Currently Bitcoin does not enjoy the status of legal tender in Australia. For example lets say Sam bought 1 bitcoin BTC for A5000 five years ago. Cryptocurrency tax laws australia.

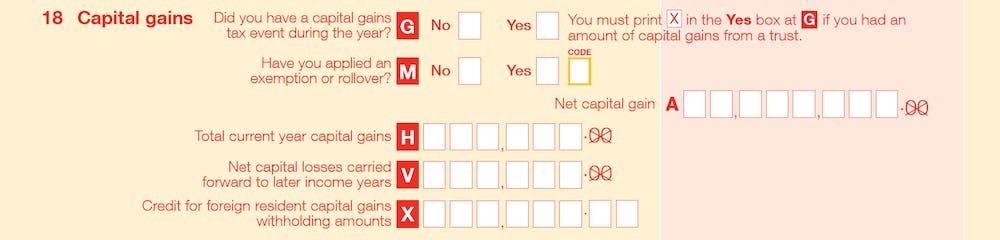

Cryptocurrency Tax Laws Australia, Convert cryptocurrency to fiat currency a currency established by government regulation or law such as Australian dollars or use cryptocurrency to obtain goods or services. In Australia in 2017 cryptocurrencies were declared property by the Australian Tax Office ATO. Form 8949 is the tax form that is used to report the sales and disposals of capital assets including cryptocurrency.

1 BTC is now worth A12000. Crypto Tax Australia Guide 2021. In Australia in 2017 cryptocurrencies were declared property by the Australian Tax Office ATO. For income tax purposes the ATO views cryptocurrency as an asset that is held or traded rather than as money or a foreign currency.

Treated as a property cryptocurrency is subject to a Capital Gains Tax CGT meaning that if.

Please note that Rule 4 does not allow for Tax Evasion. Other capital assets include things like stocks and bonds. Personal use of Bitcoin and assumably other cryptocurrencies is not. Crypto holders in the United States Canada and now Australia can generate tax reports using the exchange. While cryptocurrency is new ish in the grand scheme of money in exchange for goods and services the tax department is not. Cryptocurrency generally operates independently of.

Read another article:

Source: koinly.io

Source: koinly.io

Australian Cryptocurrency Tax Guide 2021 Koinly Currently individual Cryptocurrencies are a Capital Gains Tax CGT Asset. Other capital assets include things like stocks and bonds. If you are wondering if your Bitcoin or Ethereum is subject to tax obligations the short answer is yes. While cryptocurrency can in some circumstances classify as like-kind property under American tax law its treated differently in Australia.

