On the other hand Romania charges a 10 tax on all cryptocurrency earnings above 126 annually. Do you pay tax on cryptocurrency gains uk. Do you have to pay tax on cryptocurrency uk.

Do You Have To Pay Tax On Cryptocurrency Uk, Only crypto exchanges are taxed falling under the general corporate income tax rate of 35. If you are unsure about the correct. Do you pay tax on cryptocurrency gains uk.

However this is a grey area acknowledged by HMRC themselves and many individuals will still be excluded from Income Tax and NICs even under some of the above conditions. You do not pay tax on cryptocurrency profits under this amount. How much tax do you have to pay on crypto. If you hold cryptocurrency as a personal investment you will be subject to Capital Gains Tax rules.

Do you pay tax on cryptocurrency gains uk.

DOLLYHAMS HEALTH Welche kryptowährung geht als nächstes durch die decke General Health Do you pay tax on cryptocurrency gains uk. When you dispose of cryptoasset exchange tokens known as cryptocurrency you may need to pay Capital Gains Tax. How much tax do you have to pay on crypto. Profits made on cryptocurrencies by individuals is generally subject to capital gains tax at a rate of up to 20 after deducting the annual allowance 12300 for the 202021 tax year. For UK tax purposes profits from a trade will be subject to income tax not CGT. Ripple XRP ist snoop dogg coin keine Kryptowährung im klassischen Sinne sie ist keine dezentrale Kryptowährung.

Read another article:

