Text for HR3708 - 115th Congress 2017-2018. Polis and Schweikert introduced The Cryptocurrency Tax Fairness Act of 2017 which by its very name and the fact that they belong to different parties suggests bipartisan understanding of the dozens of complaints generated by my last column that paying capital gains taxes on every single transaction is just not fair. Cryptocurrency tax fairness act 2018.

Cryptocurrency Tax Fairness Act 2018, House Ways and Means Committee on June 4 2019 US. This means bitcoin users would only have to calculate the tax implications of their bitcoin payments if theyre in amounts greater than 600. The CTFA called for transactions.

Eu Bureaucrats Seek To Diminish Your Cryptocurrency Privacy James Madison Institute From jamesmadison.org

Eu Bureaucrats Seek To Diminish Your Cryptocurrency Privacy James Madison Institute From jamesmadison.org

ICO has raised 73 billion in 2018 so far. Polis and Schweikert introduced The Cryptocurrency Tax Fairness Act of 2017 which by its very name and the fact that they belong to different parties suggests bipartisan understanding of the dozens of complaints generated by my last column that paying capital gains taxes on every single transaction is just not fair. We first reported on this possibility in late November in this update. House Ways and Means Committee on June 4 2019 US.

Representatives David Schweikert and Jared Polis are looking to alleviate some of these concerns with the Cryptocurrency Tax Fairness Act.

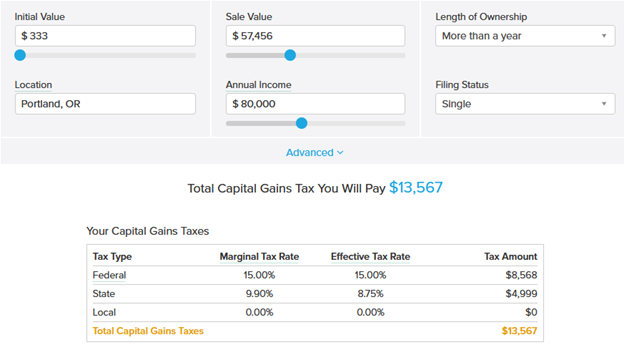

Khandelwal Rachana 2019 HR3708 115th Congress 2017-2018 The Cryptocurrency Tax Fairness Act The Contemporary Tax Journal. How will the newly crafted Cryptocurrency Tax Fairness Act of 2017 bill if passed change the situation. Cryptocurrency Tax Fairness Act left out of 2018 plan. Knowing your tax liabilities will help you. You can see other country-specific tax guides here. While the act is dubbed the tax fairness act only offering exemption to investors with under 200 in gains is really stretching the idea of fair.

Read another article:

Source: jamesmadison.org

Source: jamesmadison.org

Eu Bureaucrats Seek To Diminish Your Cryptocurrency Privacy James Madison Institute THE COLORADO CRYPTOCURRENCY TAX FAIRNESS ACT OF 2019. 1 Winter 2019 Article 12 2-25-2019 HR3708 115th Congress 2017-2018 The Cryptocurrency. To amend the Internal Revenue Code of 1986 to exclude from gross income de minimus gains from certain sales or exchanges of virtual currency and for. Cryptocurrency Tax Fairness Act H.

Source: greenbacktaxservices.com

Source: greenbacktaxservices.com

Cryptocurrency Made Less Cryptic For Us Expats Text for HR3708 - 115th Congress 2017-2018. 1 Winter 2019 Article 12 2-25-2019 HR3708 115th Congress 2017-2018 The Cryptocurrency. According to him the new bill will extend the minims exemption for personal transactions using foreign currencies to cover all kinds of digital assets based on the blockchain too. Republican Congressman Ted Budd mentioned two crypto specific bills he hopes would witness unanimous support from the Congress.

