Details This manual sets out HMRCs view of the appropriate tax treatment of cryptoassets based on the law as it stands on the date of publication. So while Germany taxes certain crypto events like short term trades mining and staking its tax rules on crypto. Cryptocurrency taxes germany.

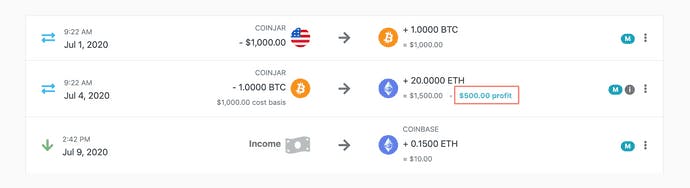

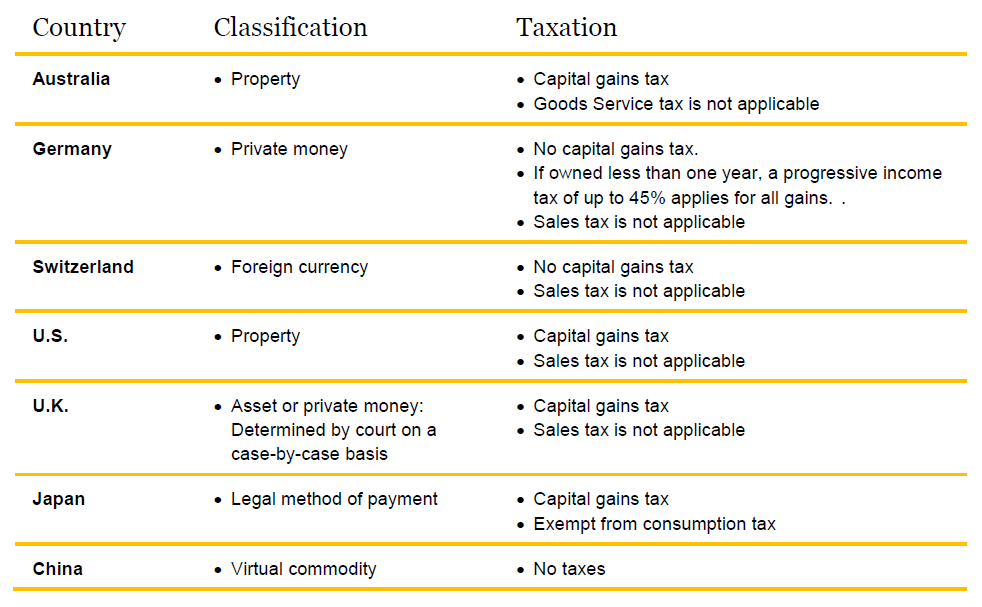

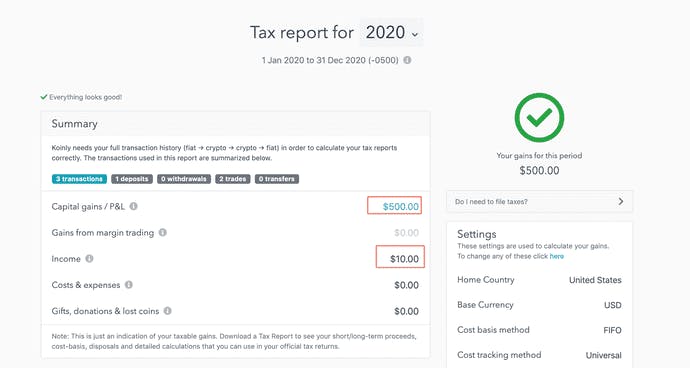

Cryptocurrency Taxes Germany, This effectively allows the asset chains data to be then included within the backup thats pushed into the protective hash price of the principle Proof-of-Work PoW blockchain Bitcoin. If the cryptocurrencies are sold before 12 months then the gains on the sale will be taxed with a Progressive Income Tax of 45. In Germany cryptocurrency transactions are exempted from VAT and have no capital gains tax.

