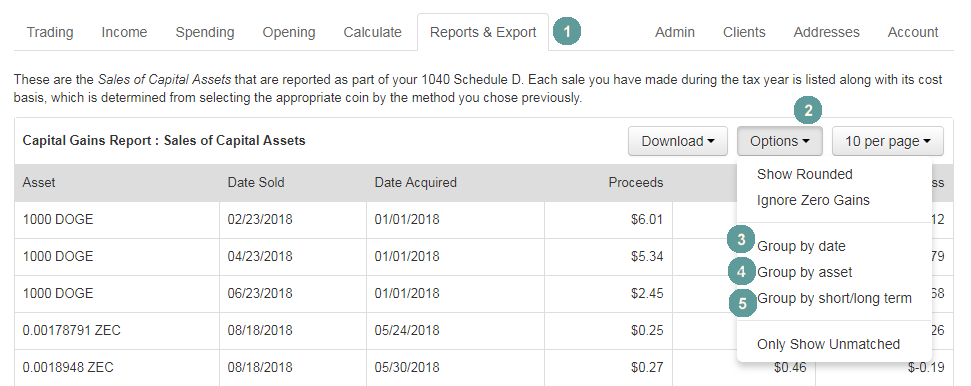

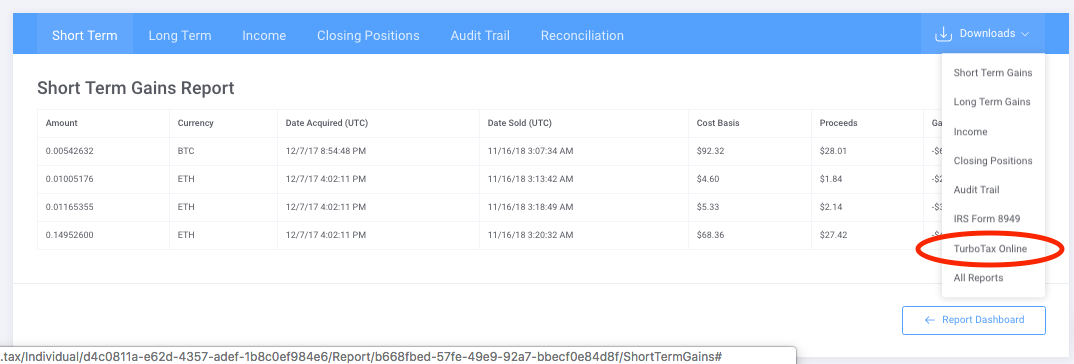

Simply export the Tax Exchange Format under the Downloads popup. Select Federal from the left menu and Wages Income from the menu near the top. Danny Delgado August 13 2021 1102 am. Follow the instructions and well calculate the gain or loss from the sale.

Sign up using your Coinbase account to import your transactions and calculate your crypto gainslosses.

Follow the instructions and well calculate the gain or loss from the sale. You can upload your trading information that CryptoTraderTax creates into the desktop version of TurboTax so that you can complete your entire tax return. Youll be asked if you sold or traded cryptocurrency in 2019. Recently the Internal Revenue Service IRS clarified the tax treatment of virtual currency transactions. Next go to your TokenTax Documents page and create a TurboTax CSV. Some employees are paid with Bitcoin more than a few retailers accept Bitcoin as payment and others hold the e-currency as a capital asset.

Read another article:

Source: koinly.io

Source: koinly.io

How To Do Your Crypto Tax With Koinly Turbotax Watch Found the story interesting. If you earn cryptocurrency by mining it its considered taxable income. You can upload your trading information that CryptoTraderTax creates into the desktop version of TurboTax so that you can complete your entire tax return. Navigate to File Import From Accounting Software.

