Erangadot - 8 May 2021. Each individual has a personal CGT allowance every year 6 April to 5 April which for many crypto investors is sufficient for avoiding a CGT liability. Avoid tax on cryptocurrency uk.

Avoid Tax On Cryptocurrency Uk, Posted by citizenshipandtax August 10 2021 Posted in Uncategorized Tags. We cover the options available to you that you may not be. How to AVOID TAX on Cryptocurrency UK.

In this video we explore multiple methods that help you legally avoid cryptocurrency tax in the UK. Each individual has a personal CGT allowance every year 6 April to 5 April which for many crypto investors is sufficient for avoiding a CGT liability. If you buy cryptocurrency inside of a traditional IRA you will defer tax on the gains until you begin to take distributions. Home Videos How to AVOID TAX on Cryptocurrency UK.

We also cover some really important tips to remember in order to efficiently and effectively calculate and.

We also cover some really important tips to remember in order to efficiently and effectively calculate and. Avoiding mistakes now means avoiding potential penalties further down the line and using a dedicated application helps to free up time that could be better invested elsewhere. Erangadot - 8 May 2021. We cover the options available to you that you may not be. You should also be wary of thinking that cryptocurrency makes it easy for you to keep profits or income anonymous and get away with defrauding the IRS. Cryptocurrency taxes arent going anywhere.

Read another article:

Source: pinterest.com

Source: pinterest.com

Tax Professional Explains The Most Important Thing For Us Crypto Holders Capital Gains Tax Capital Gain Cryptocurrency Dont hide crypto profits from the IRS. Most exchanges have APIs that can allow Koinly to download your transaction history automatically. If you buy cryptocurrency inside of a traditional IRA you will defer tax on the gains until you begin to take distributions. Although there are some exceptions you should assume youll be paying some form of tax for cryptocurrency trading.

Uk Cryptocurrency Tax Guide Cointracker Connect your exchanges and wallets. If you hold cryptocurrency as a personal investment you will be subject to Capital Gains Tax rules. Sold traded used for a purchase etc. So heres a look at some of the potential cryptocurrency tax nightmares you can easily wander into and more importantly how you can be sure you avoid them.

Uk Cryptocurrency Tax Guide Cointracker We also cover some really important tips to remember in order to efficiently and effectively calculate and. We also cover some really important tips to remember in order to efficiently and effectively calculate and. Connect your exchanges and wallets. This means that you are taxed on the capital gain at the time the cryptocurrency is disposed of eg.

Source: forbes.com

Source: forbes.com

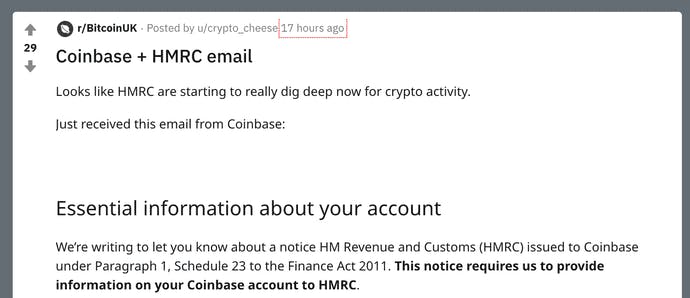

How Is Cryptocurrency Taxed Forbes Advisor HMRC has published guidance for people who hold cryptoassets or cryptocurrency as they are also known explaining what taxes they may need to pay and what records they need to keep. HMRC has published guidance for people who hold cryptoassets or cryptocurrency as they are also known explaining what taxes they may need to pay and what records they need to keep. HMRC taxes cryptocurrency depending on how you deal with cryptocurrency. Most exchanges have APIs that can allow Koinly to download your transaction history automatically.

Source: support.binance.us

Source: support.binance.us

Cryptocurrency Tax Reporting Binance Us Likewise Malta has become a haven for cryptocurrency transactions due to its policy to not charge income or gain taxes on isolated transfers. Erangadot - 8 May 2021. Cryptocurrency tax software automates your taxes and record-keeping. Each individual has a personal CGT allowance every year 6 April to 5 April which for many crypto investors is sufficient for avoiding a CGT liability.

Uk Cryptocurrency Tax Guide Cointracker You should also be wary of thinking that cryptocurrency makes it easy for you to keep profits or income anonymous and get away with defrauding the IRS. Therefore all those who are involved in regular transactions should consider crypto accounting as essential as their regular fiat accounting. How to AVOID TAX on Cryptocurrency UK. This means that you are taxed on the capital gain at the time the cryptocurrency is disposed of eg.