Source: gordonlawltd.com

Source: gordonlawltd.com

How To Respond To Irs Cp2501 Notice Gordon Law Group House Ways and Means Committee on June 4 2019 US. THE COLORADO CRYPTOCURRENCY TAX FAIRNESS ACT OF 2019. Polis and Schweikert introduced The Cryptocurrency Tax Fairness Act of 2017 which by its very name and the fact that they belong to different parties suggests bipartisan understanding of the dozens of complaints generated by my last column that paying capital gains taxes on every single transaction is just not fair. Knowing your tax liabilities will help you.

Source: natlawreview.com

Source: natlawreview.com

Cryptocurrency Overview Cftc Regulation Rules Representatives David Schweikert and Jared Polis are looking to alleviate some of these concerns with the Cryptocurrency Tax Fairness Act. Republican Congressman Ted Budd mentioned two crypto specific bills he hopes would witness unanimous support from the Congress. How will the newly crafted Cryptocurrency Tax Fairness Act of 2017 bill if passed change the situation. The Cryptocurrency Tax Fairness Act introduced last Congress by former representative and now governor of Colorado Jared Polis and this Committees own and my friend David Schweikert.

Source: garyduell.com

Source: garyduell.com

Here S A Cryptocurrency Tax Surprise Gary Duell Khandelwal Rachana 2019 HR3708 115th Congress 2017-2018 The Cryptocurrency Tax Fairness Act The Contemporary Tax Journal. The Cryptocurrency Tax Fairness Act introduced in Congress last year would exempt bitcoin transactions under 600 from capital gains taxation. According to him the new bill will extend the minims exemption for personal transactions using foreign currencies to cover all kinds of digital assets based on the blockchain too. Iss1 Article 12.

Source: gordonlawltd.com

Source: gordonlawltd.com

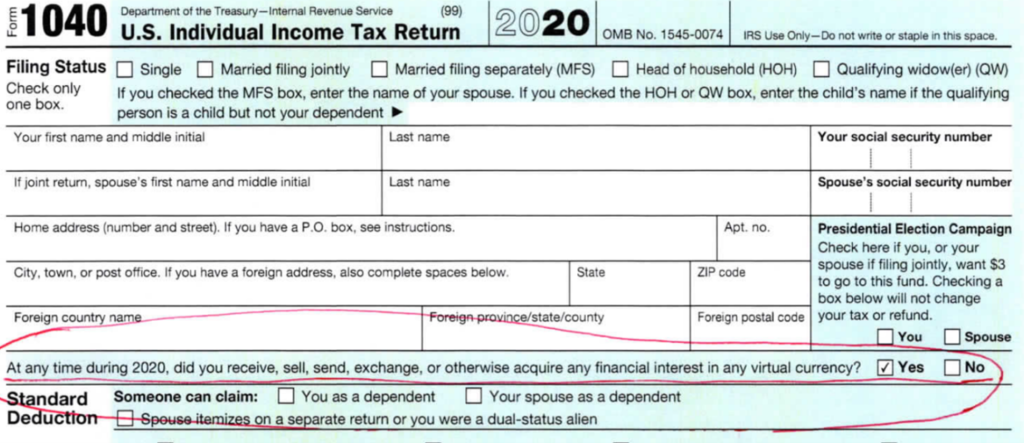

Coinbase 1099 Guide To Coinbase Tax Documents Gordon Law Group The Cryptocurrency Tax Fairness Act introduced in Congress last year would exempt bitcoin transactions under 600 from capital gains taxation. To amend the Internal Revenue Code of 1986 to exclude from gross income de minimis gains from certain sales or exchanges of virtual currency and for other purposes. Simply holding cryptocurrency whether it has gained value or lost value does not mean that you owe taxes. These bills are titled The Cryptocurrency Tax Fairness Act and the Virtual Value Tax Fix of 2018.

Source: greenbacktaxservices.com

Source: greenbacktaxservices.com

Understanding Expat Taxes On Cryptocurrency Republican Congressman Ted Budd mentioned two crypto specific bills he hopes would witness unanimous support from the Congress. Cryptocurrency Tax Fairness Act H. Collins Posted on February 4 2018 February 4 2018 Tags Bitcoin Bitcoin ira capital gains bitcoin capital gains crypto Crypto Crypto Mining cryptocurrency tax fairness act of 2017 IRA IRS Mining tax shelter Taxes taxes on bitcoin mining taxes on crypto Taxes on crypto mining 10 Comments on How to Calculate your. Knowing your tax liabilities will help you.