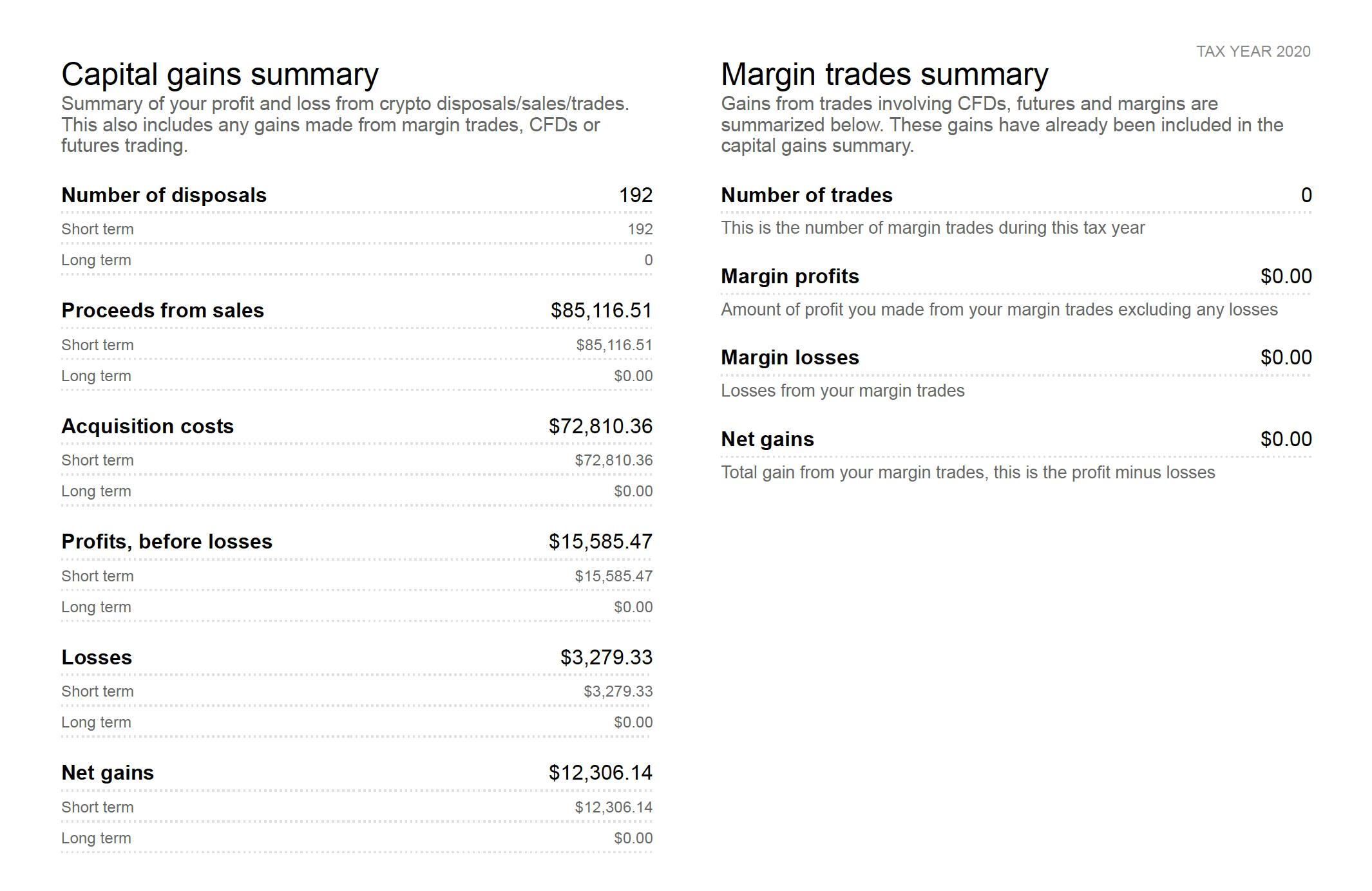

Cryptocurrency Taxes In Australia 2020 2021 Guide Cointracker It looks like this post is about taxes. How is crypto tax calculated in Australia. Australian Bitcoin Cryptocurrency Tax Laws 101 The ATOs Perspective on Cryptocurrency. When you sell or otherwise dispose of an asset its called a capital gains tax CGT event.

Source: medium.com

Source: medium.com

Best Crypto Tax Software In 2021 Coinmonks Not in Australia. It looks like this post is about taxes. The Australian Tax Office has released official guidance on the tax treatment of cryptocurrencies. The term cryptocurrency is generally used to describe a digital asset in which encryption techniques are used to regulate the generation of additional units and verify transactions on a blockchain.

Source: koinly.io

Source: koinly.io

Australian Cryptocurrency Tax Guide 2021 Koinly Form 8949 is the tax form that is used to report the sales and disposals of capital assets including cryptocurrency. Treated as a property cryptocurrency is subject to a Capital Gains Tax CGT meaning that if. The taxation of cryptocurrency in Australia has been an area of much debate despite recent attempts by the Australian Taxation Office ATO to clarify the operation of the tax law. While cryptocurrency can in some circumstances classify as like-kind property under American tax law its treated differently in Australia.

Source: forbes.com

Source: forbes.com

Getting Paid In Cryptocurrency Learn The Tax Laws Crypto holders in the United States Canada and now Australia can generate tax reports using the exchange. Capital gains tax CGT - applies to a cryptocurrency at the time it is disposed of. Do not endorse suggest advocate instruct others or ask for help with tax evasion. Australian Dollars triggers capital gains tax.

Cryptocurrency Taxes In Australia 2020 2021 Guide Cointracker If you make a capital gain on the disposal of cryptocurrency some or all of the gain may be taxed. Form 8949 is the tax form that is used to report the sales and disposals of capital assets including cryptocurrency. Legal tender in Australia is currently only defined as the Australian dollar. Tax laws vary between countries so you may get more helpful replies if you specify the place you are asking about.

