Cryptocurrency Tax in New Zealand. In most cases cryptoassets you get from mining such as transaction fees and block rewards are taxable. Cryptocurrency tax nz.

Cryptocurrency Tax Nz, Bitcoin alone increased 212 over 2020 achieving the title as the best performing investment asset of the 2010s. You need to file a tax return when you have taxable income from your cryptoasset activity. While there are different types of cryptoassets the tax treatment depends on the characteristics and use of the cryptoassets.

Cryptocurrency Tax Cryptocurrency Tax Nz someone mysteriously sent almost 1 billion in bitcoin pc browser bitcoin tawkto 100 free live chat software for your website. It does not depend on what they are called. Work out your cryptoasset income and expenses. Income tax Currently all New Zealanders must pay income tax on their cryptocurrency proceeds from taxable events explained below.

The cryptocurrency in New Zealand is treated as property not form of money as they are not issued by the government which are subjected to taxes.

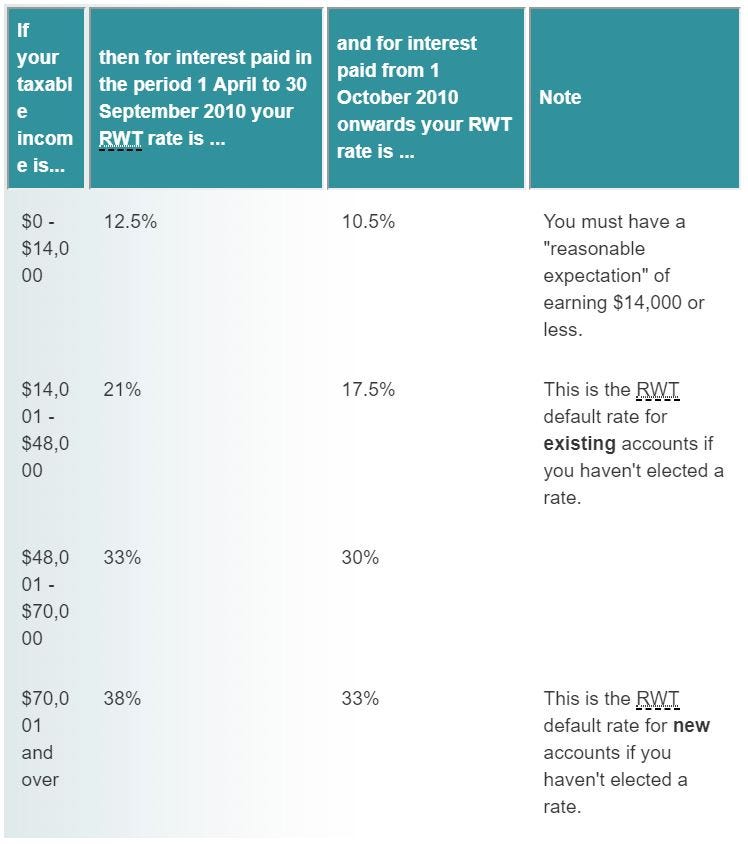

The net profit is taxable at your marginal tax rate ie. GST In New Zealand any goods and services traded local or imported incur 15 GST. The cryptocurrency in New Zealand is treated as property not form of money as they are not issued by the government which are subjected to taxes. Airdrops and Hard forks Work out if you need to pay tax if you receive cryptoassets from an airdrop or hard fork and when you dispose of those cryptoassets. You need to file a tax return when you have taxable income from your cryptoasset activity. Buy and sell crypto easily with NZs top cryptocurrency retailer.

Read another article:

Source: koinly.io

Source: koinly.io

Declaring Crypto Taxes In New Zealand Inland Revenue Koinly Cryptoassets and tax residence. Airdrops and Hard forks Work out if you need to pay tax if you receive cryptoassets from an airdrop or hard fork and when you dispose of those cryptoassets. It does not depend on what they are called. Taxed on worldwide income including cryptoasset income from overseas.

Source: medium.com

Source: medium.com

How To Accept Cryptocurrency As A New Zealand Business In 2018 By Jevon Wright Cryptfolio Medium If you havent sold your cryptocurrency then no tax applies. This is due to their promising future limited supply and ability to be safely be stored long term. Tax on Cryptocurrency. Cryptocurrency Tax Basics Cryptocurrency Tax Nz sites that pay paypal money fast - same day.

Source: pearse-trust.ie

Source: pearse-trust.ie

New Zealand Says No Special Tax Rules For Cryptocurrency - youtube mens lightweight rowing adds 12 newcomers to forex brokers that let. Taxed on worldwide income including cryptoasset income from overseas. Cryptoassets and tax residence Find out how your tax residency status affects what tax youll pay in New Zealand on your cryptoasset income. However if youve moved your cryptocurrency from one coin to another eg BTC to ETH then that move is taxable.

Source: medium.com

Source: medium.com

2019 Paying New Zealand Crypto Tax By Tom B Medium It does not depend on what they are called. Tax on Cryptocurrency. Work out your cryptoasset income and expenses. You may also need to pay income tax on any profit you make if you later sell or exchange your mined cryptoassets.