Source: reddit.com

Source: reddit.com

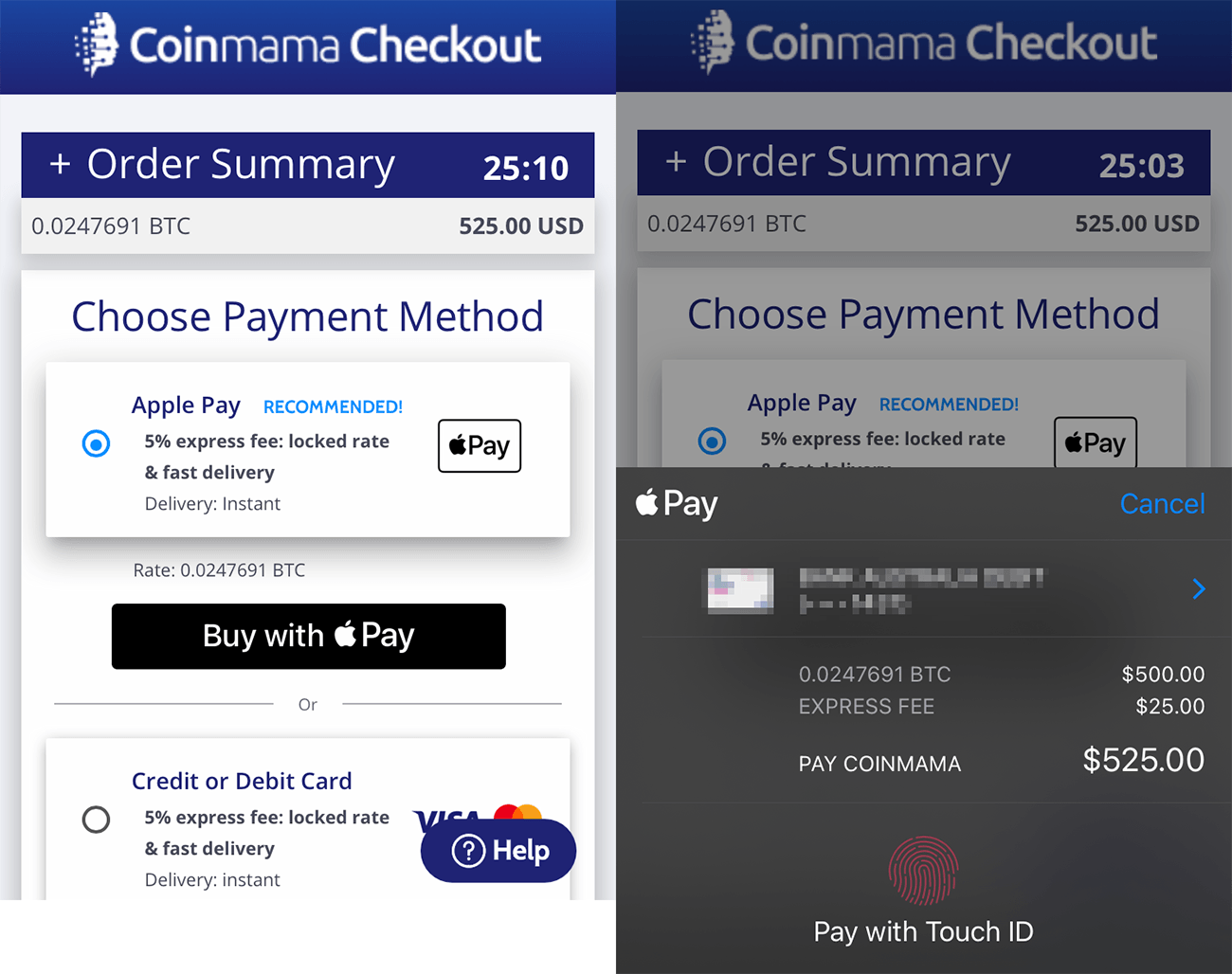

Turbotax Doesn T Accept Ccv From Coinbase Is Anybody Had This Issue How Did You Solve It Thanks Cryptocurrency Theres an upload limit of 2000 cryptocurrency transactions in TurboTax. Youll be asked if you sold or traded cryptocurrency in 2019. Scroll down and select Show more next to Investment Income. Navigate to TurboTax Online and Select the Premier or Self-Employment Package.