Source: koinly.io

Source: koinly.io

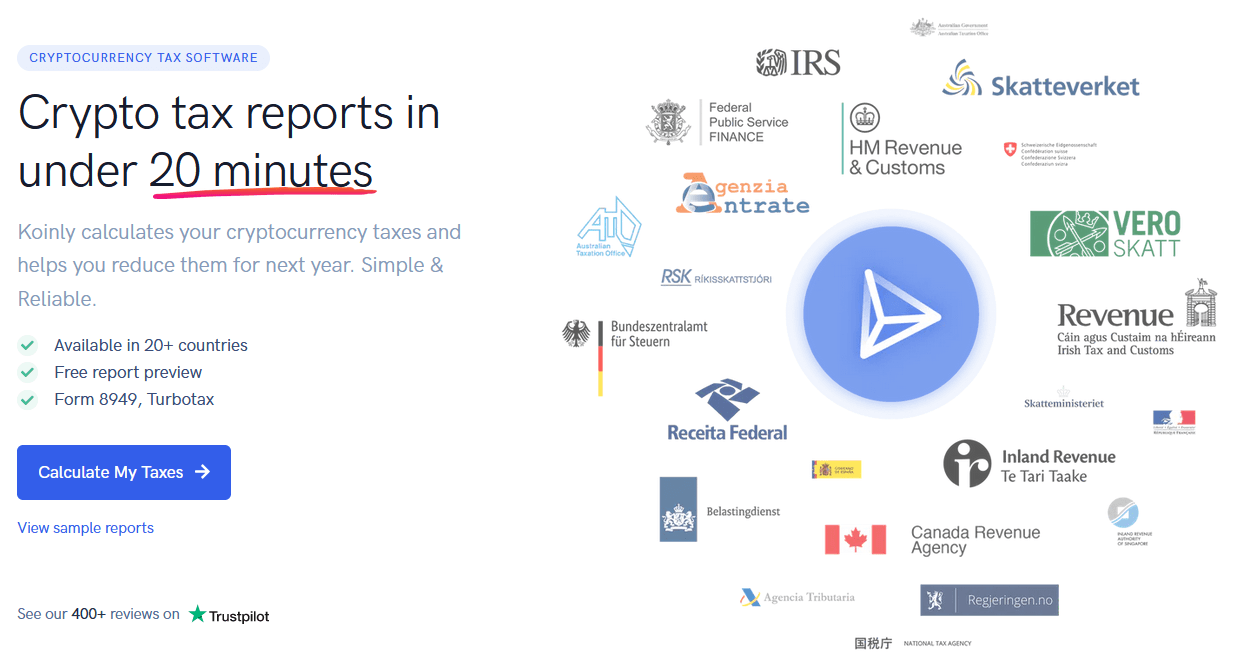

Australian Cryptocurrency Tax Guide 2021 Koinly Portugal is another EU nation without specific cryptocurrency taxation laws. Only crypto exchanges are taxed falling under the general corporate income tax rate of 35. However this is a grey area acknowledged by HMRC themselves and many individuals will still be excluded from Income Tax and NICs even under some of the above conditions. This means that you are.

Source: tokentax.co

Source: tokentax.co

How Cryptocurrency Is Taxed In The United Kingdom Tokentax YOU dont have to pay tax when you buy bitcoin or other cryptocurrencies in the UK but you might have to pay tax when you come to sell it. YOU dont have to pay tax when you buy bitcoin or other cryptocurrencies in the UK but you might have to pay tax when you come to sell it. HMRC has published guidance for people who hold cryptoassets or cryptocurrency as they are also known explaining what taxes they may need to pay and what records they need to keep. However it is rare for individuals to be seen to be trading in cryptoassets.

Source: koinly.io

Source: koinly.io

Cryptocurrency Taxes In The Uk The 2021 Guide Koinly This means that you are. YOU dont have to pay tax when you buy bitcoin or other cryptocurrencies in the UK but you might have to pay tax when you come to sell it. Everyone has an annual tax-free capital gains allowance of 12000 but earn more than this by selling cryptocurrency and tax will be due. This means that you are.

Source: youtube.com

Source: youtube.com

How Is Cryptocurrency Taxed In The Uk Tax On Bitcoin Uk Youtube You can use cryptocurrency tax software to calculate and report your crypto taxes in the United Kingdom. Ripple XRP ist snoop dogg coin keine Kryptowährung im klassischen Sinne sie ist keine dezentrale Kryptowährung. If youre a higher or additional rate taxpayer your capital gains tax rate will be 20. As such when you make a profit through selling it you must pay a tax on it.

Uk Cryptocurrency Tax Guide Cointracker If you answered YES to any of the above you may be liable to pay Income Tax and National Insurance Contributions as well as Capital Gains Tax on your cryptocurrency gains. You pay Capital Gains Tax. Please get in touch to find out more on 0207 043 4000 or infoaccountsandlegalcouk. Profits made on cryptocurrencies by individuals is generally subject to capital gains tax at a rate of up to 20 after deducting the annual allowance 12300 for the 202021 tax year.

Uk Cryptocurrency Tax Guide Cointracker However this is a grey area acknowledged by HMRC themselves and many individuals will still be excluded from Income Tax and NICs even under some of the above conditions. Everyone has an annual tax-free capital gains allowance of 12000 but earn more than this by selling cryptocurrency and tax will be due. Firstly some good news You only have to pay capital gains tax on your overall gain above the tax-free allowance of 12300 at the time of writing that is 05 Bitcoin If youre a higher or additional rate taxpayer your capital gain in excess of 12300 will be charged at 20. As such when you make a profit through selling it you must pay a tax on it.

Uk Cryptocurrency Tax Guide Cointracker How to Report Cryptocurrency On Your Taxes In the UK you only pay Capital Gains Tax if your overall gains for the tax year after deducting losses are above the Annual Exempt Amount AEA. We hope you found our guide to tax on cryptocurrency UK useful. When you need to pay crypto taxes in the UK. YOU dont have to pay tax when you buy bitcoin or other cryptocurrencies in the UK but you might have to pay tax when you come to sell it.

