From April 2019 non-UK residents will pay CGT on gains realised on UK property both commercial and residential. A transfer between spouses or civil partners is tax-free made on a. Capital gains tax ireland cryptocurrency.

Capital Gains Tax Ireland Cryptocurrency, But when it comes to capital gains. The recipient is responsible for the tax on the gift or inheritance. Multiple ways are available to.

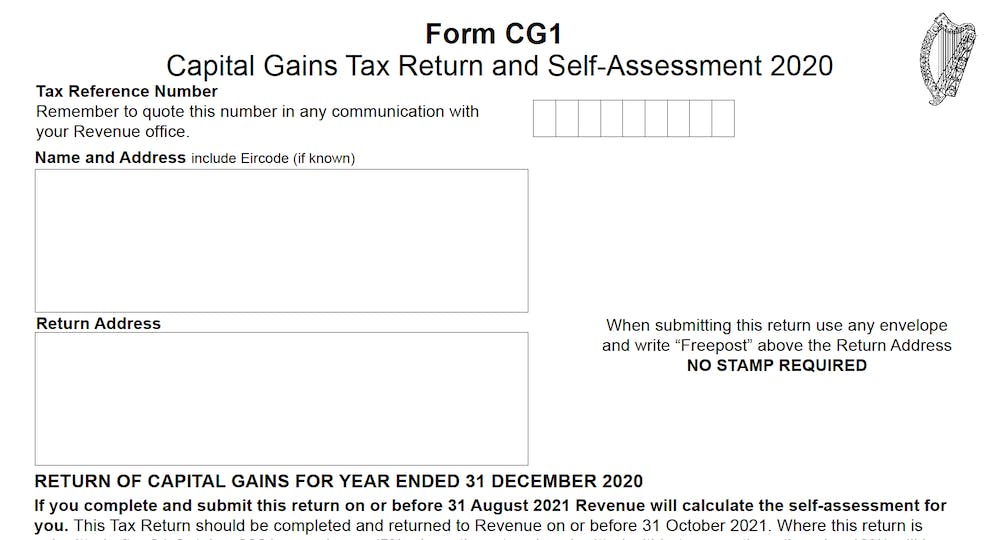

Tax On Crypto In Ireland A Complete Guide Youtube From youtube.com

Tax On Crypto In Ireland A Complete Guide Youtube From youtube.com

From April 2019 non-UK residents will pay CGT on gains realised on UK property both commercial and residential. Some people refer to it as the Gift Tax. In some traditional definitions a tax haven also offers financial secrecy. Capital Gains Tax basic rules.

Capital Acquisitions Tax CAT is sometimes also known as Inheritance Tax in IrelandCAT is a tax charged on money or property that is gifted to or inherited by someone.

Each jurisdiction has the right to tax the income of its own residents under their own domestic laws so the tax treaty will not always restate this rule. If you sell shares or any item of property for a higher price than you originally paid for it you are deemed to have made a capital gainThis capital gain is subject to a tax called Capital Gains Tax CGT which is currently charged at a rate of 33 in Ireland. Bloomberg Industry Group provides guidance grows your business and remains compliant with trusted resources that deliver results for legal tax compliance government affairs and. A tax haven is a country or place with very low effective rates of taxation for foreign investors headline rates may be higher. Each jurisdiction has the right to tax the income of its own residents under their own domestic laws so the tax treaty will not always restate this rule. However while countries with high levels of secrecy but also high rates of taxation most notably the United States and Germany in the Financial Secrecy Index FSI rankings can be.

Read another article:

Source: pinterest.com

Source: pinterest.com

Message Or Email Me For More Information And Let S Start Saving Tjones Sweeneyconrad Com How To Plan Bitcoin Let It Be Get all the latest India news ipo bse business news commodity sensex nifty politics news with ease and comfort any time anywhere only on Moneycontrol. But when it comes to capital gains. If you sell shares or any item of property for a higher price than you originally paid for it you are deemed to have made a capital gainThis capital gain is subject to a tax called Capital Gains Tax CGT which is currently charged at a rate of 33 in Ireland. Biden budget reiterates 434 top capital gains tax rate for millionaires.

