We do so in full. If you acquired cryptocurrency units in order to hold them and store value over extended period of time or for other purposes then you need to apply the standard IAS 38 Intangible Assets. Cryptocurrency accounting treatment.

Cryptocurrency Accounting Treatment, It is important to note that the accounting treatment for a digital asset will ultimately be driven by the specific terms form underlying rights and obligations of the digital asset. Short-Term vs Long-Term. Cryptocurrency Accounting for a Financial Firm Galaxy Digital Galaxy Digital is a financial services firm that offers asset management for digital assets It trades invests and mines for cryptocurrencies and it offers traditional asset management and investment banking services as well.

Cryptocurrency Accounting On The Financial Statements M I From mergersandinquisitions.com

Cryptocurrency Accounting On The Financial Statements M I From mergersandinquisitions.com

The purpose can differ for different parties. Where the party obtains the crypto asset as part of cryptocurrency mining activity it would be treated as a finished good ie inventory with the actual cost of its production such as IT and electricity resources serving as the measurement criteria. Beyond the blockchain the accounting bookkeeping and tax side of. Selected activities of standard setters 10 32.

The accounting for digital assets is an emerging area and so far neither the FASB nor the IASB have provided specific accounting guidance.

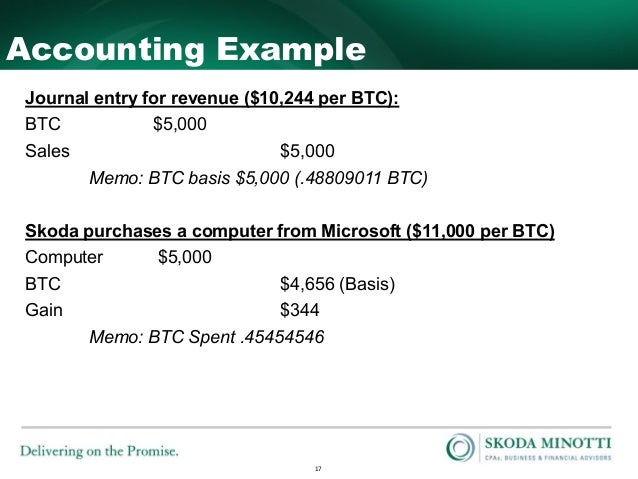

Accounting for crypto-assets 10 31. Reuters reports that companies record the value of virtual currency at the time of purchase. You calculate the cost basis using the fair market value on the date you received the BTC. More like CRYPTIC-currency Dad jokes aside theres a lot to wrap your head around with cryptocurrency if youre a small business owner. Despite the markets increasingly urgent need for accounting guidance. Cryptocurrencies and digital tokens challenge traditional financial reporting boundaries.

Read another article:

Source: mergersandinquisitions.com

Source: mergersandinquisitions.com

Cryptocurrency Accounting On The Financial Statements M I Reuters reports that companies record the value of virtual currency at the time of purchase. There is diversity of rights and obligations associated with cryptographic assets. The purpose can differ for different parties. If the value of that currency rises gains are not logged until time of sale.

Source: crowe.com

Source: crowe.com

Accounting For Cryptocurrencies In The Financial Statements Crowe Malaysia Plt Cryptocurrency Accounting for a Financial Firm Galaxy Digital Galaxy Digital is a financial services firm that offers asset management for digital assets It trades invests and mines for cryptocurrencies and it offers traditional asset management and investment banking services as well. Reuters reports that companies record the value of virtual currency at the time of purchase. Cryptocurrencies may meet the definition of an intangible asset with potential circumstances for inventory or investment accounting by an investment company. Unfortunately IFRIC did not state any recommendations or decisions on how to apply IAS 38 for cryptocurrencies.

Source: arbittmax.blogspot.com

Source: arbittmax.blogspot.com

Arbittmax Cryptocurrency Accounting Cryptocurrency is NOT treated as currency to determine losses or gains under tax laws. Reuters reports that companies record the value of virtual currency at the time of purchase. In the event that value is lost however that loss is recorded as an impairment charge. We do so in full.

Source: medium.com

Source: medium.com

Crypto Accounting With Bitmain S Filing By Greg Cipolaro Digital Asset Research Medium For example the issuer of the crypto-currency who has created the crypto-currency through its efforts may view their crypto-currency created as inventory. The accounting treatment of the crypto-assets depends greatly on the purpose for holding the crypto-assets. In the event that value is lost however that loss is recorded as an impairment charge. Selected activities of standard setters 10 32.

Source: medium.com

Source: medium.com

Crypto Accounting With Bitmain S Filing By Greg Cipolaro Digital Asset Research Medium It is important to note that the accounting treatment for a digital asset will ultimately be driven by the specific terms form underlying rights and obligations of the digital asset. Beyond the blockchain the accounting bookkeeping and tax side of. In March of 2014 the IRS released Notice 2014-21 that addressed some not all of the. The accounting treatment of the crypto-assets depends greatly on the purpose for holding the crypto-assets.