Germany Cryptocurrency Tax Guide 2021 Koinly From koinly.io

Germany Cryptocurrency Tax Guide 2021 Koinly From koinly.io

Details This manual sets out HMRCs view of the appropriate tax treatment of cryptoassets based on the law as it stands on the date of publication. As a result we focus primarily on the unfolding bitcoin taxation frameworks in the European Union Germany and the United States. When crypto holders exchange or sell crypto assets they will. So while Germany taxes certain crypto events like short term trades mining and staking its tax rules on crypto.

This effectively allows the asset chains data to be then included within the backup thats pushed into the protective hash price of the principle Proof-of-Work PoW blockchain Bitcoin.

The tax rates for gifts. As opposed to most developed countries Germany doesnt see cryptos as currencies commodities or stocks. So while Germany taxes certain crypto events like short term trades mining and staking its tax rules on crypto. Cryptocurrency tax germany In this way the asset chain data might be protected by the most important hash-rate obtainable on one blockchain. The buyers are required to hold their digital assets for a minimum period of 12. But this opinion is only binding upon Hamburgs tax offices.

Read another article:

Source: koinly.io

Source: koinly.io

Germany Cryptocurrency Tax Guide 2021 Koinly No tax if you hold Bitcoin for one year. This effectively allows the asset chains data to be then included within the backup thats pushed into the protective hash price of the principle Proof-of-Work PoW blockchain Bitcoin. Cryptocurrency and Taxes in Germany BTC is not recognized as a payment method or type of electronic cash in Germany. Crypto taxes in the European Union Cryptocurrency in the EU is subject to taxation.

Source: jeangalea.com

Source: jeangalea.com

How Are Bitcoin And Other Crytpocurrencies Taxed Jean Galea Instead Bitcoin and altcoins are considered private money. Crypto taxes in the European Union Cryptocurrency in the EU is subject to taxation. This effectively allows the asset chains data to be then included within the backup thats pushed into the protective hash price of the principle Proof-of-Work PoW blockchain Bitcoin. As opposed to most developed countries Germany doesnt see cryptos as currencies commodities or stocks.

Source: coinpanda.io

Source: coinpanda.io

Germany Calculate And File Bitcoin Cryptocurrency Taxes Coinpanda Crypto taxes in the European Union Cryptocurrency in the EU is subject to taxation. How is Cryptocurrency taxed in Germany. The tax rates for gifts. If you hold for less than one year income taxes of up to 45 apply.

Source: koinly.io

Source: koinly.io

Germany Cryptocurrency Tax Guide 2021 Koinly Indeed you are completely exempt of capital gains taxes if you hold your crypto asset for more than one year. This distinction is important since private sales bring tax benefits in Germany. As a result we focus primarily on the unfolding bitcoin taxation frameworks in the European Union Germany and the United States. Instead the Federal Ministry of Finance BMFhas designated bitcoin as private money and so considers it to be a foreign currency.

Source: blog.blockpit.io

Source: blog.blockpit.io

Taxes On Bitcoin Co In Austria Germany And Switzerland Cryptocurrency Tax Guide Cryptocurrency tax germanyThe Hamburg ministry of finance also dealt with the topic cryptocurrency tax germany and published its opinion on the fiscal treatment of income from Bitcoin trading within the private capital sector on December 11 2017. No tax if you hold Bitcoin for one year. Giving Bitcoins or other cryptos to your family or friends as a gift is regarded as any other gift in Germany. Cryptocurrency tax germany In this way the asset chain data might be protected by the most important hash-rate obtainable on one blockchain.

Source: coinlist.me

Source: coinlist.me

Cryptocurrency Tax Guide De 2021 Coinlist Me Because everyone who makes taxable profits from activities with cryptocurrencies has to file a tax return. Cryptocurrency tax germanyThe Hamburg ministry of finance also dealt with the topic cryptocurrency tax germany and published its opinion on the fiscal treatment of income from Bitcoin trading within the private capital sector on December 11 2017. As opposed to most developed countries Germany doesnt see cryptos as currencies commodities or stocks. Giving Bitcoins or other cryptos to your family or friends as a gift is regarded as any other gift in Germany.