Source: koinly.io

Source: koinly.io

Cryptocurrency Taxes In The Uk The 2021 Guide Koinly Sold traded used for a purchase etc. Each individual has a personal CGT allowance every year 6 April to 5 April which for many crypto investors is sufficient for avoiding a CGT liability. Likewise Malta has become a haven for cryptocurrency transactions due to its policy to not charge income or gain taxes on isolated transfers. Cryptocurrency taxes arent going anywhere.

Source: koinly.io

Source: koinly.io

Cryptocurrency Taxes In The Uk The 2021 Guide Koinly You should also be wary of thinking that cryptocurrency makes it easy for you to keep profits or income anonymous and get away with defrauding the IRS. Each individual has a personal CGT allowance every year 6 April to 5 April which for many crypto investors is sufficient for avoiding a CGT liability. Cryptocurrency tax software automates your taxes and record-keeping. This means that you are taxed on the capital gain at the time the cryptocurrency is disposed of eg.

Source: fullstack.com.au

Source: fullstack.com.au

Crypto Tax Australia Cryptocurrency Tax 2021 Guide Fullstack Home Videos How to AVOID TAX on Cryptocurrency UK. Most exchanges have APIs that can allow Koinly to download your transaction history automatically. We cover the options available to you that you may not be aware of to help save you some money. The easiest way to defer or eliminate tax on your cryptocurrency investments is to buy inside of an IRA 401-k defined benefit or other retirement plans.

Source: pinterest.com

Source: pinterest.com

Trading In Cryptocurrency Cryptocurrency Bitcoin Account Bitcoin Connect your exchanges and wallets. Avoiding mistakes now means avoiding potential penalties further down the line and using a dedicated application helps to free up time that could be better invested elsewhere. If you buy cryptocurrency inside of a traditional IRA you will defer tax on the gains until you begin to take distributions. Only crypto exchanges are taxed falling under the general corporate income tax rate of 35.

Source: in.pinterest.com

Source: in.pinterest.com

Pin On Cryptonews We cover the options available to you that you may not be. Although there are some exceptions you should assume youll be paying some form of tax for cryptocurrency trading. We cover the options available to you that you may not be aware of to help save you some money. Regulations vary by country and also by your type of involvement in cryptocurrencies mining trading receiving payment investing etc.

Source: cryptotrader.tax

Source: cryptotrader.tax

Uk Crypto Tax Guide 2021 Cryptotrader Tax If you hold cryptocurrency as a personal investment you will be subject to Capital Gains Tax rules. In this video we explore multiple methods that help you legally avoid cryptocurrency tax in the UK. Avoid crypto taxes avoid taxes bitcoin bitcoin taxes citizenship by investment crypto taxes crypto taxes explained cryptocurrency 2021 cryptocurrency taxes pay zero tax on cryptocurrency pay zero taxes stop paying crypto taxes tax friendly countries. Connect your exchanges and wallets.

Source: koinly.io

Source: koinly.io

Cryptocurrency Taxes In The Uk The 2021 Guide Koinly If you buy cryptocurrency inside of a traditional IRA you will defer tax on the gains until you begin to take distributions. Each individual has a personal CGT allowance every year 6 April to 5 April which for many crypto investors is sufficient for avoiding a CGT liability. If you hold cryptocurrency as a personal investment you will be subject to Capital Gains Tax rules. The moral of the story is.

Source: buybitcoinworldwide.com

Source: buybitcoinworldwide.com

3 Steps To Calculate Binance Taxes 2021 Updated You should also be wary of thinking that cryptocurrency makes it easy for you to keep profits or income anonymous and get away with defrauding the IRS. Although there are some exceptions you should assume youll be paying some form of tax for cryptocurrency trading. Erangadot - 8 May 2021. Cryptocurrency tax software automates your taxes and record-keeping.

Source: pinterest.com

Source: pinterest.com

Cryptocurrency Taxation In Romania Cryptocurrency Romania Transaction Cost Likewise Malta has become a haven for cryptocurrency transactions due to its policy to not charge income or gain taxes on isolated transfers. Avoid crypto taxes avoid taxes bitcoin bitcoin taxes citizenship by investment crypto taxes crypto taxes explained cryptocurrency 2021 cryptocurrency taxes pay zero tax on cryptocurrency pay zero taxes stop paying crypto taxes tax friendly countries. So heres a look at some of the potential cryptocurrency tax nightmares you can easily wander into and more importantly how you can be sure you avoid them. Home Videos How to AVOID TAX on Cryptocurrency UK.