Australia has been open in accepting cryptocurrencies as legal and made some pragmatic implementations in their regulations. In 2017 Australias government declared that cryptocurrencies were legal and therefore subject to the Anti-Money Laundering and Counter-Terrorism Financing Act 2006 AMLCTF 2006 section 5 and associated. Cryptocurrency laws australia.

Cryptocurrency Laws Australia, Regulation of Digital Currencies. In 2017 Australias government declared that cryptocurrencies were legal and therefore subject to the Anti-Money Laundering and Counter-Terrorism Financing Act 2006 AMLCTF 2006 section 5 and associated. Provides that operation of a cryptocurrency mining center shall only be authorized following completion of a full generic environmental impact statement review and a finding that such center will not adversely affect the state greenhouse gas emission targets in the climate leadership and community protection act of 2019.

How To Sell Bitcoin In Australia 8 Easy Ways Hedgewithcrypto From hedgewithcrypto.com

How To Sell Bitcoin In Australia 8 Easy Ways Hedgewithcrypto From hedgewithcrypto.com

Since 2017 Australia has switched its restrictive double taxation policies on crypto to a more favorable capital gains tax law CGT treating Bitcoin BTC and similar assets eg. Another set of laws which also applies to cryptocurrency exchanges operating in Australia is that they are also required to hold an Australian Financial Services ASF license as the sale of crypto assets such as Bitcoin or other tokens are regarded as financial products. Cryptocurrency generally operates independently of. Provides that operation of a cryptocurrency mining center shall only be authorized following completion of a full generic environmental impact statement review and a finding that such center will not adversely affect the state greenhouse gas emission targets in the climate leadership and community protection act of 2019.

Generally if estate plans do not cater for the specific nature of cryptocurrency and steps are not taken to ensure executors can access a deceaseds cryptocurrency eg by accessing the private key it may not pass to the beneficiaries.

Personal Cryptocurrency Tax in Australia Personal use of Bitcoin and assumably other cryptocurrencies is not subject to GST or income tax. Cryptocurrency Bitcoins Blockchain Technology. Cryptocurrency exchanges operating in Australia must now register with AUSTRAC and. While cryptocurrency first entered circulation in 2009 it wasnt until December of 2014 that the ATO published guidance on how cryptocurrency fits into existing tax law. Tax treatment of cryptocurrencies. Since 2017 Australia has switched its restrictive double taxation policies on crypto to a more favorable capital gains tax law CGT treating Bitcoin BTC and similar assets eg.

Read another article:

Source: cryptonews.com.au

Source: cryptonews.com.au

Where To Buy Bitcoin In Australia Crypto News Au Cryptocurrency exchanges operating in Australia must now register with AUSTRAC and. Adopt and maintain a working AMLCTF program to identify and mitigate money laundering risks Identify and verify the activities of their customers Report suspicious activity to AUSTRAC as well as transactions involving physical currency of 10000 or more. Cryptocurrency in Australia The Australian Taxation Office estimates between 500000 and 1 million Australians own cryptocurrency. On May 30 2019 the Australian Securities and Investment Commission ASIC published updated guidance with respect to initial coin offerings ICOs and cryptocurrency trading.

Source: luno.com

Source: luno.com

Crypto Around The World Australia Luno Australia has been open in accepting cryptocurrencies as legal and made some pragmatic implementations in their regulations. Ethereum ETH Ripple XRP Bitcoin Cash BCH Litecoin LTC like property. In 2017 with the legalization of cryptocurrency it had recognized such items as property and is subject to their Capital Gains Tax CGT. To date there has been no explicit regulation or case law surrounding the treatment of cryptocurrency in Australian succession law.

Source: gocardless.com

Source: gocardless.com

Cryptocurrency Regulations In Australia Gocardless Since 2017 Australia has switched its restrictive double taxation policies on crypto to a more favorable capital gains tax law CGT treating Bitcoin BTC and similar assets eg. Another set of laws which also applies to cryptocurrency exchanges operating in Australia is that they are also required to hold an Australian Financial Services ASF license as the sale of crypto assets such as Bitcoin or other tokens are regarded as financial products. That guidance takes the position that ICOs by their nature seek to raise. Tax treatment of cryptocurrencies.

Source: complyadvantage.com

Source: complyadvantage.com

Cryptocurrency Regulations In Australia Complyadvantage In 2017 Australias government declared that cryptocurrencies were legal and therefore subject to the Anti-Money Laundering and Counter-Terrorism Financing Act 2006 AMLCTF 2006 section 5 and associated. Another set of laws which also applies to cryptocurrency exchanges operating in Australia is that they are also required to hold an Australian Financial Services ASF license as the sale of crypto assets such as Bitcoin or other tokens are regarded as financial products. New laws for digital currency exchange DCE providers operating in Australia have just been implemented by AUSTRAC Australias financial intelligence agency and anti-money laundering and counter-terrorism financing AMLCTF regulator. New Australian laws to regulate cryptocurrency providers.