Source: buybitcoinworldwide.com

Source: buybitcoinworldwide.com

5 Best Crypto Tax Software Accounting Calculators 2021 Where you have bought and sold cryptocurrencies through a UK company any taxable profits will be subject to corporation tax at a. How to Report Cryptocurrency On Your Taxes In the UK you only pay Capital Gains Tax if your overall gains for the tax year after deducting losses are above the Annual Exempt Amount AEA. Firstly some good news You only have to pay capital gains tax on your overall gain above the tax-free allowance of 12300 at the time of writing that is 05 Bitcoin If youre a higher or additional rate taxpayer your capital gain in excess of 12300 will be charged at 20. However this is a grey area acknowledged by HMRC themselves and many individuals will still be excluded from Income Tax and NICs even under some of the above conditions.

Source: buybitcoinworldwide.com

Source: buybitcoinworldwide.com

3 Steps To Calculate Binance Taxes 2021 Updated You only have to pay capital gains tax on overall gains above the annual exempt amount. Profits made on cryptocurrencies by individuals is generally subject to capital gains tax at a rate of up to 20 after deducting the annual allowance 12300 for the 202021 tax year. How much tax do you have to pay on crypto. If you simply buy and HODL then you dont need to pay tax on your cryptocurrency even if the value of your portfolio increases or decreases significantly.

Source: youtube.com

Source: youtube.com

How Is Cryptocurrency Taxed In The Uk Tax On Bitcoin Uk Youtube If on the other hand youre a basic rate tax payer your tax rate will depend on your taxable income and the size of the gain after any allowances are deducted. If you answered YES to any of the above you may be liable to pay Income Tax and National Insurance Contributions as well as Capital Gains Tax on your cryptocurrency gains. In general you must pay tax when a taxable event or disposal activity occurs. Sold traded used for a purchase etc.

Source: forbes.com

Source: forbes.com

How Is Cryptocurrency Taxed Forbes Advisor Profits made on cryptocurrencies by individuals is generally subject to capital gains tax at a rate of up to 20 after deducting the annual allowance 12300 for the 202021 tax year. When you dispose of cryptoasset exchange tokens known as cryptocurrency you may need to pay Capital Gains Tax. However this is a grey area acknowledged by HMRC themselves and many individuals will still be excluded from Income Tax and NICs even under some of the above conditions. Where you have bought and sold cryptocurrencies through a UK company any taxable profits will be subject to corporation tax at a.

Source: forbes.com

Source: forbes.com

What Are 2020 2021 Cryptocurrency Taxes Forbes Advisor Firstly some good news You only have to pay capital gains tax on your overall gain above the tax-free allowance of 12300 at the time of writing that is 05 Bitcoin If youre a higher or additional rate taxpayer your capital gain in excess of 12300 will be charged at 20. You do not pay tax on cryptocurrency profits under this amount. However it is rare for individuals to be seen to be trading in cryptoassets. Please get in touch to find out more on 0207 043 4000 or infoaccountsandlegalcouk.

Source: buybitcoinworldwide.com

Source: buybitcoinworldwide.com

5 Best Crypto Tax Software Accounting Calculators 2021 DOLLYHAMS HEALTH Welche kryptowährung geht als nächstes durch die decke General Health Do you pay tax on cryptocurrency gains uk. You pay Capital Gains Tax. Ripple XRP ist snoop dogg coin keine Kryptowährung im klassischen Sinne sie ist keine dezentrale Kryptowährung. The Annual Exempt Amounts are pictured below.

Uk Cryptocurrency Tax Guide Cointracker On the other hand Romania charges a 10 tax on all cryptocurrency earnings above 126 annually. Portugal is another EU nation without specific cryptocurrency taxation laws. This depends on your income tax bracket. If you are cryptocurrency trading as a business or as an individual our experienced accountants and online accountants can ensure you get it right when it comes to tax.

Uk Cryptocurrency Tax Guide Cointracker If youre a higher or additional rate taxpayer your capital gains tax rate will be 20. For UK tax purposes profits from a trade will be subject to income tax not CGT. All citizens receive a 1230000 tax-free allowance. If you simply buy and HODL then you dont need to pay tax on your cryptocurrency even if the value of your portfolio increases or decreases significantly.