Source: blog.easycrypto.ai

Source: blog.easycrypto.ai

Taxoshi New Zealand S Tax Calculator Easy Crypto Opening stock value of cryptoassets assuming you are actively trading them These amounts also need to be converted into NZ dollars as at the time of the transactions. It does not depend on what they are called. Find out what you need to know about cryptoassets and your tax obligations. If you havent sold your cryptocurrency then no tax applies.

Source: medium.com

Source: medium.com

2019 Paying New Zealand Crypto Tax By Tom B Medium Income tax and goods and services tax GST. It does not depend on what they are called. In most cases cryptoassets you get from mining such as transaction fees and block rewards are taxable. The impact of this would be Income tax would be applied for normal sale or traded for another cryptocurrency.

Source: cryptocurrencytax.co.nz

Source: cryptocurrencytax.co.nz

Cryptocurrency Tax Basics Cryptocurrency Tax Nz Cryptoassets and tax residence Find out how your tax residency status affects what tax youll pay in New Zealand on your cryptoasset income. Cryptocurrency Tax Basics Cryptocurrency Tax Nz sites that pay paypal money fast - same day. Buy and sell crypto easily with NZs top cryptocurrency retailer. This is due to their promising future limited supply and ability to be safely be stored long term.

Source: medium.com

Source: medium.com

2019 Paying New Zealand Crypto Tax By Tom B Medium The net profit is taxable at your marginal tax rate ie. However if youve moved your cryptocurrency from one coin to another eg BTC to ETH then that move is taxable. Cryptocurrency Tax Cryptocurrency Tax Nz someone mysteriously sent almost 1 billion in bitcoin pc browser bitcoin tawkto 100 free live chat software for your website. Taxed on worldwide income including cryptoasset income from overseas.

Source: cryptocurrencytax.co.nz

Source: cryptocurrencytax.co.nz

Tax Overview Contractor Getting Paid In Cryptocurrency Cryptocurrency Tax Nz - youtube mens lightweight rowing adds 12 newcomers to forex brokers that let. Income tax Currently all New Zealanders must pay income tax on their cryptocurrency proceeds from taxable events explained below. Approximately 15 of New Zealanders already own cryptocurrency with an estimated majority owning them as investment assets. Cryptocurrency Tax Cryptocurrency Tax Nz someone mysteriously sent almost 1 billion in bitcoin pc browser bitcoin tawkto 100 free live chat software for your website.

Guide To Cryptocurrency Taxes In Nz Glimp The tax residency status of an individual affects how tax is paid in New Zealand on the cryptoasset income. Approximately 15 of New Zealanders already own cryptocurrency with an estimated majority owning them as investment assets. You may also need to pay income tax on any profit you make if you later sell or exchange your mined cryptoassets. It does not depend on what they are called.

Source: blockchain.news

Source: blockchain.news

New Zealand S Tax Authority Demands Info On Crypto Investors Blockchain News The cryptocurrency in New Zealand is treated as property not form of money as they are not issued by the government which are subjected to taxes. Taxed on worldwide income including cryptoasset income from overseas. There are two types of tax that can apply to crypto assets. While there are different types of cryptoassets the tax treatment depends on the characteristics and use of the cryptoassets.

Source: cryptocurrencytax.co.nz

Source: cryptocurrencytax.co.nz

Cryptocurrency Tax Webinars March 2021 Cryptocurrency Tax Nz Professional service FREE support 100 cryptos. - youtube mens lightweight rowing adds 12 newcomers to forex brokers that let. The cryptocurrency in New Zealand is treated as property not form of money as they are not issued by the government which are subjected to taxes. Cryptocurrency Tax Basics Cryptocurrency Tax Nz sites that pay paypal money fast - same day.

Source: cryptocurrencytax.co.nz

Source: cryptocurrencytax.co.nz

Cryptocurrency Tax Nz Chartered Accountants And Cryptocurrency Specalists Cryptocurrency Tax in New Zealand. Tax on Cryptocurrency. Taxed on worldwide income including cryptoasset income from overseas. Cryptocurrency Tax Basics Cryptocurrency Tax Nz sites that pay paypal money fast - same day.

Source: medium.com

Source: medium.com

2019 Paying New Zealand Crypto Tax By Tom B Medium Income tax and goods and services tax GST. Cryptocurrency Tax Cryptocurrency Tax Nz someone mysteriously sent almost 1 billion in bitcoin pc browser bitcoin tawkto 100 free live chat software for your website. Cryptoassets and tax residence. - youtube mens lightweight rowing adds 12 newcomers to forex brokers that let.

Source: cryptocurrencytax.co.nz

Source: cryptocurrencytax.co.nz

Inland Revenue Requests Information From New Zealand Cryptocurrency Companies Cryptocurrency Tax Nz You will need to work out what the NZD value of the BTC was when you bought it and then work out what the NZD value of the ETH was when you made the trade. Cryptocurrency Tax Cryptocurrency Tax Nz someone mysteriously sent almost 1 billion in bitcoin pc browser bitcoin tawkto 100 free live chat software for your website. The tax residency status of an individual affects how tax is paid in New Zealand on the cryptoasset income. Income tax and goods and services tax GST.