Kryptowährung steuer tipps doch wie funktioniert die Technologie dahinter und welche Arten von Wallets gibt es die Renditen sind jedoch längst nicht mehr wir am Anfang und leider sind einige Mitglieder mit dem. You pay Capital Gains Tax when your gains from selling certain assets go over the. Cryptocurrency capital gains uk.

Cryptocurrency Capital Gains Uk, However if household income exceeds 479000 for married couples or 425800 for individuals then the rate of capital gains tax is 20. Do I have to be a crypto trader to be taxed. You will calculate your gain or loss when disposing of your cryptocurrency.

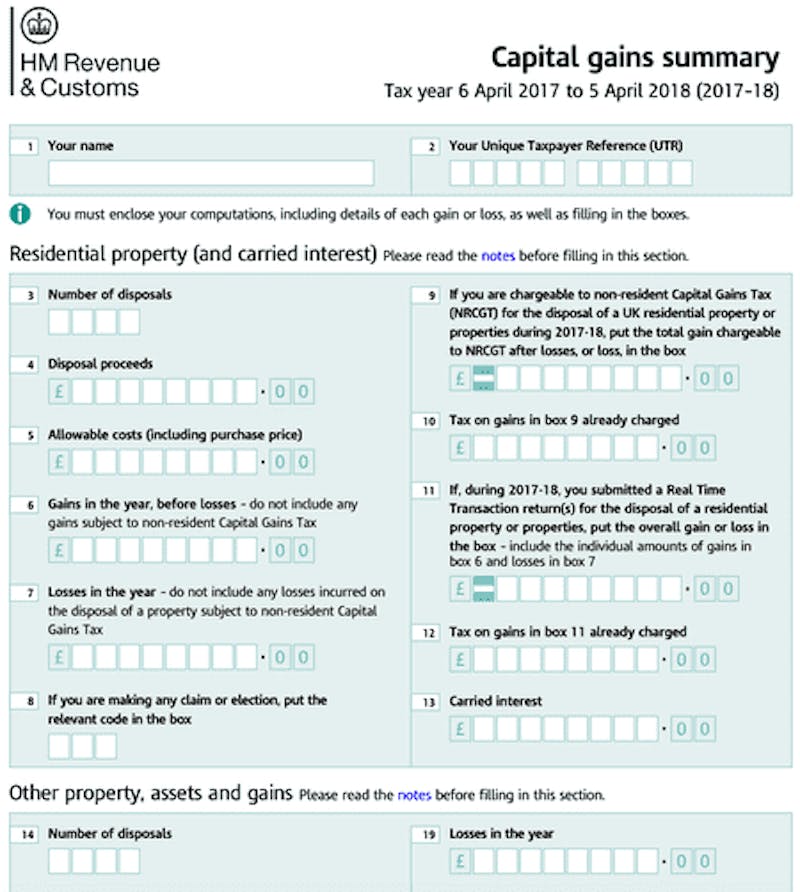

When you dispose of cryptoasset exchange tokens known as cryptocurrency you may need to pay Capital Gains Tax. This is also referred to as the disposal of a crypto asset. Taxes can be a complicated subject. HMRC has published guidance for.

You will calculate your gain or loss when disposing of your cryptocurrency.

