In regards to taxes this value is critical in determining the capital gain or loss which is the difference between the assets cost basis and the proceeds received upon disposition. In most cases the cost basis of an investment is the original price upon acquisition. Cryptocurrency cost basis calculator.

Cryptocurrency Cost Basis Calculator, Is cryptocurrency mining profitable. The earnings also depend on the cryptocurrency being mined. If an individual sells cryptocurrency for less than the cost basis then they will have a capital loss.

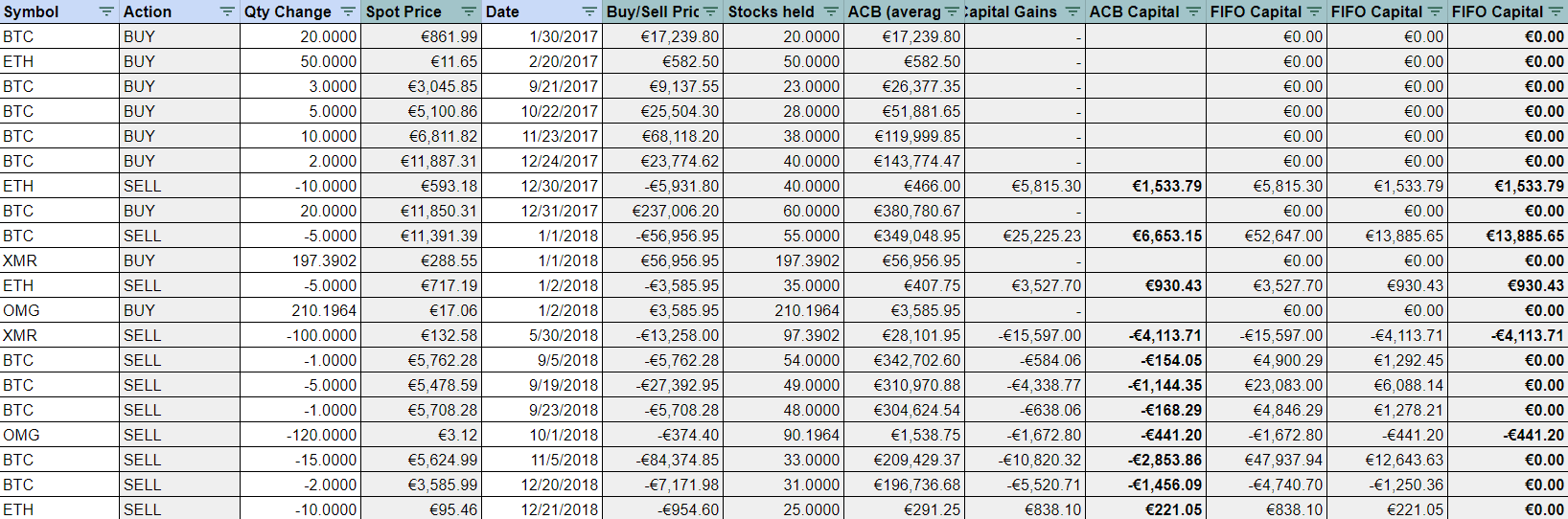

Crypto Taxes In Canada Adjusted Cost Base Explained From coinpanda.io

Crypto Taxes In Canada Adjusted Cost Base Explained From coinpanda.io

To use the same you will need the configuration of your mining hardware and the electricity price in the area you are going to setup the bitcoin mining rig. However the loss needs to be reported to the HMRC first. The value of Bitcoin since then has soared and continues to grow with the current estimations suggesting that 1 Bitcoin holds the equivalent value of over 8000 US Dollars. Thats why TD Ameritrade Holding Corporation has invested in ErisXan innovative company that offers traders access to cryptocurrency spot contracts as well as futures contracts on a single exchange.

However the loss needs to be reported to the HMRC first.

Our Ethereum mining calculator is the perfect tool for all cryptocurrency miners looking forward to mine for Ether ETH. In most cases the cost basis of an investment is the original price upon acquisition. As long as the calculator finds the profit it is also apt of working out mark up percentage and discounted selling prices. We publish latest crypto news coin mining guides wallet setups reviews token guides trading tips online. The hash rate calculator will then show your estimated expected crypto earnings. The value of Bitcoin since then has soared and continues to grow with the current estimations suggesting that 1 Bitcoin holds the equivalent value of over 8000 US Dollars.

Read another article:

Source: coinpanda.io

Source: coinpanda.io

Crypto Taxes In Canada Adjusted Cost Base Explained Is cryptocurrency mining profitable. This report shows your largest loss harvesting opportunities in descending order. ZenLedger is the best crypto tax software. Thats why TD Ameritrade Holding Corporation has invested in ErisXan innovative company that offers traders access to cryptocurrency spot contracts as well as futures contracts on a single exchange.

![]() Source: cointracking.info

Source: cointracking.info

Cointracking Crypto Tax Calculator Best Cryptocurrency Tax Calculator Lets have a look into some of the best cryptocurrency tax calculator apps and software available in the market. The hash rate calculator will then show your estimated expected crypto earnings. The underlying cost of mining is the energy consumed. Losses can be reported either by letter or on the Tax Return itself.

Source: koinly.io

Source: koinly.io

Koinly Bitcoin Tax Calculator For Canada This report shows your largest loss harvesting opportunities in descending order. So generally cryptocurrency is treated for most people like a typical capital asset says Harris. The Profit Calculator works out the profit that is earned from selling a particular item. Like stock cryptocurrency enjoys a stepped-up cost basis to the fair value on the day of death.

