Currently neither IFRS nor UK GAAP make specific reference to the accounting for cryptocurrencies which are a subset of cryptoassets which include Bitcoin Ethereum and Ripple as well as a range of newer cryptocurrencies being released at a rapid rate. Views are mixed on how to account for the cryptocurrency received. Accounting for cryptocurrency gaap.

Accounting For Cryptocurrency Gaap, GAAP the Committee is requesting that the Financial Accounting Standards Board consider adding a project to the Boards or Emerging Issues Task Forces technical agenda to address the accounting for and disclosure of cryptocurrencies. Some see an e xchange transaction that creates income whereas others see an internally generated intangible asset. There are no accounting rules dedicated to cryptocurrencies.

Cryptocurrency Accounting For Investment Funds U S Gaap Vs Ifrs Gaap Dynamics From gaapdynamics.com

Cryptocurrency Accounting For Investment Funds U S Gaap Vs Ifrs Gaap Dynamics From gaapdynamics.com

The accounting therefore has to be evaluated based on the nature of the asset the type of investor and how the asset is held. Therefore an investment company as defined by ASC 946 where this specialized guidance is provided does not have to perform nearly as complex an analysis as under IFRS. A holders accounting for cryptocurrencies US GAAP does not specifically address a holders accounting for cryptocurrencies. However IFRS Interpretations Committee IFRIC met in June 2019 and discussed that and issued their decision so at least we have some official guidance for a part of the problem.

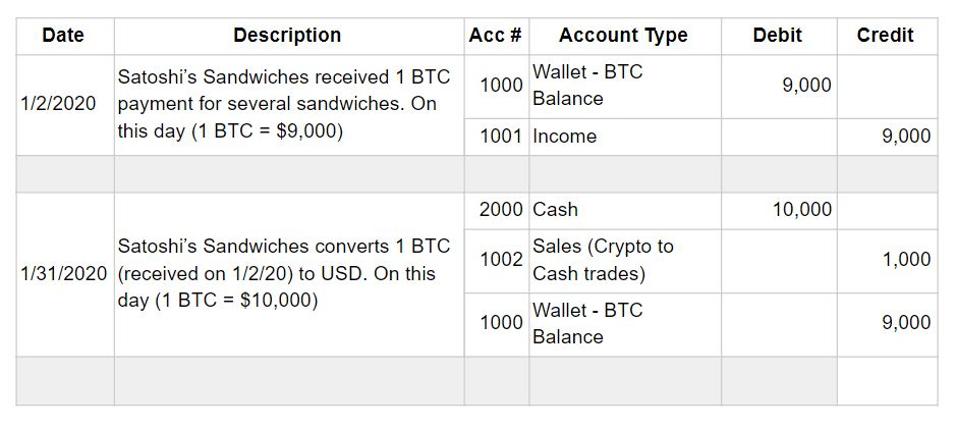

More businesses are beginning to accept cryptocurrencies including stablecoins as a form of payment in addition to more traditional methods such as cash and credit card.

The accounting therefore has to be evaluated based on the nature of the asset the type of investor and how the asset is held. GAAP does not specifically address the accounting for cryptocurrencies. Top Cryptocurrency Accounting Softwares. GAAP Unlike IFRS US. GAAP provides industry-specific guidance for many industries including investment companies. Industry players say the current GAAP accounting practice only leads to an understatement of cryptocurrency assets and prohibits a business from showing the true value of its crypto assets under possession on its financial statements.

Read another article:

Source: forbes.com

Source: forbes.com

How Are Cryptocurrencies Classified In Gaap Financials Industry players say the current GAAP accounting practice only leads to an understatement of cryptocurrency assets and prohibits a business from showing the true value of its crypto assets under possession on its financial statements. Top Cryptocurrency Accounting Softwares. Generally accepted accounting principles GAAP for nongovernmental entities and generally accepted auditing standards GAAS respectively. GAAP the Committee is requesting that the Financial Accounting Standards Board consider adding a project to the Boards or Emerging Issues Task Forces technical agenda to address the accounting for and disclosure of cryptocurrencies.

