You can crystallise capital losses for cryptocurrency you still own if it became worthless or of negligible value. Cryptocurrency is considered property for federal income tax purposes meaning the IRS treats it as a capital asset. Capital loss cryptocurrency.

Capital Loss Cryptocurrency, Cryptocurrency losses must be reported on your IRS 8949 just like cryptocurrency gains. In this example above can i claim for capital loss. This volatility means that.

Crypto Tax Forms Form 8949 Cryptocurrency Download Tokentax From tokentax.co

Crypto Tax Forms Form 8949 Cryptocurrency Download Tokentax From tokentax.co

You will need to fill out Form 8949 and Form 1040 Schedule D to note your capital gains from cryptocurrency transactions. The Schedule D form is the main tax form for reporting overall capital gains and losses. You may be able to claim a capital loss if you lose your cryptocurrency private key or your cryptocurrency is stolen. Thus the sale of cryptocurrency results in capital gains and losses rather than ordinary income.

Thus the sale of cryptocurrency results in capital gains and losses rather than ordinary income.

A capital gain or loss is triggered anytime you dispose of selltrade a capital asset. In the same time i have made some capital gains on selling one of my shares which amount up to 800. For more information on capital assets capital gains and capital losses see Publication 544 Sales and Other Dispositions of Assets. As with capital gains capital losses are divided by the. In this context the issue is likely to be whether the cryptocurrency is lost whether you have lost evidence of your ownership or whether you have lost access to the cryptocurrency. If you disposed of your crypto at a capital loss.

Read another article:

Source: tokentax.co

Source: tokentax.co

Crypto Tax Forms Form 8949 Cryptocurrency Download Tokentax If you disposed of your crypto at a capital loss. You may be able to claim a capital loss if you lose your cryptocurrency private key or your cryptocurrency is stolen. Its important to note that CGT is not a separate tax. A wash sale results when you incur a capital loss and then buy the same security back within a 30-day.

![]() Source: cointracking.info

Source: cointracking.info

Cointracking Crypto Tax Calculator In this scenario can i use my losses made through selling my cryptocurrency to offset my capital gains. If a cryptocurrency investor has more than 3000 in net capital losses in a taxable year then the excess losses can be carried forward into future tax years. This volatility means that. On the other hand a capital loss is a loss on the sale of a capital asset such as a stock mutual fund real estate or cryptocurrency.

Source: blockfi.com

Source: blockfi.com

Crypto Tax Rates Capital Gains Tax A Break Down On How It All Works In this scenario can i use my losses made through selling my cryptocurrency to offset my capital gains. I made investments in Bicoin and Ethereum since last year and due to the fall of the price recently i have made a gain loss of up to 1000 in total which i have sold it yet. If you disposed of your crypto at a capital loss. Cryptocurrency is considered property for federal income tax purposes meaning the IRS treats it as a capital asset.

Income Earned Via Cryptocurrency Must Be Disclosed Losses on Cryptocurrency. This means the crypto taxes you. Cryptocurrencies such as bitcoin are treated as property by the IRS and they are subject to capital gains and losses rules. I will do it on the exam.