Source: crowe.com

Source: crowe.com

Accounting For Cryptocurrencies In The Financial Statements Crowe Malaysia Plt For broker-traders of digital assets that might be exposed to volatilit y in their profit or loss from fair value movements tax volatility may also occur. Unfortunately IFRIC did not state any recommendations or decisions on how to apply IAS 38 for cryptocurrencies. Reuters reports that companies record the value of virtual currency at the time of purchase. The accounting for digital assets is an emerging area and so far neither the FASB nor the IASB have provided specific accounting guidance.

Source: mergersandinquisitions.com

Source: mergersandinquisitions.com

Cryptocurrency Accounting On The Financial Statements M I Unfortunately IFRIC did not state any recommendations or decisions on how to apply IAS 38 for cryptocurrencies. Where the party obtains the crypto asset as part of cryptocurrency mining activity it would be treated as a finished good ie inventory with the actual cost of its production such as IT and electricity resources serving as the measurement criteria. Short-Term vs Long-Term. For implementing token rights.

Source: medium.com

Source: medium.com

Crypto Accounting With Bitmain S Filing By Greg Cipolaro Digital Asset Research Medium For example the issuer of the crypto-currency who has created the crypto-currency through its efforts may view their crypto-currency created as inventory. Cryptocurrency is NOT treated as currency to determine losses or gains under tax laws. If the value of that currency rises gains are not logged until time of sale. In the event that value is lost however that loss is recorded as an impairment charge.

Source: forbes.com

Source: forbes.com

It S Time To Rethink Accounting For Cryptocurrency However cryptocurrencies cannot be considered equivalent to cash currency as defined in IAS 7 and IAS 32 because they cannot readily be exchanged for any good or service. For implementing token rights. The accounting treatment of the crypto-assets depends greatly on the purpose for holding the crypto-assets. Accounting for crypto-assets 10 31.

Source: mergersandinquisitions.com

Source: mergersandinquisitions.com

Cryptocurrency Accounting On The Financial Statements M I The accounting for digital assets is an emerging area and so far neither the FASB nor the IASB have provided specific accounting guidance. You calculate the cost basis using the fair market value on the date you received the BTC. Cryptocurrency is accounted for as an intangible asset. Before determining the accounting treatment of a transaction from the issuers or owners perspective it is important to understand the purpose and utility of the cryptographic asset.

Source: mergersandinquisitions.com

Source: mergersandinquisitions.com

Cryptocurrency Accounting On The Financial Statements M I Conclusions on the accounting treatment. Before determining the accounting treatment of a transaction from the issuers or owners perspective it is important to understand the purpose and utility of the cryptographic asset. We do so in full. Cryptocurrency is confusing enough.

2 Furthermore the paper identifies scenarios under which cryptocurrencies shall be treated as foreign currencies even though financial system regulators do not consider cryptocurrencies as being. The accounting for digital assets is an emerging area and so far neither the FASB nor the IASB have provided specific accounting guidance. Cryptocurrencies and digital tokens challenge traditional financial reporting boundaries. Unfortunately IFRIC did not state any recommendations or decisions on how to apply IAS 38 for cryptocurrencies.

Source: pherrus.com.au

Source: pherrus.com.au

Cryptocurrency Accounting Bookkeeping Guide On Crypto Tax More Cryptocurrency Accounting IRS Treatment of Cryptocurrencies. Cryptocurrencies like bitcoin are liquid and work extremely similar to. The relevant accounting standards however were written before the birth of blockchain and cryptoassets and thus do not provide for their unique economic makeup. Selected activities of standard setters 10 32.

Source: gaapdynamics.com

Source: gaapdynamics.com

Cryptocurrency Accounting For Investment Funds U S Gaap Vs Ifrs Gaap Dynamics Practically speaking this accounting treatment does not align with the reality. Practically speaking this accounting treatment does not align with the reality. You calculate the cost basis using the fair market value on the date you received the BTC. Furthermore the paper identifies scenarios under which cryptocurrencies shall be treated as foreign currencies even though financial system regulators do not consider cryptocurrencies as being.

Source: accountingdepartment.com

Source: accountingdepartment.com

Accounting In The World Of Cryptocurrency Cryptocurrency is NOT treated as currency to determine losses or gains under tax laws. For example the issuer of the crypto-currency who has created the crypto-currency through its efforts may view their crypto-currency created as inventory. It is important to note that the accounting treatment for a digital asset will ultimately be driven by the specific terms form underlying rights and obligations of the digital asset. Beyond the blockchain the accounting bookkeeping and tax side of.