Source: annualreporting.info

Source: annualreporting.info

Best Intro To Accounting For Cryptocurrencies In 1 View Annual Reporting Views are mixed on how to account for the cryptocurrency received. Accounting for Cryptocurrencies. This publication does not address the accounting for tokens. GAAP does not specifically address the accounting for cryptocurrencies.

Source: gaapdynamics.com

Source: gaapdynamics.com

Cryptocurrency Accounting For Investment Funds U S Gaap Vs Ifrs Gaap Dynamics GAAP provides industry-specific guidance for many industries including investment companies. GAAP does not specifically address the accounting for cryptocurrencies. The accounting therefore has to be evaluated based on the nature of the asset the type of investor and how the asset is held. Views are mixed on how to account for the cryptocurrency received.

Source: cointracker.io

Source: cointracker.io

Small Businesses Can Bypass Complicated Gaap Rules For Crypto Accounting Cointracker Therefore an investment company as defined by ASC 946 where this specialized guidance is provided does not have to perform nearly as complex an analysis as under IFRS. Generally accepted accounting principles GAAP consider cryptocurrency to be an intangible asset that is recorded at cost and impairment of. More businesses are beginning to accept cryptocurrencies including stablecoins as a form of payment in addition to more traditional methods such as cash and credit card. Therefore an investment company as defined by ASC 946 where this specialized guidance is provided does not have to perform nearly as complex an analysis as under IFRS.

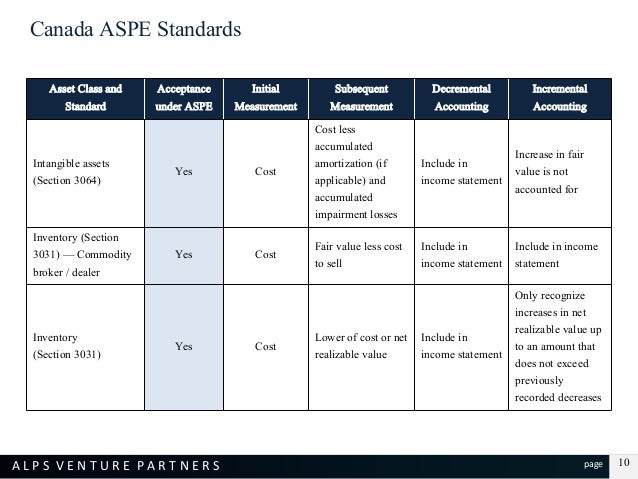

2 If the inventory standard were chosen to account for cryptocurrency the currency would need to be held at the lower of cost and net realizable value under both IFRS and US. In accordance with IFRIC decision cryptocurrency meets the definition of intangible. GAAP does not specifically address the accounting for cryptocurrencies. There are no accounting rules dedicated to cryptocurrencies.

Source: slideshare.net

Source: slideshare.net

Cryptocurrency Recognition Standards Ifrs Us Gaap Aspe In accordance with IFRIC decision cryptocurrency meets the definition of intangible. Generally accepted accounting principles GAAP consider cryptocurrency to be an intangible asset that is recorded at cost and impairment of. It is fair to say that accounting for cryptocurrency under the aforementioned measurement criteria in the current volatile market would not provide useful information to users of financial statements. If the inventory standard were chosen to account for cryptocurrency the currency would need to be held at the lower of cost and net realizable value under both IFRS and US.

Source: youtube.com

Source: youtube.com

Accounting For Cryptocurrency The Complete Guide Youtube The answer that is provided is that crypto assets such as bitcoin bitcoin cash and ether should be treated as intangible assets. Generally accepted accounting principles GAAP for nongovernmental entities and generally accepted auditing standards GAAS respectively. However given the increase in cryptocurrency transactions questions are now being raised about how cryptocurrencies should be accounted for. We use the reporting by MicroStrategy to illustrate why this does not provide the right information for investors and explain how you should include cryptocurrency assets in your analysis.