Source: winheller.com

Source: winheller.com

Bitcoin Taxation In Germany Cryptocurrency Attorneys Advise Because everyone who makes taxable profits from activities with cryptocurrencies has to file a tax return. The tax rates for gifts. This distinction is important since private sales bring tax benefits in Germany. Because everyone who makes taxable profits from activities with cryptocurrencies has to file a tax return.

Source: nomoretax.eu

Source: nomoretax.eu

Germany A Surprising Bitcoin Tax Haven No More Tax As opposed to most developed countries Germany doesnt see cryptos as currencies commodities or stocks. Giving Bitcoins or other cryptos to your family or friends as a gift is regarded as any other gift in Germany. Instead Bitcoin and altcoins are considered private money. In Germany cryptocurrency transactions are exempted from VAT and have no capital gains tax.

Source: 3commas.io

Source: 3commas.io

Crypto And Bitcoin Taxes Guide 2021 Cryptocurrencies Regulations And Taxation Worldwide The tax rates for gifts. This distinction is important since private sales bring tax benefits in Germany. There are no transfer taxes in Germany on cryptocurrencies. Details This manual sets out HMRCs view of the appropriate tax treatment of cryptoassets based on the law as it stands on the date of publication.

Source: koinly.io

Source: koinly.io

Germany Cryptocurrency Tax Guide 2021 Koinly Crypto taxes in the European Union Cryptocurrency in the EU is subject to taxation. As a result we focus primarily on the unfolding bitcoin taxation frameworks in the European Union Germany and the United States. This distinction is important since private sales bring tax benefits in Germany. Giving Bitcoins or other cryptos to your family or friends as a gift is regarded as any other gift in Germany.

Source: cryptoresearch.report

Source: cryptoresearch.report

Taxation Of Cryptocurrencies In Europe Crypto Research Report If the cryptocurrencies are sold before 12 months then the gains on the sale will be taxed with a Progressive Income Tax of 45. Cryptocurrency and Taxes in Germany BTC is not recognized as a payment method or type of electronic cash in Germany. This distinction is important since private sales bring tax benefits in Germany. Giving Bitcoins or other cryptos to your family or friends as a gift is regarded as any other gift in Germany.

Source: koinly.io

Source: koinly.io

Germany Cryptocurrency Tax Guide 2021 Koinly No tax if you hold Bitcoin for one year. No tax if you hold Bitcoin for one year. Cryptocurrency and Taxes in Germany BTC is not recognized as a payment method or type of electronic cash in Germany. As opposed to most developed countries Germany doesnt see cryptos as currencies commodities or stocks.

Source: winheller.com

Source: winheller.com

Bitcoin Taxation In Germany Cryptocurrency Attorneys Advise Automated Crypto Tax Report for German Tax Authorities The crypto tax return regularly poses challenges for private crypto investors. Crypto taxes in the European Union Cryptocurrency in the EU is subject to taxation. Cryptocurrency and Taxes in Germany BTC is not recognized as a payment method or type of electronic cash in Germany. However stating losses can also be an advantage as these can be offset against future profits.

Source: koinly.io

Source: koinly.io

Germany Cryptocurrency Tax Guide 2021 Koinly The buyers are required to hold their digital assets for a minimum period of 12 months to get exempted from the taxes. Other The issue or transfer might be subject to inheritance tax or gift tax both would be considered transfer taxes in the. Cryptocurrency is views as a private asset in Germany which means it attracts an individual Income Tax rather than a Capital Gains Tax. The key thing to know is that Germany only taxes crypto if its sold within the same year it was bought.

Source: koinly.io

Source: koinly.io

Germany Cryptocurrency Tax Guide 2021 Koinly The tax rates for gifts. This effectively allows the asset chains data to be then included within the backup thats pushed into the protective hash price of the principle Proof-of-Work PoW blockchain Bitcoin. The buyers are required to hold their digital assets for a minimum period of 12 months to get exempted from the taxes. How is Cryptocurrency taxed in Germany.