Separate types of trusts can be. For example Grayscale Investments Bitcoin Trust has seen striking growth. Cryptocurrency unit trust.

Cryptocurrency Unit Trust, The Grayscale Bitcoin Trust is a digital currency investment product that individual investors can buy and sell in their own brokerage accounts. This is exactly why cryptocurrency funds exist. Instead of trusting in one regulatory authority you trust in the decentralized system.

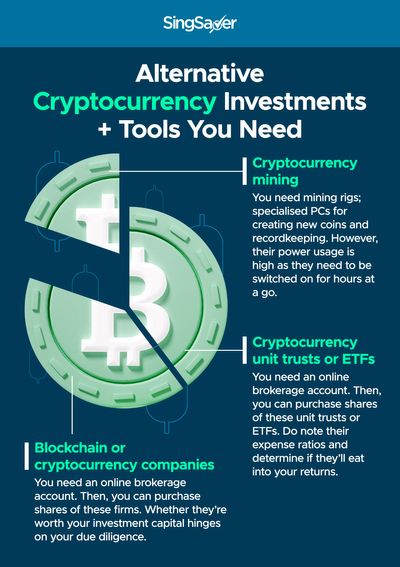

Begin Investing In Cryptocurrency The Definitive Guide 2021 From singsaver.com.sg

Begin Investing In Cryptocurrency The Definitive Guide 2021 From singsaver.com.sg

Trustees will increasingly encounter crypto-assets and will be expected to hold them within structures so need more than a passing awareness of the technology and processes involved in cryptocurrency management. Putting your cryptocurrency in a trust makes it less likely that your cryptocurrency will go undiscovered after your death because the existence of your cryptocurrency will be documented in the trust. 14 rows Founded in 2012 by Jean-Luc Landry and Fred Pye 3iQ is a fully-regulated. This is not something that should be abused by any means as the IRS will uncover fraudulent behavior sooner or later.

This is not something that should be abused by any means as the IRS will uncover fraudulent behavior sooner or later.

Trustees will increasingly encounter crypto-assets and will be expected to hold them within structures so need more than a passing awareness of the technology and processes involved in cryptocurrency management. The Grayscale Bitcoin Trust Established as the Bitcoin Trust an open-ended private trust by Alternative Currency Asset Management in 2013 this fund is now sponsored by Grayscale Investments LLC. This is not something that should be abused by any means as the IRS will uncover fraudulent behavior sooner or later. This is due the fact that many financial advisers are promoting it though investment-linked policies and the public perception that its a profitable and effortless way to invest their money. The thing is you can invest in cryptocurrency by transferring your assets into trust management by professionals. The digital advisor explains on its website that cryptocurrencies are significantly more volatile than most securities-based ETFs the trusts can trade at prices that differ significantly from.

Read another article:

Source: blockgeeks.com

Source: blockgeeks.com

What Is Cryptocurrency Everything You Need To Know Theyre one of the best performing assets of 2020. Separate types of trusts can be. Instead the market is overseen by cryptocurrency miners and network nodes. Updated Jun 25 2019 Investors looking for exposure to cryptocurrencies but who want to avoid the hassles associated with holding the actual digital coins.

Source: medium.com

Source: medium.com

Crypto Assets The Allocation Of Crypto In A Balanced Portfolio By Swissone Capital Medium A cryptocurrency trust is a trust like any other in the financial sector except its one that solely holds cryptocurrency assets. 1 day agoCryptocurrencies are referred to as trustless because there is no regulatory body to put your trust in. The Grayscale Bitcoin Trust is a digital currency investment product that individual investors can buy and sell in their own brokerage accounts. This is exactly why cryptocurrency funds exist.

Source: nasdaq.com

Source: nasdaq.com

An Overview Of The Top Crypto Indexes Nasdaq This is due the fact that many financial advisers are promoting it though investment-linked policies and the public perception that its a profitable and effortless way to invest their money. The digital advisor explains on its website that cryptocurrencies are significantly more volatile than most securities-based ETFs the trusts can trade at prices that differ significantly from. This is due the fact that many financial advisers are promoting it though investment-linked policies and the public perception that its a profitable and effortless way to invest their money. Updated Jun 25 2019 Investors looking for exposure to cryptocurrencies but who want to avoid the hassles associated with holding the actual digital coins.

Source: wired.com

Source: wired.com

Why A Tiny Kentucky Firm Rules A Corner Of The Crypto Market Wired The Grayscale Bitcoin Trust Established as the Bitcoin Trust an open-ended private trust by Alternative Currency Asset Management in 2013 this fund is now sponsored by Grayscale Investments LLC. They will require a level of understanding sufficient to apply trust and structuring principles to this new type of asset. It has gained 51 per cent year-to-date YTD. 14 rows Founded in 2012 by Jean-Luc Landry and Fred Pye 3iQ is a fully-regulated.

Source: coinswitch.co

Source: coinswitch.co

Bitcoin Vs Mutual Funds Which Is A Better Option To Invest In 2021 Updated Jun 25 2019 Investors looking for exposure to cryptocurrencies but who want to avoid the hassles associated with holding the actual digital coins. This is not something that should be abused by any means as the IRS will uncover fraudulent behavior sooner or later. Instead of trusting in one regulatory authority you trust in the decentralized system. It has gained 51 per cent year-to-date YTD.