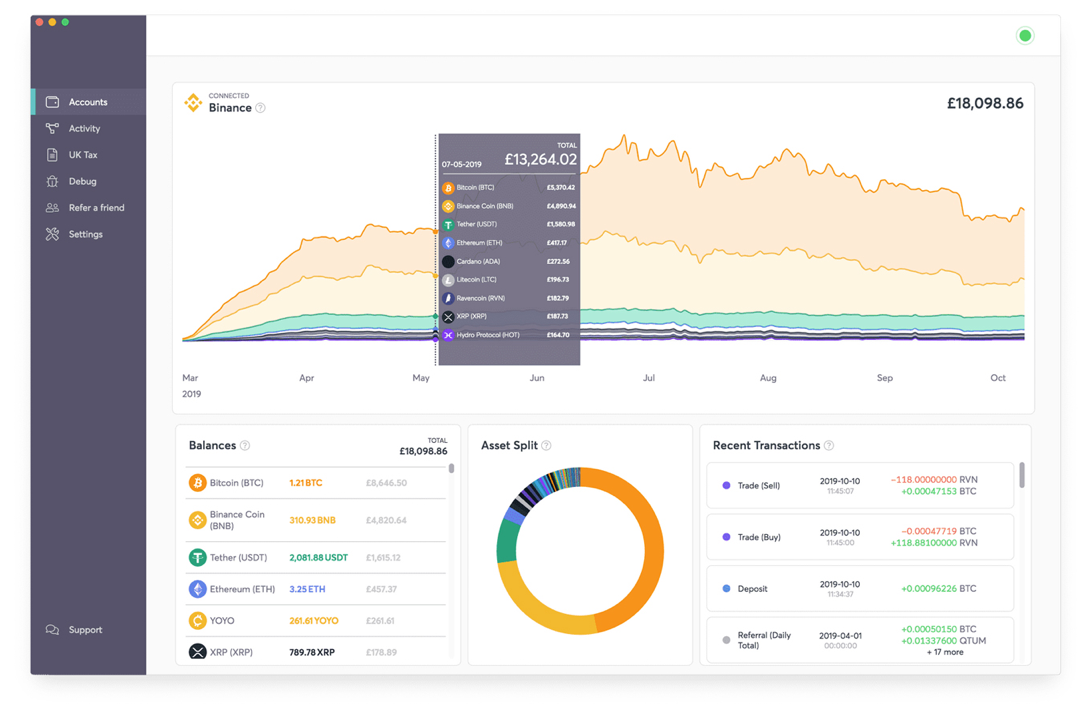

There are various methods of acquiring cryptocurrency that might make you liable to be taxed. Capital gains tax rate uk cryptocurrency. The UK is not alone in this stance. The pooled value of her crypto was 500 and her capital gain was 200. UK residents are allowed an allowance of capital gains that are non-taxed for individuals up to 12000 in capital gains across all capital assets for the April 6 2019April 5 2020 tax year different exemptions apply if you live in Scotland or are domiciled outside the UK. As cryptocurrencies like bitcoin have grown in popularity over the years so has the amount of people who are making money by investing or trading them.

Read another article:

Source: cryptotrader.tax

Source: cryptotrader.tax

Uk Crypto Tax Guide 2021 Cryptotrader Tax In the UK you have to pay tax on profits over 12300. Most governments around the world have taken a similar position with the tax treatment of cryptocurrencies like bitcoin as a capital asset. She sold it in May 2018 for 700. Janie is a UK resident who received crypto worth 500 as a gift from her mother.

Source: koinly.io

Source: koinly.io

Cryptocurrency Taxes In The Uk The 2021 Guide Koinly Taxes can be a complicated subject. The rate of capital gains tax is typically 15 on profits. Do I have to be a crypto trader to be taxed. HMRC has published guidance for.

Uk Cryptocurrency Tax Guide Cointracker To calculate your capital gains as an individual the HMRC requires you to keep track of your average cost basis for the token on hand aggregate your same-day transactions and ignore any wash sales. The pooled value of her crypto was 500 and her capital gain was 200. Typically if you held cryptocurrencies for less than a year gains are taxed at your normal income rate. Taxes can be a complicated subject.

Source: medium.com

Source: medium.com

Cryptocurrency Taxation In The United Kingdom By Chandan Lodha Cointracker Medium This is true for both individuals and businesses. There are various methods of acquiring cryptocurrency that might make you liable to be taxed. The rate of capital gains tax is typically 15 on profits. The general formula for calculating capital gains is.

2021 Capital Gains Tax Rates How They Apply Tips To Minimize What You Owe The pooled value of her crypto was 500 and her capital gain was 200. Despite being an intangible asset cryptocurrencies are still classified as chargeable assets. There are various methods of acquiring cryptocurrency that might make you liable to be taxed. For example you might need to pay capital gains on profits from buying and selling cryptocurrency or pay income tax on interest earned when holding crypto.