Source: cryptotaxcalculator.io

Source: cryptotaxcalculator.io

Crypto Tax Calculator Selling using or mining bitcoin or other cryptos can trigger bitcoin taxes. Selling using or mining bitcoin or other cryptos can trigger bitcoin taxes. The Profit Calculator works out the profit that is earned from selling a particular item. This report shows your largest loss harvesting opportunities in descending order.

How To Lower Your Crypto Tax Bill Which Cost Basis Method Is Best Cointracker There is currently about 74 billion worth of Ethereum circulating individual coins are known as Ether. More than a year later you sold the 10000 LTC for 11000 including fees in dollars thus the proceeds are 11000. While Ether is much cheaper on a per coin basis they tend to broadly move together. Currenctly it supports over 2500 cryptocurrencies and auto syncs your transaction details to manage your tax information.

How To Lower Your Crypto Tax Bill Which Cost Basis Method Is Best Cointracker The earnings also depend on the cryptocurrency being mined. Like stock cryptocurrency enjoys a stepped-up cost basis to the fair value on the day of death. Is cryptocurrency mining profitable. While Bitcoin is the oldest and largest cryptocurrency market Ethereum started in 2015 but quickly established itself.

Source: zenledger.io

Source: zenledger.io

Free Bitcoin Tax Calculator How To Calculate Bitcoin Taxes Zenledger And as a firm we are too. Bitcoin BTC Mining Calculator is a simple calculator which can be used to calculate profitability or number of bitcoins can be generated using specific bitcoin mining hardware. There is currently about 74 billion worth of Ethereum circulating individual coins are known as Ether. However the loss needs to be reported to the HMRC first.

Source: medium.com

Source: medium.com

Best Crypto Tax Software In 2021 Coinmonks Currenctly it supports over 2500 cryptocurrencies and auto syncs your transaction details to manage your tax information. The underlying cost of mining is the energy consumed. More than a year later you sold the 10000 LTC for 11000 including fees in dollars thus the proceeds are 11000. In most cases the cost basis of an investment is the original price upon acquisition.

Cryptocurrency Bitcoin Tax Guide 2021 Edition Cointracker The Swyftx cryptocurrency tax calculator will ask you if youve held your crypto asset for 12 months. The hash rate calculator will then show your estimated expected crypto earnings. What if the cryptocurrency tax calculator shows a loss. Best Cryptocurrency Tax Calculator Lets have a look into some of the best cryptocurrency tax calculator apps and software available in the market.

Source: bitcourier.co.uk

Source: bitcourier.co.uk

Best Bitcoin Tax Calculator In The Uk 2021 The report is comparing your cost basis in a specific cryptocurrency how much you paid for it to the current market price. The earnings also depend on the cryptocurrency being mined. Heres a guide to reporting income or capital gains tax on your cryptocurrency. If an individual sells cryptocurrency for less than the cost basis then they will have a capital loss.

Source: finder.com

Source: finder.com

How To Estimate Cryptocurrency Taxes In 2021 Finder Com Coin Guides is a fast-growing cryptocurrency publication that helps users to understand the Blockchain Technology and Crypto Currency. Directorate of Enforcement ED has issued a show-cause notice to cryptocurrency exchange Zanmai Labs Pvt Ltd WazirX and its directors Nischal Shetty and Sameer Hanuman Mhatre under Foreign Exchange Management Act 1999 FEMA for transactions involving cryptocurrencies worth Rs 279074 crore Get more Currency News and Business News on Zee Business. Is cryptocurrency mining profitable. If you have the calculator will automatically apply a 50 discount to your capital gain.

Source: tokeneconomy.co

Source: tokeneconomy.co

Crypto Tax Calculation Via Google Sheets Fifo Abc By Ha Duong Token Economy The Swyftx cryptocurrency tax calculator will ask you if youve held your crypto asset for 12 months. If you have the calculator will automatically apply a 50 discount to your capital gain. It supports 400 exchanges ᐉ Coinbase Binance tracks your gains and automatically creates your tax forms for free. Currenctly it supports over 2500 cryptocurrencies and auto syncs your transaction details to manage your tax information.

![]() Source: cointracking.info

Source: cointracking.info

Cointracking Crypto Tax Calculator To use the same you will need the configuration of your mining hardware and the electricity price in the area you are going to setup the bitcoin mining rig. However the loss needs to be reported to the HMRC first. As long as the calculator finds the profit it is also apt of working out mark up percentage and discounted selling prices. Initially released in January 2009 Bitcoin prompted the boom of cryptocurrencies as we know them today.

![]() Source: cointracking.info

Source: cointracking.info

Cointracking Crypto Tax Calculator Is cryptocurrency mining profitable. The underlying cost of mining is the energy consumed. The total cost is 4100 and the tax basis of each of your shares is 41. Currenctly it supports over 2500 cryptocurrencies and auto syncs your transaction details to manage your tax information.

Source: zenledger.io

Source: zenledger.io

Free Crypto Tax Calculator How To Calculate Cryptocurrency Taxes Zenledger Thats why TD Ameritrade Holding Corporation has invested in ErisXan innovative company that offers traders access to cryptocurrency spot contracts as well as futures contracts on a single exchange. Subtract the cost basis of 8000 from the proceeds of 10000 and your gain is 2000 that amount of which you are liable for short term capital gains tax on. The calculator considers various factors to derive these figures. Directorate of Enforcement ED has issued a show-cause notice to cryptocurrency exchange Zanmai Labs Pvt Ltd WazirX and its directors Nischal Shetty and Sameer Hanuman Mhatre under Foreign Exchange Management Act 1999 FEMA for transactions involving cryptocurrencies worth Rs 279074 crore Get more Currency News and Business News on Zee Business.