Source: mergersandinquisitions.com

Source: mergersandinquisitions.com

Cryptocurrency Accounting On The Financial Statements M I Accounting for cryptocurrency under US. In accordance with IFRIC decision cryptocurrency meets the definition of intangible. Industry players say the current GAAP accounting practice only leads to an understatement of cryptocurrency assets and prohibits a business from showing the true value of its crypto assets under possession on its financial statements. The accounting therefore has to be evaluated based on the nature of the asset the type of investor and how the asset is held.

Source: gaapdynamics.com

Source: gaapdynamics.com

Crypto Assets Doge The Fasb Plan To Do Anything About Them Gaap Dynamics Some see an e xchange transaction that creates income whereas others see an internally generated intangible asset. If the inventory standard were chosen to account for cryptocurrency the currency would need to be held at the lower of cost and net realizable value under both IFRS and US. The answer that is provided is that crypto assets such as bitcoin bitcoin cash and ether should be treated as intangible assets. Generally accepted accounting principles GAAP consider cryptocurrency to be an intangible asset that is recorded at cost and impairment of.

Source: forbes.com

Source: forbes.com

It S Time To Rethink Accounting For Cryptocurrency More businesses are beginning to accept cryptocurrencies including stablecoins as a form of payment in addition to more traditional methods such as cash and credit card. Accounting for cryptocurrency under US. Accounting for and auditing of digital assets i Notice to readers The objective of this practice aid is to develop nonauthoritative guidance on how to account for and audit digital assets under US. Some see an e xchange transaction that creates income whereas others see an internally generated intangible asset.

Source: cpacanada.ca

Source: cpacanada.ca

Financial Reporting Of Cryptocurrencies External Resources Determining the nature of assets. Generally accepted accounting principles GAAP for nongovernmental entities and generally accepted auditing standards GAAS respectively. GAAP provides industry-specific guidance for many industries including investment companies. In accordance with IFRIC decision cryptocurrency meets the definition of intangible.

Source: blockchain.news

Source: blockchain.news

Aicpa Publishes A Practice Aid For Digital Assets Blockchain News More businesses are beginning to accept cryptocurrencies including stablecoins as a form of payment in addition to more traditional methods such as cash and credit card. However given the increase in cryptocurrency transactions questions are now being raised about how cryptocurrencies should be accounted for. Determining the nature of assets. This publication does not address the accounting for tokens.

Source: mergersandinquisitions.com

Source: mergersandinquisitions.com

Cryptocurrency Accounting On The Financial Statements M I However cryptocurrencies cannot be considered equivalent to cash currency as defined in IAS 7 and IAS 32 because they cannot readily be exchanged for any good or service. GAAP does not currently directly address the accounting for cryptocurrencies. GAAP provides industry-specific guidance for many industries including investment companies. The accounting therefore has to be evaluated based on the nature of the asset the type of investor and how the asset is held.

Small Businesses Can Bypass Complicated Gaap Rules For Crypto Accounting Cointracker The answer that is provided is that crypto assets such as bitcoin bitcoin cash and ether should be treated as intangible assets. Determining the nature of assets. However given the increase in cryptocurrency transactions questions are now being raised about how cryptocurrencies should be accounted for. Under current US GAAP and usually under IFRS intangible asset accounting is applied.

Source: gaapdynamics.com

Source: gaapdynamics.com

Cryptocurrency Accounting For Investment Funds U S Gaap Vs Ifrs Gaap Dynamics It is fair to say that accounting for cryptocurrency under the aforementioned measurement criteria in the current volatile market would not provide useful information to users of financial statements. However we believe that under Generally Accepted Accounting Principles GAAP in the United States cryptoassets would generally meet the definition of an indefinite-lived intangible asset because they do not convey specific rights to cash or ownership in a legal entity in the same way as financial instruments. GAAP Unlike IFRS US. There are no accounting rules dedicated to cryptocurrencies.