Source: youtube.com

Source: youtube.com

Tax On Crypto In Ireland A Complete Guide Youtube Capital Acquisitions Tax CAT is sometimes also known as Inheritance Tax in IrelandCAT is a tax charged on money or property that is gifted to or inherited by someone. The Biden administration wants to get tougher on tax cheats and cryptocurrency is an area of interest. These are the top 5 holdings of IDG China Venture Capital Fund IV Associates LP. Each time a bitcoin is sold the seller would have to pay a capital gains tax of 25.

Source: pinterest.com

Source: pinterest.com

Cryptocurrency Taxes 2020 What You Need To Know In 2021 Money Basics Cryptocurrency Owe Taxes A transfer between spouses or civil partners is tax-free made on a. Capital Acquisitions Tax CAT is sometimes also known as Inheritance Tax in IrelandCAT is a tax charged on money or property that is gifted to or inherited by someone. A transfer between spouses or civil partners is tax-free made on a. Multiple ways are available to.

Source: pinterest.com

Source: pinterest.com

Schema Blockchain Cryptocurrency Ethereum Wallet Lamp Donohoe reiterated that Irelands annual corporate tax take is set to be around 20 or 2 billion euros lower than it otherwise would have been by 2025 due to the anticipated changes. If you sell shares or any item of property for a higher price than you originally paid for it you are deemed to have made a capital gainThis capital gain is subject to a tax called Capital Gains Tax CGT which is currently charged at a rate of 33 in Ireland. But when it comes to capital gains. A transfer between spouses or civil partners is tax-free made on a.

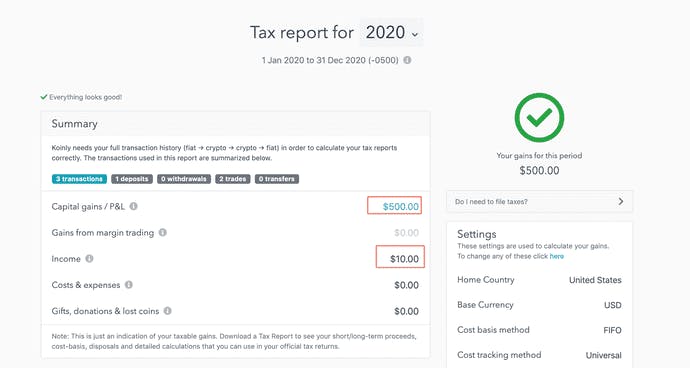

Source: koinly.io

Source: koinly.io

Ireland Cryptocurrency Tax Guide 2021 Koinly But when it comes to capital gains. Bloomberg Industry Group provides guidance grows your business and remains compliant with trusted resources that deliver results for legal tax compliance government affairs and. Some people refer to it as the Gift Tax. However while countries with high levels of secrecy but also high rates of taxation most notably the United States and Germany in the Financial Secrecy Index FSI rankings can be.

Uk Cryptocurrency Tax Guide Cointracker As of 2017 the Israel Tax Authorities issued a statement saying that bitcoin and other cryptocurrencies would not fall under the legal definition of currency and neither of that of a financial security but of a taxable asset. A transfer between spouses or civil partners is tax-free made on a. Each time a bitcoin is sold the seller would have to pay a capital gains tax of 25. If you sell shares or any item of property for a higher price than you originally paid for it you are deemed to have made a capital gainThis capital gain is subject to a tax called Capital Gains Tax CGT which is currently charged at a rate of 33 in Ireland.

Source: cryptotax.io

Source: cryptotax.io

Bitcoin And Taxes Blockpit Cryptotax Bloomberg Industry Group provides guidance grows your business and remains compliant with trusted resources that deliver results for legal tax compliance government affairs and. If you sell shares or any item of property for a higher price than you originally paid for it you are deemed to have made a capital gainThis capital gain is subject to a tax called Capital Gains Tax CGT which is currently charged at a rate of 33 in Ireland. The tax traps wealth in an investment vehicle requiring special techniques to free the capital without penalty. Each jurisdiction has the right to tax the income of its own residents under their own domestic laws so the tax treaty will not always restate this rule.