Source: freemanlaw.com

Source: freemanlaw.com

Australia And Cryptocurrency Digital Blockchain Laws Freeman Law While cryptocurrency can in some circumstances classify as like-kind property under American tax law its treated differently in Australia. Australia has been open in accepting cryptocurrencies as legal and made some pragmatic implementations in their regulations. Adopt and maintain a working AMLCTF program to identify and mitigate money laundering risks Identify and verify the activities of their customers Report suspicious activity to AUSTRAC as well as transactions involving physical currency of 10000 or more. Since 2017 Australia has switched its restrictive double taxation policies on crypto to a more favorable capital gains tax law CGT treating Bitcoin BTC and similar assets eg.

Source: sklawyers.com.au

Source: sklawyers.com.au

Cryptocurrency Fraud Guide For Australian Investors Sewell Kettle While cryptocurrency first entered circulation in 2009 it wasnt until December of 2014 that the ATO published guidance on how cryptocurrency fits into existing tax law. Australia Cryptocurrency Laws. While cryptocurrency first entered circulation in 2009 it wasnt until December of 2014 that the ATO published guidance on how cryptocurrency fits into existing tax law. Since 2017 Australia has switched its restrictive double taxation policies on crypto to a more favorable capital gains tax law CGT treating Bitcoin BTC and similar assets eg.

Source: findbitcoinatm.com.au

Source: findbitcoinatm.com.au

How To Buy Bitcoin In Australia Don T Buy Any Until You Read This Cryptocurrencies digital currencies and cryptocurrency exchanges are legal in Australia and the country has been progressive in its implementation of cryptocurrency regulations. Not in Australia. In 2017 Australias government declared that cryptocurrencies were legal and therefore subject to the Anti-Money Laundering and Counter-Terrorism Financing Act 2006 AMLCTF 2006 section 5 and associated. In 2017 with the legalization of cryptocurrency it had recognized such items as property and is subject to their Capital Gains Tax CGT.

Source: cryptocurrencyblog.com.au

Source: cryptocurrencyblog.com.au

Is Bitcoin Legal In Australia Cryptocurrency Blog Australia These are legal but all cryptocurrency exchanges must register with the Australian Transaction Reports and Analysis Centre AUSTRAC in line with Part 6A of the AMLCTF 2006 rules. In 2017 with the legalization of cryptocurrency it had recognized such items as property and is subject to their Capital Gains Tax CGT. On May 30 2019 the Australian Securities and Investment Commission ASIC published updated guidance with respect to initial coin offerings ICOs and cryptocurrency trading. Generally if estate plans do not cater for the specific nature of cryptocurrency and steps are not taken to ensure executors can access a deceaseds cryptocurrency eg by accessing the private key it may not pass to the beneficiaries.

Cryptocurrency Taxes In Australia 2020 2021 Guide Cointracker The term cryptocurrency is generally used to describe a digital asset in which encryption techniques are used to regulate the generation of additional units and verify transactions on a blockchain. The first set of cryptocurrency laws in Australia relate to its exchanges. Cryptocurrency exchanges operating in Australia must now register with AUSTRAC and. Another set of laws which also applies to cryptocurrency exchanges operating in Australia is that they are also required to hold an Australian Financial Services ASF license as the sale of crypto assets such as Bitcoin or other tokens are regarded as financial products.