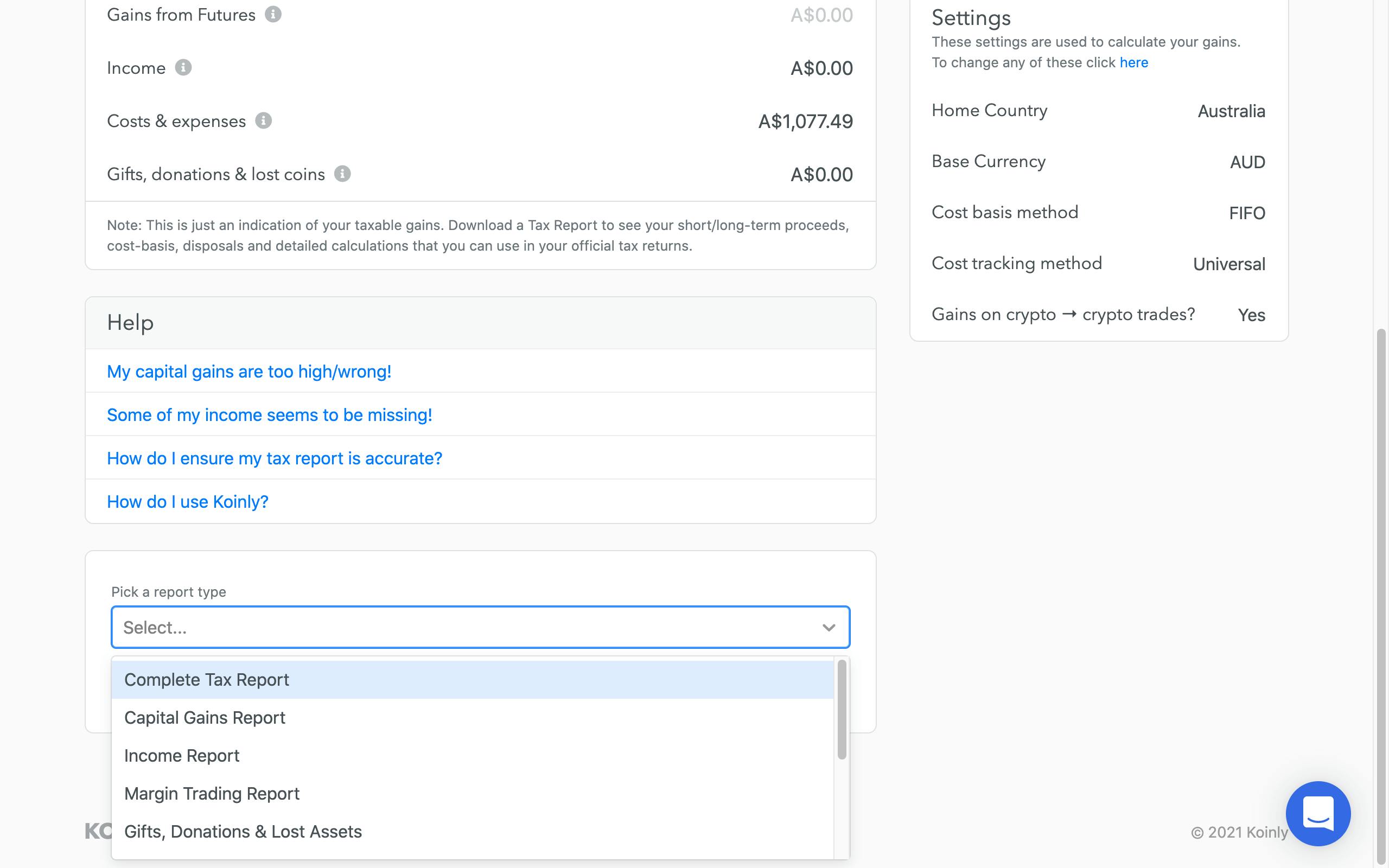

Source: koinly.io

Source: koinly.io

Australian Cryptocurrency Tax Guide 2021 Koinly Fill Out Your Tax Forms Properly. If a cryptocurrency investor has more than 3000 in net capital losses in a taxable year then the excess losses can be carried forward into future tax years. Loss or theft of cryptocurrency. In this scenario can i use my losses made through selling my cryptocurrency to offset my capital gains.

Source: tokentax.co

Source: tokentax.co

How Cryptocurrency Is Taxed In The United Kingdom Tokentax There is a silver lining here though. In 2014 the IRS declared cryptocurrency to be a capital asset meaning that every sale or trade of cryptocurrency results in a capital gain or loss. Form 8949 deals with the disposition of capital assets and you can use it to calculate your gains as well as losses. Claiming your cryptocurrency capital losses can result in a higher refund on your tax return through this deduction.

How To Report Crypto Losses On Your Taxes In 2021 Taxbit Blog This answer will point you to clarify the different types of cryptocurrency thefts whether its a capital loss or a theft depending on the circumstances. This means the crypto taxes you. When you sell virtual currency you must recognize any capital gain or loss on the sale subject to any limitations on the deductibility of capital losses. Cryptocurrency losses must be reported on your IRS 8949 just like cryptocurrency gains.