Source: prweb.com

Source: prweb.com

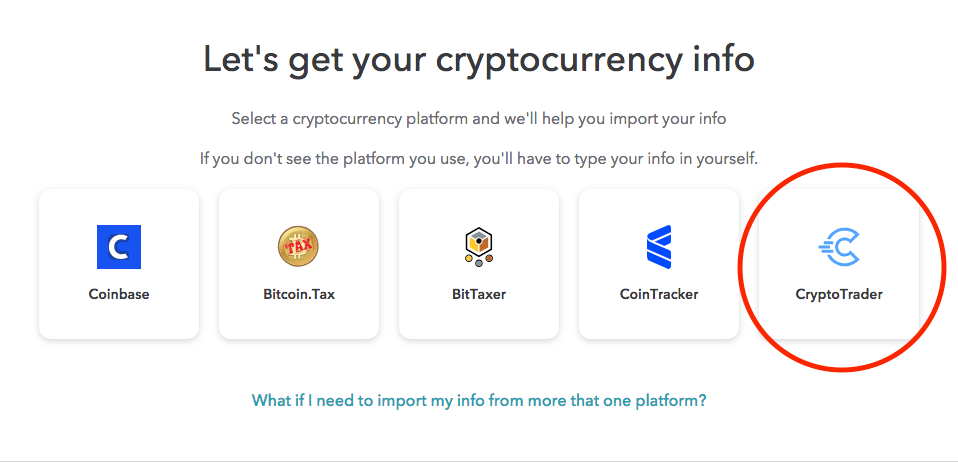

Cryptocurrency Tax Software Leader Cryptotrader Tax Integrates With Turbotax To Bring Crypto Tax Reporting To The Mainstream Found the story interesting. When you get to the page that says Lets get an idea of your financial picture select I sold or traded Cryptocurrency. Open or continue your return in TurboTax Online. If you didnt already select that you sold or traded cryptocurrency add it by clicking Add more income on this screen and selecting cryptocurrency.

Source: youtube.com

Source: youtube.com

How Do I Clear And Start Over In Turbotax Online Turbotax Support Video Youtube If you have more than that youll need a transaction aggregator. Select Start or Revisit next to Cryptocurrency. Classic bearish chart pattern forms for Bitcoin as BTC price tumbles to 32K. Virtual currency like Bitcoin has shifted into the public eye in recent years.

Source: youtube.com

Source: youtube.com

How To File Crypto Taxes Robinhood And All Other Brokerage Acct Turbotax 1099b Youtube Select Start or Revisit next to Cryptocurrency. For the 2020 tax year Coinbase customers can get a discount to TurboTax products using this link or take advantage of CoinTracker to determine their gainslosses. Well walk you through that in the cryptocurrency section. How To Import Cryptocurrency Trades Turbotax Premier intro to cryptocurrency trading ethereum wallet track address bitcoin mccafee.

Source: turbotax.intuit.com

Source: turbotax.intuit.com

Your Cryptocurrency Tax Guide Turbotax Tax Tips Videos If you have more than that youll need a transaction aggregator. Theres an upload limit of 2000 cryptocurrency transactions in TurboTax. If you didnt already select that you sold or traded cryptocurrency add it by clicking Add more income on this screen and selecting cryptocurrency. Answer Initial Prompts and Questions.

Source: blog.turbotax.intuit.com

Source: blog.turbotax.intuit.com

Turbotax Makes It Easier For Coinbase Customers To Report Their Cryptocurrency Transactions The Turbotax Blog Scroll down and select Show more next to Investment Income. How To Import Cryptocurrency Trades Turbotax Premier intro to cryptocurrency trading ethereum wallet track address bitcoin mccafee. Continue through the filing flow through the cryptocurrency page by pressing Continue. Select Federal from the left menu and Wages Income from the menu near the top.