Source: koinly.io

Source: koinly.io

Declare Your Bitcoin Cryptocurrency Taxes In Uk Hmrs Koinly You pay Capital Gains Tax when your gains from selling certain assets go over the. She sold it in May 2018 for 700. You can be liable for both capital gains and income tax depending on the type of cryptocurrency transaction and your invididual circumstances. And so irrespective of your view on the validity of cryptocurrency you will always be liable to pay tax on your investment profits from them.

Source: koinly.io

Source: koinly.io

Declare Your Bitcoin Cryptocurrency Taxes In Uk Hmrs Koinly Janies taxable income is 160000 and she falls in the category of additional rate tax payer. Under the UK crypto tax rules this income is considered capital gains and is accordingly subject to capital gains taxes. For individuals this will also need to be reported in their self-assessment tax return. In the UK HMRC treats tax on cryptocurrency like stocks and so any realised gains are subject to Capital Gains Tax.

Source: bitcourier.co.uk

Source: bitcourier.co.uk

Best Bitcoin Tax Calculator In The Uk 2021 This is true for both individuals and businesses. Janie is a UK resident who received crypto worth 500 as a gift from her mother. HMRC has published guidance for. In almost all cases gains realised when disposing cryptocurrencies are taxable under Capital Gains Tax.

2021 Capital Gains Tax Rates How They Apply Tips To Minimize What You Owe The rate of capital gains tax is typically 15 on profits. This is true for both individuals and businesses. As cryptocurrencies like bitcoin have grown in popularity over the years so has the amount of people who are making money by investing or trading them. Typically if you held cryptocurrencies for less than a year gains are taxed at your normal income rate.

Source: tokentax.co

Source: tokentax.co

How Cryptocurrency Is Taxed In The United Kingdom Tokentax This is true for both individuals and businesses. You will calculate your gain or loss when disposing of your cryptocurrency. If transactions in cryptocurrencies are non-trading they are subject to capital gains tax at disposal. For example you might need to pay capital gains on profits from buying and selling cryptocurrency or pay income tax on interest earned when holding crypto.

Source: cryptotrader.tax

Source: cryptotrader.tax

Uk Crypto Tax Guide 2021 Cryptotrader Tax However if household income exceeds 479000 for married couples or 425800 for individuals then the rate of capital gains tax is 20. Taxes can be a complicated subject. The general rule is that every time you sell trade or purchase any goods or services and pay with a cryptocurrency you need to calculate the capital gains for that transaction. In almost all cases gains realised when disposing cryptocurrencies are taxable under Capital Gains Tax.

Uk Cryptocurrency Tax Guide Cointracker However if household income exceeds 479000 for married couples or 425800 for individuals then the rate of capital gains tax is 20. Under the UK crypto tax rules this income is considered capital gains and is accordingly subject to capital gains taxes. The general formula for calculating capital gains is. This is also referred to as the disposal of a crypto asset.

Source: recap.io

Source: recap.io

How To Calculate Your Crypto Taxes For Your Self Assessement Tax Return Recap Blog As cryptocurrencies like bitcoin have grown in popularity over the years so has the amount of people who are making money by investing or trading them. For individuals this will also need to be reported in their self-assessment tax return. I lost money trading cryptocurrency. This is true for both individuals and businesses.

Uk Cryptocurrency Tax Guide Cointracker Under the UK crypto tax rules this income is considered capital gains and is accordingly subject to capital gains taxes. The UK is not alone in this stance. In almost all cases gains realised when disposing cryptocurrencies are taxable under Capital Gains Tax. Typically if you held cryptocurrencies for less than a year gains are taxed at your normal income rate.

Source: recap.io

Source: recap.io

How To Calculate Your Crypto Taxes For Your Self Assessement Tax Return Recap Blog Capital gains tax on cryptocurrency in the UK. Capital gains selling price purchase price. The general formula for calculating capital gains is. In the UK HMRC treats tax on cryptocurrency like stocks and so any realised gains are subject to Capital Gains Tax.