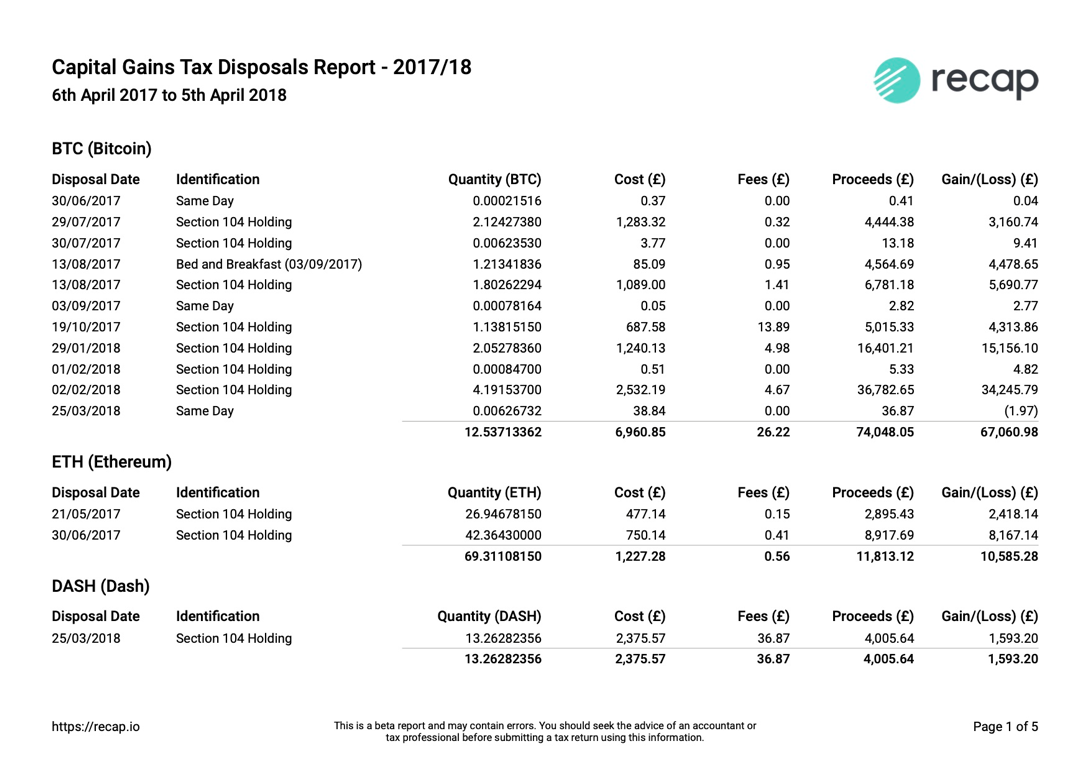

Source: recap.io

Source: recap.io

How To Calculate Your Crypto Taxes For Your Self Assessement Tax Return Recap Blog Claiming your cryptocurrency capital losses can result in a higher refund on your tax return through this deduction. Thus the sale of cryptocurrency results in capital gains and losses rather than ordinary income. You will need to fill out Form 8949 and Form 1040 Schedule D to note your capital gains from cryptocurrency transactions. In this scenario can i use my losses made through selling my cryptocurrency to offset my capital gains.

Capital One Blocks Cryptocurrency Purchases With Its Card If you are a cryptocurrency investor gains and losses are generally taxed as capital gains and losses as opposed to ordinary gains and losses. On the other hand a smart investor can deduct net capital losses from their income. Claiming your cryptocurrency capital losses can result in a higher refund on your tax return through this deduction. A capital loss is realised you dispose of an asset eg.

Source: tokentax.co

Source: tokentax.co

How To Report Cryptocurrency On Taxes Tokentax A capital loss is realised you dispose of an asset eg. You will need to fill out Form 8949 and Form 1040 Schedule D to note your capital gains from cryptocurrency transactions. In this video I will tell you how to calculate Capital Gains and Losses on exchanging one cryptocurrency to another cryptocurrency. You can crystallise capital losses for cryptocurrency you still own if it became worthless or of negligible value.

Source: taxbit.com

Source: taxbit.com

How To Report Crypto Losses On Your Taxes In 2021 Taxbit Blog A capital loss is realised you dispose of an asset eg. In the same time i have made some capital gains on selling one of my shares which amount up to 800. A wash sale results when you incur a capital loss and then buy the same security back within a 30-day. In general the basis of a taxpayers cryptocurrency is the price paid to acquire the currency in US.

Source: taxbit.com

Source: taxbit.com

What Are The Taxes On Cryptocurrency Gains And How Can You Offset These Taxbit Blog This volatility means that. This answer will point you to clarify the different types of cryptocurrency thefts whether its a capital loss or a theft depending on the circumstances. As with capital gains capital losses are divided by the. You may be able to claim a capital loss if you lose your cryptocurrency private key or your cryptocurrency is stolen.

Source: recap.io

Source: recap.io

How To Calculate Your Crypto Taxes For Your Self Assessement Tax Return Recap Blog Thus the sale of cryptocurrency results in capital gains and losses rather than ordinary income. If a cryptocurrency investor has more than 3000 in net capital losses in a taxable year then the excess losses can be carried forward into future tax years. In this video I will tell you how to calculate Capital Gains and Losses on exchanging one cryptocurrency to another cryptocurrency. In this example above can i claim for capital loss.

Source: medium.com

Source: medium.com

6 Ways To Avoid Capital Gains Tax On Your Bitcoin Transactions By Richard Knight The Capital Medium In 2014 the IRS declared cryptocurrency to be a capital asset meaning that every sale or trade of cryptocurrency results in a capital gain or loss. Its important to note that CGT is not a separate tax. A capital loss is realised you dispose of an asset eg. A wash sale results when you incur a capital loss and then buy the same security back within a 30-day.

Source: youtube.com

Source: youtube.com

How To Calculate Cryptocurrency Capital Gains And Losses Tax Treatment Of Bitcoin Youtube The Schedule D form is the main tax form for reporting overall capital gains and losses. Cryptocurrency is considered property for federal income tax purposes meaning the IRS treats it as a capital asset. Cryptocurrencies such as bitcoin are treated as property by the IRS and they are subject to capital gains and losses rules. Fill Out Your Tax Forms Properly.