Source: singsaver.com.sg

Source: singsaver.com.sg

Begin Investing In Cryptocurrency The Definitive Guide 2021 A Charitable Remainder Unit Trust CRUT A taxpayer donates highly appreciated assets in this case cryptocurrency into a CRUT and then immediately sells the assets with the intent on creating a. Ninepoint follows the example of Grayscale which pioneered the model of creating a trust dedicated to buying Bitcoin and then selling shares in that trust in. 14 rows Founded in 2012 by Jean-Luc Landry and Fred Pye 3iQ is a fully-regulated. This is important because unlike other property cryptocurrency is not an easily discoverable asset.

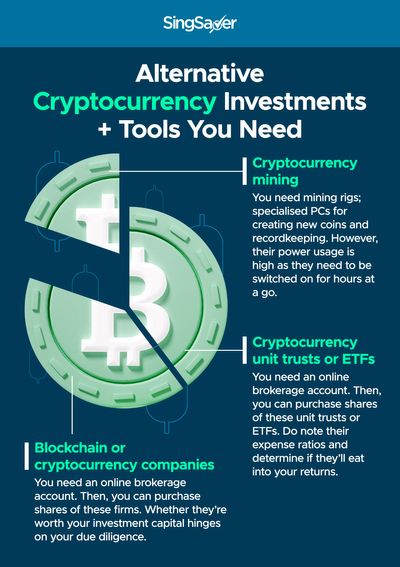

Source: bitpanda.com

Source: bitpanda.com

Five Use Cases Of Cryptocurrencies Bitpanda Academy Although these vehicles are still subject to taxation there are a few methods out there to reduce or negate ones taxes. Unit trusts and open ended investment companies Oeics are forms of shared investments or funds that allow you to pool your money with thousands of other people and invest in. Cryptocurrency is known as a virtual currency or digital. Trustees will increasingly encounter crypto-assets and will be expected to hold them within structures so need more than a passing awareness of the technology and processes involved in cryptocurrency management.

Source: investornews.vanguard

Source: investornews.vanguard

The Case For Caution With Cryptocurrencies Vanguard Chris Ratcliffe Bloomberg Since bitcoins launch in 2009 the largest cryptocurrencys. Cryptocurrencies are an exciting investment opportunity. Chris Ratcliffe Bloomberg Since bitcoins launch in 2009 the largest cryptocurrencys. Unit trusts also known as mutual funds are a popular investment options among investors.

Source: roobykon.com

Source: roobykon.com

Cryptocurrency Marketplace Integrations Are The Future Of Your Online Multi Vender Site Investing in cryptocurrency also known as digital assets is simple. And this is what we are going to talk about here. Investing in cryptocurrency also known as digital assets is simple. Grayscale Bitcoin Trust GBTC shares have narrowed their discount relative to the underlying cryptocurrency held in the fund possibly a sign that.

Source: ipe.com

Source: ipe.com

Investment In Cryptocurrency Disruption Or Disappointment Special Report Ipe Unit trusts also known as mutual funds are a popular investment options among investors. Compare this with the SP 500 048 per cent YTD performance. Although these vehicles are still subject to taxation there are a few methods out there to reduce or negate ones taxes. A cryptocurrency trust is a trust like any other in the financial sector except its one that solely holds cryptocurrency assets.

Source: bloomberg.com

Source: bloomberg.com

Bitcoin One Big Risk When Investing In Crypto Funds Bloomberg This is exactly why cryptocurrency funds exist. Instead the market is overseen by cryptocurrency miners and network nodes. Separate types of trusts can be. Revixs unit trust-like bundles mean you can own the 10 largest cryptocurrencies in one investment.

Source: trustwallet.com

Source: trustwallet.com

Cryptocurrency Rankings A Guide It has gained 51 per cent year-to-date YTD. This is not something that should be abused by any means as the IRS will uncover fraudulent behavior sooner or later. The Grayscale Bitcoin Trust is a digital currency investment product that individual investors can buy and sell in their own brokerage accounts. The digital advisor explains on its website that cryptocurrencies are significantly more volatile than most securities-based ETFs the trusts can trade at prices that differ significantly from.

Source: corporatefinanceinstitute.com

Source: corporatefinanceinstitute.com

Bitcoin Etfs Overview How It Works Advantages 1 day agoCryptocurrencies are referred to as trustless because there is no regulatory body to put your trust in. Investing in cryptocurrency also known as digital assets is simple. Cryptocurrency is known as a virtual currency or digital. This is due the fact that many financial advisers are promoting it though investment-linked policies and the public perception that its a profitable and effortless way to invest their money.

Source: medium.com

Source: medium.com

Crypto Assets The Allocation Of Crypto In A Balanced Portfolio By Swissone Capital Medium This is not something that should be abused by any means as the IRS will uncover fraudulent behavior sooner or later. This is important because unlike other property cryptocurrency is not an easily discoverable asset. It has gained 51 per cent year-to-date YTD. A cryptocurrency trust is a trust like any other in the financial sector except its one that solely holds cryptocurrency assets.

Source: blockgeeks.com

Source: blockgeeks.com

What Is Cryptocurrency Everything You Need To Know Separate types of trusts can be. Unit trusts also known as mutual funds are a popular investment options among investors. This is not something that should be abused by any means as the IRS will uncover fraudulent behavior sooner or later. Using a Trust Makes Your Cryptocurrency Known to Loved Ones.