Source: in.pinterest.com

Source: in.pinterest.com

Pin On Crypto Superhero Community Capital Acquisitions Tax CAT is sometimes also known as Inheritance Tax in IrelandCAT is a tax charged on money or property that is gifted to or inherited by someone. A transfer between spouses or civil partners is tax-free made on a. Tax treaties give the source jurisdiction a taxing right over selected types of income profits or gains sometimes at limited rates. Each time a bitcoin is sold the seller would have to pay a capital gains tax of 25.

Source: koinly.io

Source: koinly.io

Cryptocurrency Taxes In The Uk The 2021 Guide Koinly These are the top 5 holdings of IDG China Venture Capital Fund IV Associates LP. Pinduoduo Inc - 8323944 shares 8920 of the total portfolioUnity Software Inc -. However while countries with high levels of secrecy but also high rates of taxation most notably the United States and Germany in the Financial Secrecy Index FSI rankings can be. As of 2017 the Israel Tax Authorities issued a statement saying that bitcoin and other cryptocurrencies would not fall under the legal definition of currency and neither of that of a financial security but of a taxable asset.

Source: koinly.io

Source: koinly.io

Ireland Cryptocurrency Tax Guide 2021 Koinly I think tax was possibly a bigger issue for a lot of these companies coming to Ireland 15 or 20 years ago Kevin Nowlan the head of Irelands largest stock market-listed office landlord. A tax haven is a country or place with very low effective rates of taxation for foreign investors headline rates may be higher. Ireland is the only other developed nation to levy a higher tax on investment income 51 on dividends. Donohoe reiterated that Irelands annual corporate tax take is set to be around 20 or 2 billion euros lower than it otherwise would have been by 2025 due to the anticipated changes.

Source: koinly.io

Source: koinly.io

Ireland Cryptocurrency Tax Guide 2021 Koinly Tax treaties give the source jurisdiction a taxing right over selected types of income profits or gains sometimes at limited rates. The tax traps wealth in an investment vehicle requiring special techniques to free the capital without penalty. A transfer between spouses or civil partners is tax-free made on a. Executorsestates pay CGT at the higher rates of 20 and 28.

Uk Cryptocurrency Tax Guide Cointracker The recipient is responsible for the tax on the gift or inheritance. Tax treaties give the source jurisdiction a taxing right over selected types of income profits or gains sometimes at limited rates. The tax traps wealth in an investment vehicle requiring special techniques to free the capital without penalty. Multiple ways are available to.

Source: pinterest.com

Source: pinterest.com

Ireland Clarifies Taxation Of Crypto Transactions The Irish Revenue Service Has Published A Manual With Guidelines Aimed What Is Bitcoin Bitcoin Digital Coin The capital gains tax is economically senseless. Ireland is the only other developed nation to levy a higher tax on investment income 51 on dividends. The Biden administration wants to get tougher on tax cheats and cryptocurrency is an area of interest. But when it comes to capital gains.

Source: pinterest.com

Source: pinterest.com

Buy Bitcoin In China Use Any Payment Method Including Alipay Buy Bitcoin Bitcoin Cryptocurrency Trading Some people refer to it as the Gift Tax. However while countries with high levels of secrecy but also high rates of taxation most notably the United States and Germany in the Financial Secrecy Index FSI rankings can be. The capital gains tax is economically senseless. I think tax was possibly a bigger issue for a lot of these companies coming to Ireland 15 or 20 years ago Kevin Nowlan the head of Irelands largest stock market-listed office landlord.

Source: koinly.io

Source: koinly.io

Ireland Cryptocurrency Tax Guide 2021 Koinly The recipient is responsible for the tax on the gift or inheritance. As of 2017 the Israel Tax Authorities issued a statement saying that bitcoin and other cryptocurrencies would not fall under the legal definition of currency and neither of that of a financial security but of a taxable asset. Bloomberg Industry Group provides guidance grows your business and remains compliant with trusted resources that deliver results for legal tax compliance government affairs and. Capital Gains Tax basic rules.