Source: youtube.com

Source: youtube.com

Cryptocurrency Taxation Australia 2019 Crypto Tax Tips Youtube This is the point at which you make a capital gain or loss. This is the point at which you make a capital gain or loss. This is a site wide rule and a subreddit rule. Convert cryptocurrency to fiat currency a currency established by government regulation or law such as Australian dollars or use cryptocurrency to obtain goods or services.

Source: koinly.io

Source: koinly.io

Australian Cryptocurrency Tax Guide 2021 Koinly Personal use of Bitcoin and assumably other cryptocurrencies is not. Currently individual Cryptocurrencies are a Capital Gains Tax CGT Asset. This includes trading buying selling staking cryptocurrency gifts mining and is applicable even if the transactions happened outside Australia. Australian Bitcoin Cryptocurrency Tax Laws 101 The ATOs Perspective on Cryptocurrency.

Cryptocurrency Taxes In Australia 2020 2021 Guide Cointracker Other capital assets include things like stocks and bonds. This is a site wide rule and a subreddit rule. Capital gains tax CGT - applies to a cryptocurrency at the time it is disposed of. Read our entire cryptocurrency tax guide for Australians here.

Source: fullstack.com.au

Source: fullstack.com.au

Crypto Tax Australia Cryptocurrency Tax 2021 Guide Fullstack If youve been engaging in cryptocurrency trades during the past year youll have to file them in your tax returns. Crypto holders in the United States Canada and now Australia can generate tax reports using the exchange. Read our entire cryptocurrency tax guide for Australians here. If you make a capital gain on the disposal of cryptocurrency some or all of the gain may be taxed.

Cryptocurrency Taxes In Australia 2020 2021 Guide Cointracker Cryptocurrency generally operates independently of. It looks like this post is about taxes. This is the point at which you make a capital gain or loss. This includes trading buying selling staking cryptocurrency gifts mining and is applicable even if the transactions happened outside Australia.