Source: nomadcapitalist.com

Source: nomadcapitalist.com

The Death Of The Tax Fairness For Americans Abroad Act Nomad Capitalist Knowing your tax liabilities will help you. Cryptocurrency Tax Fairness Act left out of 2018 plan. House Ways and Means Committee on June 4 2019 US. This guide breaks down the specific crypto tax implications within the US.

Source: nasdaq.com

Source: nasdaq.com

On Guard In Crypto Nasdaq Cryptocurrency Speaking at the US. We first reported on this possibility in late November in this update. Text for HR3708 - 115th Congress 2017-2018. 1 Winter 2019 Article 12 2-25-2019 HR3708 115th Congress 2017-2018 The Cryptocurrency.

Source: sec.gov

Source: sec.gov

424b4 1 Ea123412 424b4 Ebanginter Htm Prospectus Filed The Cryptocurrency Tax Fairness Act introduced last Congress by former representative and now governor of Colorado Jared Polis and this Committees own and my friend David Schweikert. We first reported on this possibility in late November in this update. Polis and Schweikert introduced The Cryptocurrency Tax Fairness Act of 2017 which by its very name and the fact that they belong to different parties suggests bipartisan understanding of the dozens of complaints generated by my last column that paying capital gains taxes on every single transaction is just not fair. This means bitcoin users would only have to calculate the tax implications of their bitcoin payments if theyre in amounts greater than 600.

Source: americanexpatfinance.com

Source: americanexpatfinance.com

Irs Cryptocurrency Accounts To Be Included In Fbar Reports According to him the new bill will extend the minims exemption for personal transactions using foreign currencies to cover all kinds of digital assets based on the blockchain too. In order to owe taxes you would have to sell cryptocurrency trade for another cryptocurrency or purchase something with it. Anyone with gains under 200 in a tax year wont have to report anything cryptocurrency related on their tax returns. The Cryptocurrency Tax Fairness Act introduced in Congress last year would exempt bitcoin transactions under 600 from capital gains taxation.

Source: natlawreview.com

Source: natlawreview.com

Crypto Currency Business Class Actions Stopped By Statute Of Limitations How will the newly crafted Cryptocurrency Tax Fairness Act of 2017 bill if passed change the situation. Cryptocurrency Speaking at the US. Cryptocurrency Tax Fairness Act H. You can create a free account here.

Source: garyduell.com

Source: garyduell.com

Here S A Cryptocurrency Tax Surprise Gary Duell House Ways and Means Committee on June 4 2019 US. Be it enacted by the General Assembly of the State of Colorado SECTION 1. Text for HR3708 - 115th Congress 2017-2018. Polis and Schweikert introduced The Cryptocurrency Tax Fairness Act of 2017 which by its very name and the fact that they belong to different parties suggests bipartisan understanding of the dozens of complaints generated by my last column that paying capital gains taxes on every single transaction is just not fair.

Source:

Source:

Fcgssg1qaxnpgm Be it enacted by the General Assembly of the State of Colorado SECTION 1. This means bitcoin users would only have to calculate the tax implications of their bitcoin payments if theyre in amounts greater than 600. A BILL To amend the Colorado Income Tax Act of 1987 to exclude from gross income de minimis gains from certain sales or exchanges of virtual currency and for other purposes. Cryptocurrency Tax Fairness Act left out of 2018 plan.

Source: garyduell.com

Source: garyduell.com

Here S A Cryptocurrency Tax Surprise Gary Duell Text for HR3708 - 115th Congress 2017-2018. HR3708 115th Congress 2017-2018 The Cryptocurrency. To amend the Internal Revenue Code of 1986 to exclude from gross income de minimis gains from certain sales or exchanges of virtual currency and for other purposes. According to him the new bill will extend the minims exemption for personal transactions using foreign currencies to cover all kinds of digital assets based on the blockchain too.