Cryptocurrency and the fbar trusts estates.

Cryptocurrency And The Fbar Trusts Estates,

Rules And Requirements For Reporting Foreign Trusts To The Irs From klasing-associates.com

Rules And Requirements For Reporting Foreign Trusts To The Irs From klasing-associates.com

Read another article:

Source: blog.scorechain.com

Source: blog.scorechain.com

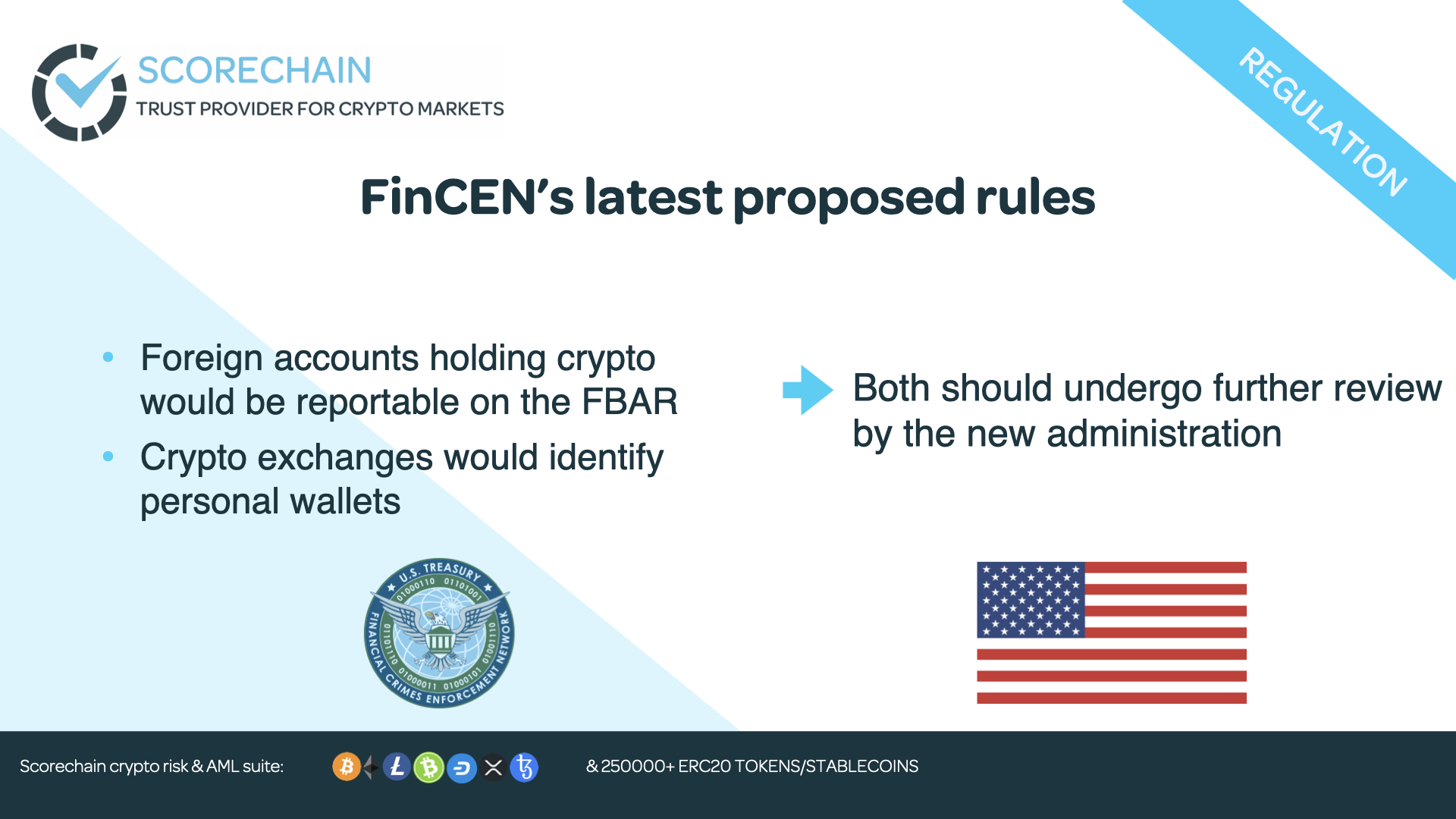

Fincen Proposed Crypto Rules Foreign Accounts Holding Crypto Would Be Reportable On The Fbar Crypto Exchanges Would Identify Personal Wallets Both Should Undergo Further Review By The New Administration Though

Source: goldinglawyers.com

Source: goldinglawyers.com

How Does Irs Investigate Foreign Bank Accounts 5 Examples

Byword Obligatory Foreign Trusts Have To Be Reported

Source: klasing-associates.com

Source: klasing-associates.com

Tax Law Offices Of David W Klasing Wills And Trusts

Source: klasing-associates.com

Source: klasing-associates.com

Is It Possible For A Domestic Trust To Become A Foreign Trust

Source: freemanlaw.com

Source: freemanlaw.com

Austria And Cryptocurrency Vitural Currecy Laws Freeman Law

Source: cpapracticeadvisor.com

Source: cpapracticeadvisor.com

The Classification Of Bitcoin And Cryptocurrency By The Irs Cpa Practice Advisor

Source: thorntaxlaw.com

Source: thorntaxlaw.com

Cryptocurrency Taxes The Ultimate Guide To Tax Consequences

Source: katzchwat.com

Source: katzchwat.com

Cryptocurrency Decoding The Taxation Policies Katz Chwat Pc Long Island

Source: thewolfgroup.com

Source: thewolfgroup.com

New Irs Guidance Allows Owners Of Foreign Trusts And Retirement Accounts To Get Past Penalties Refunded The Wolf Group

Source: id.pinterest.com

Source: id.pinterest.com

Epic Tenant Screening Services Comparison Guide Accidental Rental Financial Advisors Investment Advisor Debt Relief Programs

Source: sftaxcounsel.com

Source: sftaxcounsel.com

Does Section 4975 Permit An Ira Account Holder To Establish An Ira Grantor Trust Investment Vehicle And Act As The Trustee Of The Ira Grantor Trust Sf Tax Counsel

Source: klasing-associates.com

Source: klasing-associates.com

Rules And Requirements For Reporting Foreign Trusts To The Irs

Source: klasing-associates.com

Source: klasing-associates.com

What Is The Difference Between A Foreign And Domestic Trust

Source: cpajournal.com

Source: cpajournal.com

The New Exemption From Required Information Reporting The Cpa Journal