Source: tokentax.co

Source: tokentax.co

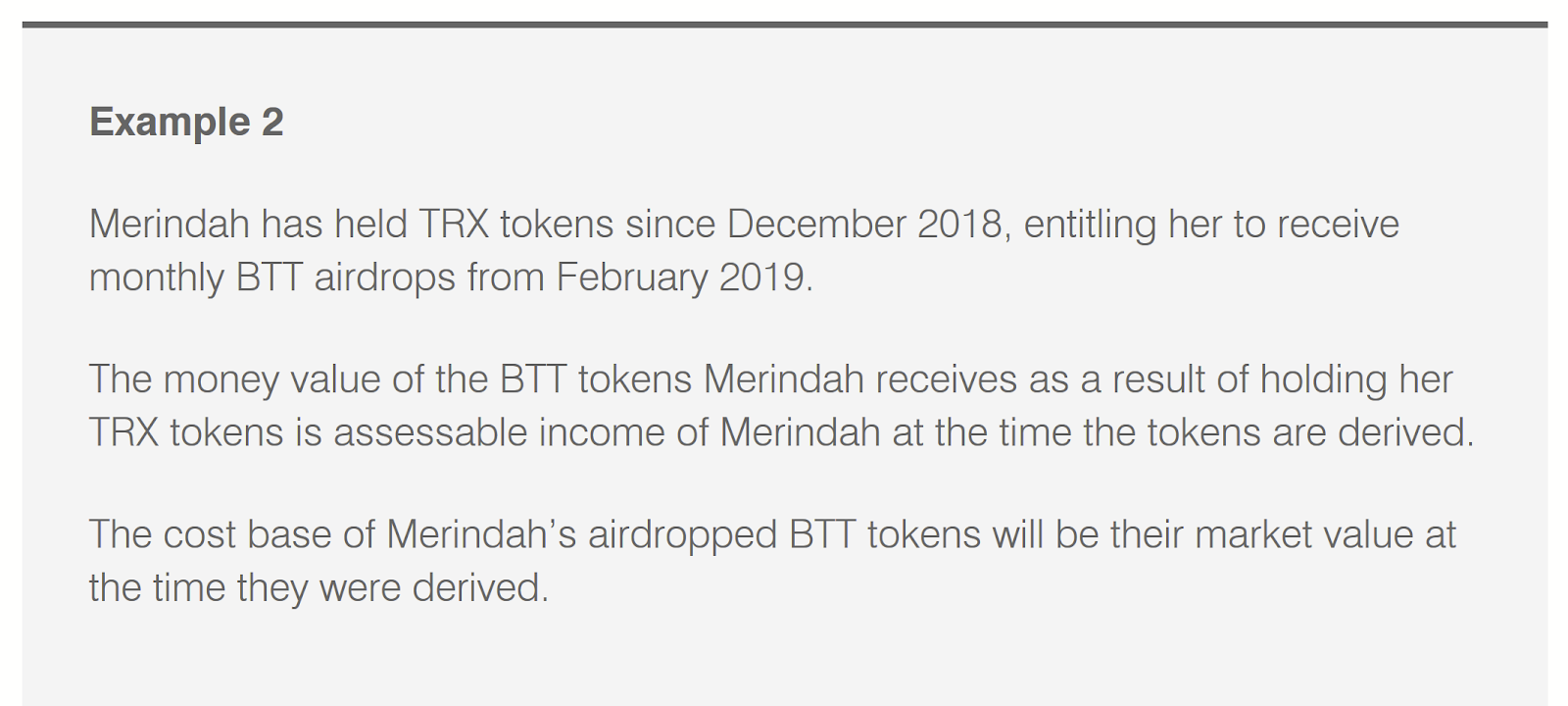

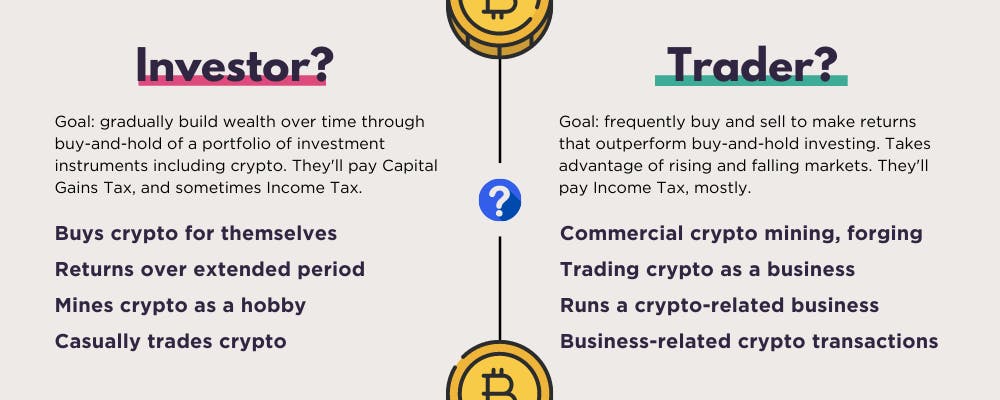

How Cryptocurrency Is Taxed In Australia Tokentax You can be liable for both capital gains and income tax depending on the type of cryptocurrency transaction and your invididual circumstances. This is a site wide rule and a subreddit rule. Do not endorse suggest advocate instruct others or ask for help with tax evasion. The taxation of cryptocurrency in Australia has been an area of much debate despite recent attempts by the Australian Taxation Office ATO to clarify the operation of the tax law.

Source: koinly.io

Source: koinly.io

Australian Cryptocurrency Tax Guide 2021 Koinly Cryptocurrency generally operates independently of. While cryptocurrency can in some circumstances classify as like-kind property under American tax law its treated differently in Australia. While cryptocurrency is new ish in the grand scheme of money in exchange for goods and services the tax department is not. The taxation of cryptocurrency in Australia has been an area of much debate despite recent attempts by the Australian Taxation Office ATO to clarify the operation of the tax law.

Crypto Tax Australia Guide 2021 Cryptocurrency Tax Swyftx Personal Cryptocurrency Tax in Australia. Capital gains tax CGT - applies to a cryptocurrency at the time it is disposed of. Currently Bitcoin does not enjoy the status of legal tender in Australia. This includes trading buying selling staking cryptocurrency gifts mining and is applicable even if the transactions happened outside Australia.

Source: koinly.io

Source: koinly.io

Australian Cryptocurrency Tax Guide 2021 Koinly In short cryptocurrencies are subject to capital gains tax treatment as well as ordinary income depending on the circumstances of your crypto transactions. In Australia in 2017 cryptocurrencies were declared property by the Australian Tax Office ATO. Presently legal tender in Australia is defined in two acts of parliament Reserve Bank Act 1959 and the Currency Act 1965. Convert cryptocurrency to fiat currency a currency established by government regulation or law such as Australian dollars or use cryptocurrency to obtain goods or services.