Source: mydealsclub.com

Source: mydealsclub.com

Turbotax Cryptocurrency Does Turbotax Do Cryptocurrency Mydealsclub Llc First complete your crypto taxes on TokenTax. I noticed that TurboTax Cryptocurrency section you selected simply asked if you sold or traded Crypto but according to the IRS guidelines Mining Crypto is a taxable event subject to standard Income Tax at your standard tax rate. If you have more than that youll need a transaction aggregator. For more information about cryptocurrency taxes checkout our Complete 2019 Guide to Cryptocurrency Taxes.

Source: buybitcoinworldwide.com

Source: buybitcoinworldwide.com

5 Best Crypto Tax Software Accounting Calculators 2021 Select Start or Revisit next to Cryptocurrency. I noticed that TurboTax Cryptocurrency section you selected simply asked if you sold or traded Crypto but according to the IRS guidelines Mining Crypto is a taxable event subject to standard Income Tax at your standard tax rate. Sign up using your Coinbase account to import your transactions and calculate your crypto gainslosses. Cryptocurrency Taxes with TurboTax 1.

Source: youtube.com

Source: youtube.com

How To File Your Cryptocurrency Taxes With Turbotax Cryptotrader Tax Youtube Classic bearish chart pattern forms for Bitcoin as BTC price tumbles to 32K. Sign in to TurboTax and go through the setup steps. Scroll down and select Show more next to Investment Income. Some employees are paid with Bitcoin more than a few retailers accept Bitcoin as payment and others hold the e-currency as a capital asset.

Source: thecollegeinvestor.com

Source: thecollegeinvestor.com

Turbotax Review 2021 The Easiest Tax Software To Use Right now TurboTax is probably the easiest online tax-filing software to use. Like us on Facebook to see. Continue through the filing flow through the cryptocurrency page by pressing Continue. Select Federal from the left menu and Wages Income from the menu near the top.

Source: bitcointaxes.zendesk.com

Source: bitcointaxes.zendesk.com

Turbotax Online Only Supports Importing 2251 Transactions What Should I Do Bitcoin Taxes The company has made it relatively simple for you to file your taxes on. In exchange for this work miners receive cryptocurrency. CoinTracker is free for up to 25 transactions per customer. I noticed that TurboTax Cryptocurrency section you selected simply asked if you sold or traded Crypto but according to the IRS guidelines Mining Crypto is a taxable event subject to standard Income Tax at your standard tax rate.

Source: medium.com

Source: medium.com

How To File Cryptocurrency Taxes With Turbotax By Lucas Wyland Hackernoon Com Medium Some employees are paid with Bitcoin more than a few retailers accept Bitcoin as payment and others hold the e-currency as a capital asset. First complete your crypto taxes on TokenTax. Classic bearish chart pattern forms for Bitcoin as BTC price tumbles to 32K. If you have more than that youll need a transaction aggregator.

Source: medium.com

Source: medium.com

How To File Cryptocurrency Taxes With Turbotax By Lucas Wyland Hackernoon Com Medium Like us on Facebook to see. Cryptocurrency mining refers to solving cartographic equations to validate and add cryptocurrency transactions to a blockchain. Head to TurboTax Online and select. First complete your crypto taxes on TokenTax.

Source: uk.pcmag.com

Source: uk.pcmag.com

Turbotax Vs H R Block Which Tax Software Is Best For Filing Your Taxes Online Found the story interesting. If you earn cryptocurrency by mining it its considered taxable income. Cryptocurrency mining refers to solving cartographic equations to validate and add cryptocurrency transactions to a blockchain. Continue through the filing flow through the cryptocurrency page by pressing Continue.