Source: medium.com

Source: medium.com

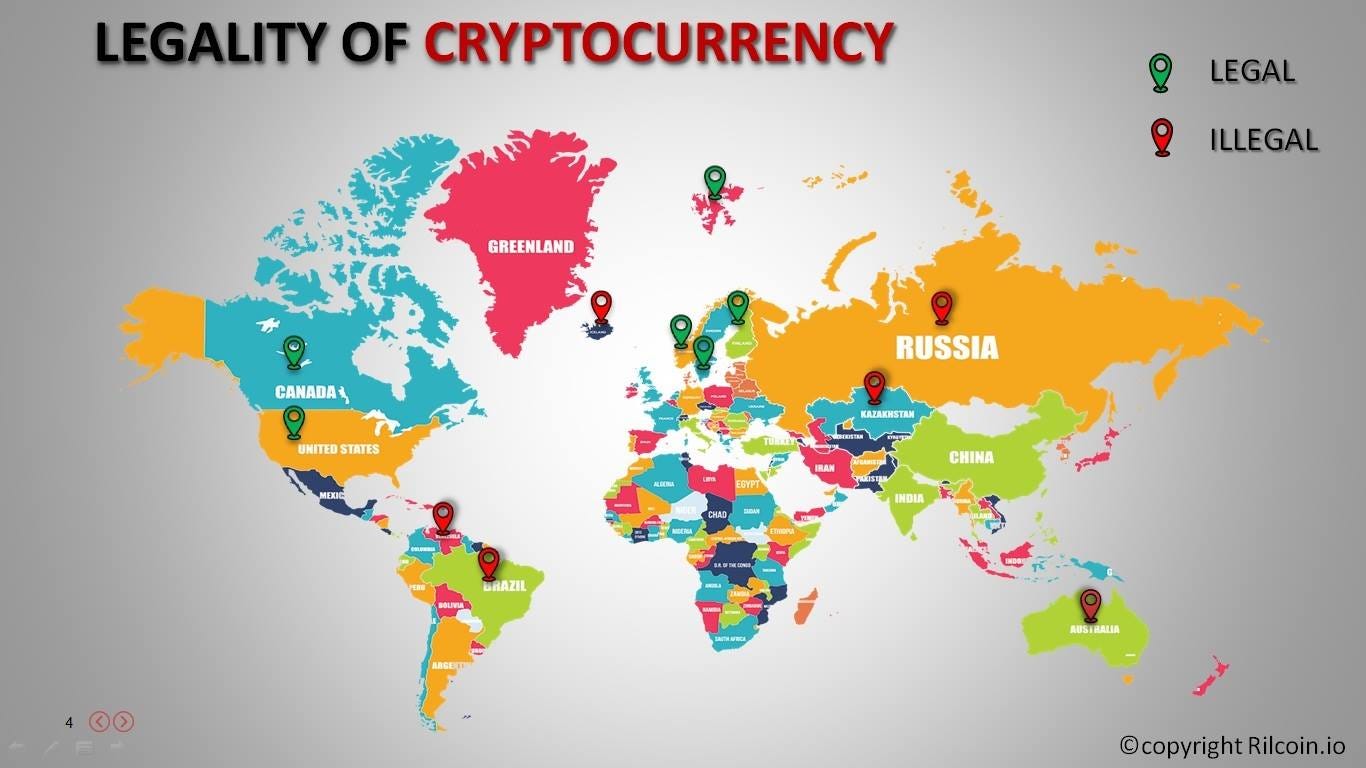

Legality Of Cryptocurrency By Country By Rilcoin Medium The new AMLCTF laws cover for the first time regulation of service providers of cryptocurrencies. Personal Cryptocurrency Tax in Australia Personal use of Bitcoin and assumably other cryptocurrencies is not subject to GST or income tax. New laws for digital currency exchange DCE providers operating in Australia have just been implemented by AUSTRAC Australias financial intelligence agency and anti-money laundering and counter-terrorism financing AMLCTF regulator. These are legal but all cryptocurrency exchanges must register with the Australian Transaction Reports and Analysis Centre AUSTRAC in line with Part 6A of the AMLCTF 2006 rules.

Source: hedgewithcrypto.com

Source: hedgewithcrypto.com

How To Sell Bitcoin In Australia 8 Easy Ways Hedgewithcrypto Another set of laws which also applies to cryptocurrency exchanges operating in Australia is that they are also required to hold an Australian Financial Services ASF license as the sale of crypto assets such as Bitcoin or other tokens are regarded as financial products. New Australian laws to regulate cryptocurrency providers. Establishes a moratorium on the operation of cryptocurrency mining centers. Cryptocurrencies digital currencies and cryptocurrency exchanges are legal in Australia and the country has been progressive in its implementation of cryptocurrency regulations.

Source: coinmama.com

Source: coinmama.com

How To Buy Bitcoin In Australia 2021 Coinmama Blog Australia Cryptocurrency Laws. Personal Cryptocurrency Tax in Australia Personal use of Bitcoin and assumably other cryptocurrencies is not subject to GST or income tax. Cryptocurrencies digital currencies and cryptocurrency exchanges are legal in Australia and the country has been progressive in its implementation of cryptocurrency regulations. The first set of cryptocurrency laws in Australia relate to its exchanges.

Source: coingape.com

Source: coingape.com

Best Crypto Exchanges In Australia 2019 Updated Cryptocurrency generally operates independently of. These are legal but all cryptocurrency exchanges must register with the Australian Transaction Reports and Analysis Centre AUSTRAC in line with Part 6A of the AMLCTF 2006 rules. To date there has been no explicit regulation or case law surrounding the treatment of cryptocurrency in Australian succession law. Australia Cryptocurrency Laws.

Cryptocurrency Taxes In Australia 2020 2021 Guide Cointracker Cryptocurrencies digital currencies and cryptocurrency exchanges are legal in Australia and the country has been progressive in its implementation of cryptocurrency regulations. Regulation of Digital Currencies. The definition of personal use is limited to paying for goods or services in Bitcoin such as online shopping. On May 30 2019 the Australian Securities and Investment Commission ASIC published updated guidance with respect to initial coin offerings ICOs and cryptocurrency trading.

Cryptocurrency Taxes In Australia 2020 2021 Guide Cointracker Australia has been open in accepting cryptocurrencies as legal and made some pragmatic implementations in their regulations. The term cryptocurrency is generally used to describe a digital asset in which encryption techniques are used to regulate the generation of additional units and verify transactions on a blockchain. In 2017 with the legalization of cryptocurrency it had recognized such items as property and is subject to their Capital Gains Tax CGT. Ethereum ETH Ripple XRP Bitcoin Cash BCH Litecoin LTC like property.